Wheat stocks sharply higher year-on-year: Grain market daily

Thursday, 22 August 2024

Market commentary

- Nov-24 UK feed wheat futures fell £1.55/t yesterday to settle at £184.20/t amid pressure across global wheat markets.

- The benchmark Dec-24 contracts on Chicago, Kansas and Minneapolis wheat futures all fell to their lowest closing prices yet. Pressure from price competitive Russian exports outweighed the potential for US wheat exports to benefit from a strike by railway operators in Canada. The strike is due to begin today.

- Provisional French wheat quality results show poor specific weights and lower protein contents. Arvalis reports just 30% of the 2024 French soft wheat crop meets or exceeds 76 kg/hl, compared to the 2019 - 2023 average of 76%. In addition, 78% of the crop has a protein content above 11%, versus the five-year average of 85%.

- The ongoing ProFarmer crop tour in the US continues to show good yield potential for US soyabeans (through pod counts), and maize. The tour wraps up later today.

- Nov-24 Paris rapeseed futures gained €5.25/t to settle at €457.25/t yesterday. There were also gains for Chicago soyabean and Winnipeg canola futures, linked to re-positioning by speculative traders.

Wheat stocks sharply higher year-on-year

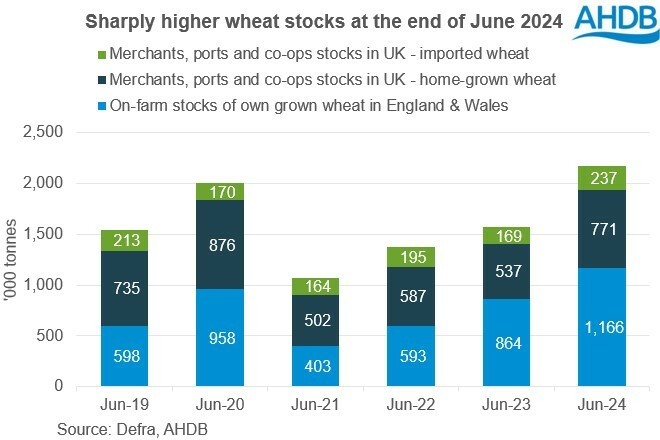

Stocks of wheat held by merchants, ports and co-operatives in the UK at the end of June 2024, plus on-farm in England and Wales were sharply higher than a year earlier. Combined they are also at their highest level since June 2016.

AHBD reported this morning that merchants, ports and co-operatives in the UK held 44% more home-grown wheat at the end of June 2024 than a year earlier, at 771 Kt. They also held 237 Kt of imported wheat, 40% more than June 2023.

Meanwhile, Defra estimates on-farm stocks of own grown wheat in England and Wales at 1.166 Mt at the end of June. This is 35% higher than at the end of June 2023 and 89% above the five-year average. However, it’s worth noting that the confidence interval is 206 Kt, which means the on-farm stocks in England and Wales could be as low as 960 Kt or as high as 1.372 Mt. This data can be found on Defra’s website.

The end of June marks the end of the 2023/24 marketing season. So, while data on on-farm stocks in Scotland and Northern Ireland is not available, this data suggests that notably higher wheat stocks are likely to be carried into the 2024/25 season. This would be the case even if the on-farm stocks in England and Wales fell towards the lower end of the confidence interval.

Back in May, AHDB forecast that total UK wheat stocks at the end of 2023/24 could total 3.05 Mt, a 56% increase from the end of 2022/23.

Higher stocks could help to cushion the impact of the lower planted area in 2024 and lower yields following the extremely challenging weather through the growing season. It’s worth noting though that higher imports are still expected to be needed this season (2024/25).

Less barley and oats

While wheat stocks look to be higher, the data available points to lower stocks of barley and oats. Merchants, ports and co-operatives in the UK held 10% less home-grown barley at the end of June 2024 than June 2023 and 6% less oats.

Defra also estimates lower on-farm stocks of home-grown barley and oats in England and Wales, but there’s more uncertainty, especially for oats, given sizeable confidence intervals.

Barley stocks are estimated at 146 Kt, 4% smaller than June 2023, but with a confidence interval of ±80 Kt. For oats, the on-farm stock estimate is 15.9 Kt, a 40% drop from June 2023, but with a confidence interval of ±30 Kt.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.