How much wheat can we expect from harvest 24? Grain market daily

Friday, 23 August 2024

Market commentary

- Global grain and oilseed futures lost ground yesterday. While Black Sea prices continue to weigh on wheat, rapeseed prices felt pressure from the rail workers' strike in Canada limiting transport of oilseeds and grain as harvesting picks up. In the top producing province of Saskatchewan, the government reports that 2% of canola (rapeseed) was cut by 19 August.

- Nov-24 UK feed wheat futures fell £2.85/t to settle at £181.35/t yesterday, its lowest price since early March. Meanwhile, Nov-24 Paris rapeseed futures closed at €449.75/t, down €7.50/t from Wednesday's close.

- There was also pressure from lower maize and soyabean futures, which lost ground due to positive results from a US crop tour that concluded yesterday. A stronger US dollar was also a factor.

- The final day of the ProFarmer crop tour through some of the key US maize and soyabean producing areas in the US concluded yesterday. Yield prospects in Illinois, one of the top producing states for both crops, were particularly strong.

How much wheat can we expect from harvest 24?

Last Friday, AHDB released the second harvest progress report of the season, providing a first look at progression, yield and quality results for wheat. As UK wheat harvest progresses, we gain a better understanding of what can be expected in terms of domestic supply this season.

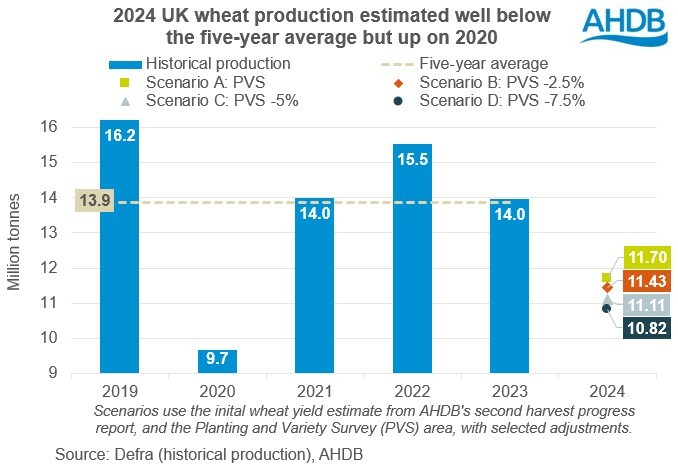

In last week’s report, at an average of 7.5 t/ha, reported yields in the UK are down 7% on the five-year average. While this could change as we progress through harvest, we can use this figure to give an initial indication of how much wheat could be produced this year, ahead of Defra’s provisional estimate of area in England, out on 29 August. When combined with AHDB’s Planting and Variety Survey (PVS) results, a yield of 7.5 t/ha, and an estimated area of 1.56 Mha, gives a production figure of 11.7 Mt. This is scenario A on the graph.

However, it’s important to note that the PVS asked growers to submit their intended harvest area, with results collected from mid-April to mid-June. As such, with the extent of conditions this season, there will have been areas of crops that were included in the survey, that may have not made it to a commercially viable state, including large gaps in fields that will not be passed with the combine (and therefore not necessarily included in all yield reductions either).

For this reason, we have included some alternative scenarios using reduced PVS areas (-2.5%, -5% and -7.5%) to give a wider range to what we expect from domestic output this season. These are scenarios B, C and D respectively on the graph.

With current area and yield estimates pointing to wheat production being in the range of 10.8 – 11.7 Mt, it’s likely domestic supplies will be well below the five-year average of 13.9 Mt, and last season’s 14.0 Mt crop. However, despite some comparisons being drawn earlier in the season, at the moment, it does not seem as though the crop will be as small as the 9.7 Mt harvested in 2020.

In terms of what this means for the UK wheat supply and demand balance, heavy ending stocks are expected to offset some of the smaller crop, though imports will also need to be historically high in order to cover demand. Look out for the provisional Defra English crops areas due out next week, as well as more analysis on total wheat availability this season in the coming weeks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.