Wheat imports uphold strong pace into new marketing year: Grain market daily

Wednesday, 18 September 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £183.70/t, down £1.45/t on Monday’s close. The May-25 contract closed at £196.90/t, down £1.20/t over the same period.

- Yesterday, the domestic market mirrored the decline in global wheat prices. Dec-24 futures for both Chicago and Paris milling wheat fell by 0.5% and 0.6%, respectively. The geopolitical tensions between Russia and Ukraine, along with drought conditions that had driven wheat prices up last week, provided less support yesterday as competitive exports from the Black Sea continued.

- Paris rapeseed futures (Nov-24) closed at €463.00/t yesterday, up €5.25/t on Monday’s close. The May-25 contract closed at €466.25/t, up €4.00/t over the session.

- European rapeseed markets tracked Chicago soyabeans futures (Nov-24) which were up 0.15% over the session. The EU’s rapeseed and soyabeans imports have firmed since the start of the 2024/25 season, due to poor weather impacting crop yields in the region. Data from the EU commission showed that as of 15 September, EU rapeseed imports had reached 1.05 Mt this season to date, compared to 0.77 Mt a year earlier. Meanwhile, soyabean imports totalled 2.62 Mt by September 15, compared to 2.61 Mt at the same time last year.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Wheat imports uphold strong pace into new marketing year

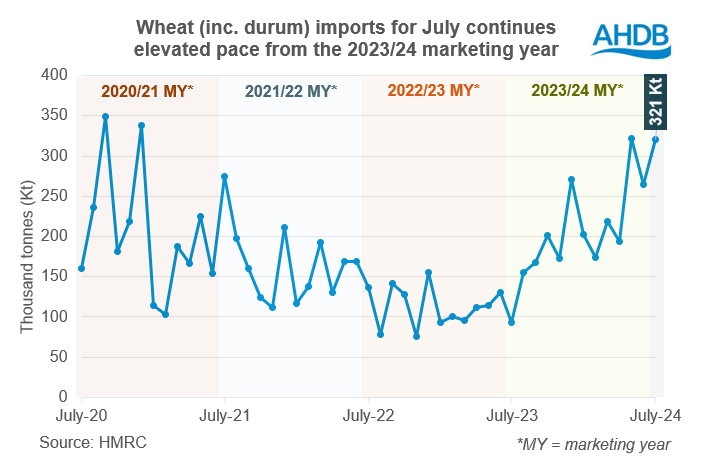

HMRC recently released trade data for July, which offers insight into the first month of the 2024/25 marketing year.

In the latter half of 2023/24, limited availability of full specification milling wheat and expectations of a smaller 2024 wheat crop encouraged wheat imports.

Leading into the 2024/25 marketing year, the strong pace of wheat imports has continued, largely due to the expected domestic crop size. The 321 Kt imports of wheat in July 2024 exceed last July’s 93 Kt and the five-year average for July of 150 Kt. Going a step further, this also exceeds the total volume of wheat imported for both July and August last year (249 Kt) and the five-year average (311 Kt).

In July 2024, Germany ranked as the top origin at 137 Kt, with Denmark second at 66Kt, and Canada third with 55 Kt.

Smaller crops for key import origins

Anecdotally, Germany and Canda are key sources of milling grade imports for the UK. However, both are facing lower production this year.

The German wheat crop has been under considerable pressure this year due to wet weather. Germany is estimated to produce 18.8 Mt of wheat this year, 13% less than last year (Germany’s agricultural ministry). There’s also reports of poorer than usual quality.

Canadian spring wheat production is estimated at 25.3 Mt, down 1% from last year (StatCan). In addition, wheat stocks (exc. durum) as of 31 July 2024 totalled 4.0 Mt, down on the year by 21%.

How is the milling wheat premium faring?

Since the beginning of the new marketing year (2024/25), spot ex-farm milling wheat premiums are slightly softer than last year, although they continue to be notably higher than the five-year average.

.png)

Please note that the ex-farm prices are an average of all trades during that period, containing different proportions of trade from different parts of the period, and different parts of the UK. To get insight into the costs of each specification of grain delivered to set localities on specific dates, look at AHDB’s delivered price survey.

There are significant challenges with elevated ergot presence and lower proteins levels in UK wheat this year. However, other characteristics look positive. Therefore, elevated imports look to be keeping a lid on the domestic milling wheat premium. But the notably smaller area and below-average yields in UK, along with reduced production in key import origins offers support to the premium compared to historical levels.

The key as to whether this trend continues, will be how imports compare to demand, plus the final size and the functionality of the 2024 UK wheat crop. Data on usage in August is due from AHDB on 03 October, with the provisional estimate of the English wheat crop from Defra on 10 October.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.