Could the US election impact global oilseed markets? Grain market daily

Tuesday, 5 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £178.20/t yesterday, falling £1.05/t from Friday’s close. The May-25 contract also fell £1.05/t over the same period, to close at £191.95/t.

- Egypt’s wheat tender highlighted the continued competition of Black Sea grain as French wheat remains more expensive, pressuring Paris and UK wheat futures. However, in view of the offers, Russian wheat priced higher than alternate Black Sea origins (e.g. Ukraine) suggesting some adherence to the unofficial price floor set by the Russian government.

- Paris rapeseed futures (May-25) closed at €514.75/t yesterday, falling €0.75/t from Friday’s close. The Aug-25 contract also fell €0.75/t over the same period, to close at €482.00/t.

- Paris rapeseed futures lost value after profit-taking and tracked weakness in Chicago soyabean oil futures (Dec-24) which lost value due to uncertainty regarding US biofuels ahead of today’s US election.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could the US election impact global oilseed markets?

The US presidential election occurs today. While the vote outcome is usually known on election night, it took several days in 2020. Recent election polls have been divided, the majority forecast a marginal win for either the Democrats (Kamala Harris) or Republicans (Donald Trump).

Both parties have shown their support to the ethanol and biofuel sector, and a recent poll by Farm Journal suggests it is fairly divided regarding who will be more supportive of US biofuel policy. The US biofuel market plays an important role for both the soyabean oil and maize market, with just over 40% of the US maize crop used for ethanol production.

However, both parties have varying intentions regarding trade policy. While Kamala Harris has supported Joe Biden’s targeted tariff rates on certain Chinese imports (e.g. steel, electric cars, batteries), she has not made a specific reference to raising tariff rates across all Chinese imports. In contrast, Donald Trump plans to impose a 60% or greater tariff across all Chinese imports, which could be of more significance upon the trading relationship with China. If elected, this would not be the first time Donald Trump has raised tariffs on Chinese imports.

How did the US-China trade war impact US exports

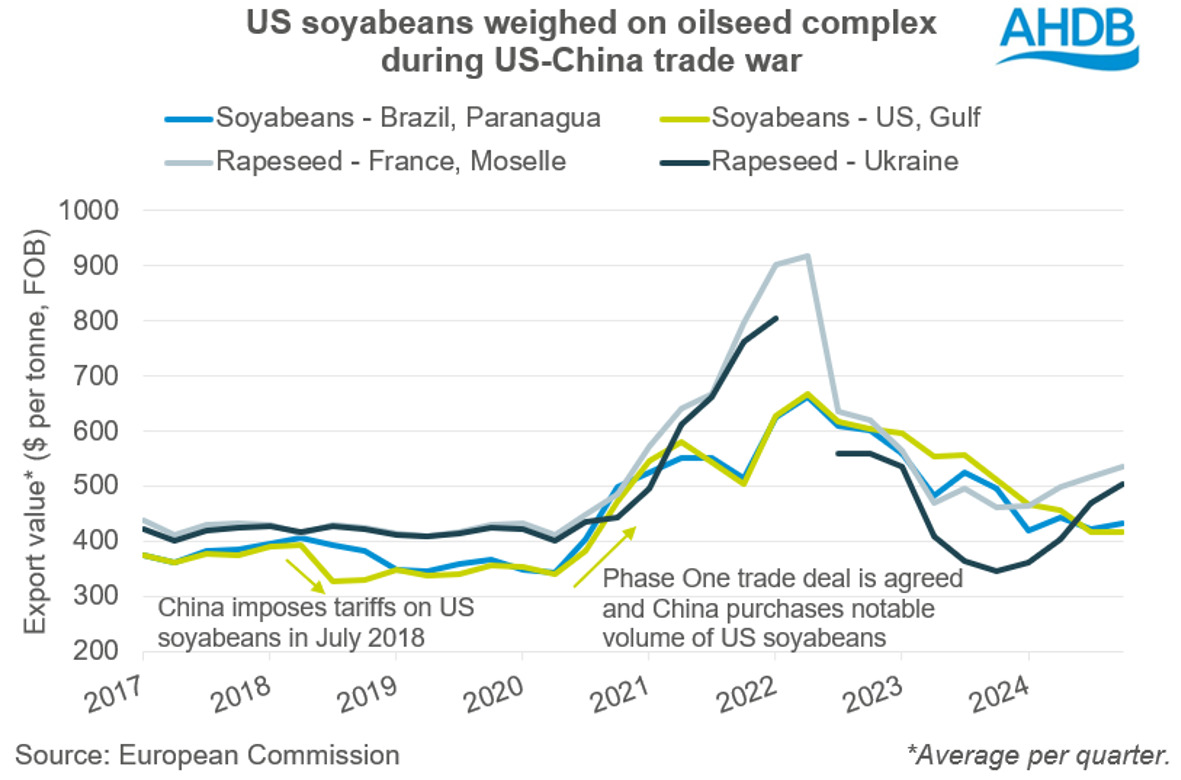

In 2018, Donald Trump began a trade war with China by raising tariffs on Chinese goods in efforts to reduce the US trade deficit with China and support US manufacturing. In response, China imposed tariffs on US products in same year.

In January 2020, Donald Trump signed a trade deal with China (called Phase One) whereby the US cut some tariffs on Chinese goods and China pledged to purchase more US products, including agricultural. While this bolstered US exports to China during the 2020/21 marketing year, exports of soyabeans have slowly trended downwards since. Lately, the US has been predominantly competing with South America for China’s soyabean demand.

While the agreement of the Phase One trade deal did also initially support US maize sales to China, the volume has reduced as China mostly imports maize from South America.

How did this impact the oilseed complex?

As a result of the US-China trade war, US soyabeans became more competitive on global oilseed markets as it sought demand from alternative destinations, anchoring prices across the oilseed complex. Then, following the Phase One trade deal, China’s purchasing of US soyabeans offered significant support to the soyabean market, lifting global oilseed prices.

Looking ahead

Although potential changes to US policy will be of greater significance to US farmers, as the US is the second largest exporter of soyabeans, any changes which impact on the crop’s value is likely to influence the global oilseed market, including rapeseed.

Following the election outcome, any revisions to US trade policy and its trading partners will be a key watch point.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.