US markets in focus: Grain market daily

Friday, 8 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £179.00/t yesterday, rising £0.20/t from Wednesday’s close. The May-25 contract fell £0.50/t over the same period, to close at £192.05/t. The Nov-24 futures contract has low open interest, due to a nearing last trading day. The main trading activity now is on May-25 (2024 crop) and Nov-25 (2025 crop) futures.

- UK feed wheat futures were mixed yesterday as Sterling strengthened against the Euro after the Bank of England cut interest rates. However, Paris milling and maize futures closed down on the previous session. Paris milling wheat is under pressure from steady EU exports and more favourable weather for winter crops in the Black Sea region.

- Paris rapeseed futures (May-25) closed at €529.25/t yesterday, rising €8.00/t from Wednesday’s close.

- Paris rapeseed futures tracked gains across the vegetable oilseeds complex. India, the world’s largest vegetable oil importer, significantly increased its palm oil imports in October 2024, compared to previous months. Brent crude oil futures (Dec-24) rose 0.93% during yesterday’s trading session. Chicago soyabean futures Nov-24 closed higher for the fourth consecutive day this week. We are awaiting the USDA’s November WASDE report today, read more on this below.

US markets in focus

Post-election market movement

US markets have experienced days of volatility following Donald Trump’s re-election. Chicago soya oil futures rose to a four-month high on Thursday on firm export demand and concerns that Trump could impose tariffs on US imports of used cooking oil. On the other hand, uncertainty rose for US soyabean exports following the election, with shipments to China severely curbed in his previous presidency. Read more analysis on this in Tuesday’s Grain market daily.

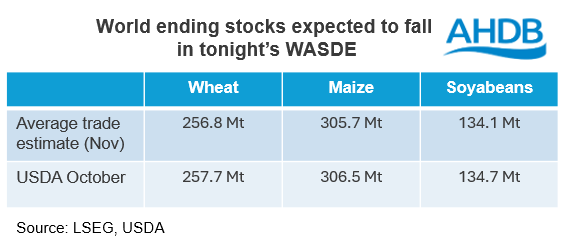

What to look out for in tonight’s WASDE

The USDA is due to publish its November World Agricultural Supply and Demand Estimates (WASDE) later today. Ahead of the published report, a Reuters pre-report poll suggests that analysts are expecting a fall in global wheat, maize and soyabean stock estimates.

As well as changes to global stocks, analysts expect US production estimates of maize and soyabeans to fall, and as such a decline in US ending stocks of these commodities. However, a slight rise in US wheat stocks is anticipated.

Harvest 25

Yesterday, the USDA published the latest forecasts of maize, soyabean and wheat area in the US for the 2025/26 season. The data showed that US farmers are expected to expand maize plantings to 37.2 Mha, from 36.7 Mha this season. The US wheat area for harvest 25 is expected to fall from 18.7 Mha this season, to 18.6 Mha in 2025/26. Finally, the soyabean area is pegged at 34.4 Mha, down from 35.2 Mha this marketing year.

These projections are based off conditions in October and come as farmers near the end of harvest. However, weather in the spring will be key in determining the size of those maize and soyabean crops.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.