Arable Market Report – 18 November 2024

Monday, 18 November 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

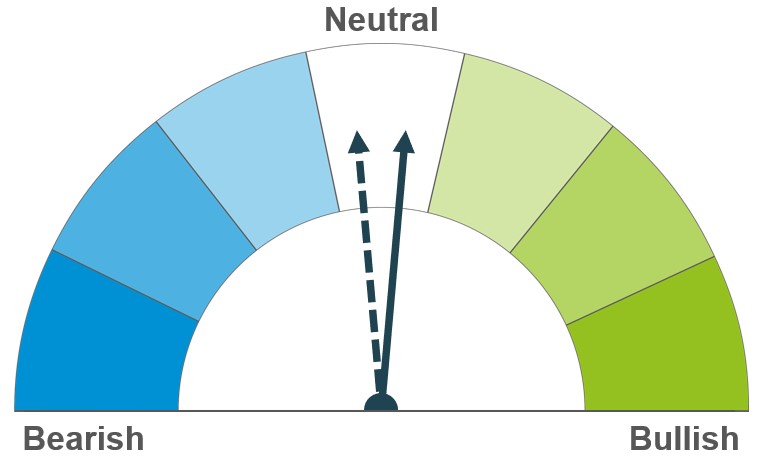

Wheat

Maize

Barley

A strong US dollar, steady wheat exports and forecasts of favourable weather in parts of the Northern Hemisphere could pressure prices short term. However, weather risks for winter wheat crops in the Black Sea could keep prices steady longer term.

Competitive US export prices and firm ethanol production in the US provide some stability in the near-term, while comfortable global supply forecasts limit price rises long term.

The wider grains complex continues to drive barley prices, with weak demand from major importers limiting any gains.

Global grain markets

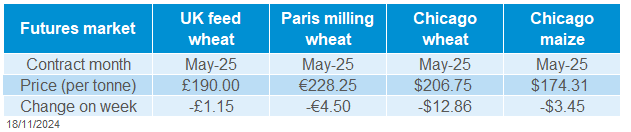

Global grain futures

US wheat markets fell significantly last week (Friday – Friday). Chicago wheat futures (Dec-24) ended down 6.3%. The cereals complex was pressured by a stronger US dollar, forecasts of favourable weather in key growing regions such as the US and western Europe, and the competitiveness of Black Sea exports.

US Dollar Index futures (Dec-24) closed higher each day last week, putting pressure on commodity markets, especially for wheat, with US export prices at the highest level in the market.

Favourable rains are forecast in the US, which could improve winter wheat crop conditions further. As a result, Chicago wheat futures prices are near four-year lows. Paris milling wheat futures were under pressure from US markets, as well as an accelerated winter planting campaign in France.

Improved weather is a key factor at the moment. Stratégie Grains estimate the wheat area in the EU to increase on the year, due to improved weather conditions, while barley and maize areas could decrease. Meanwhile, Australia is in the process of harvesting a larger-than-expected wheat crop.

Export sales of US maize were reported at 1.3 Mt for 2024/2025 by 7 November and down 53% from the previous week. Though weekly data (by 11 November) from the EIA showed ethanol production in the US is at an all-time record level.

FranceAgriMer reported that 71% of the French maize crop had been harvested by 11 November, up from 96% in 2023 and the five-year average of 93%. Speculators switched to a net long position in Chicago Board of Trade maize futures for the week ending 12 November.

Barley markets have been stable due to competitive prices compared to maize and feed wheat. However, barley prices have limited upside potential as demand from main importers China and Saudi Arabia is steady for now. FranceAgriMer reported that 89% of the French winter barley had been planted by 11 November, up from 83% last year, but behind the five-year average of 91%.

UK focus

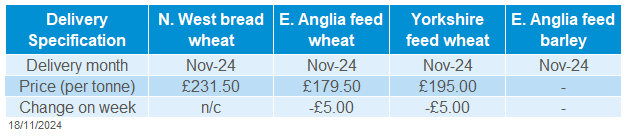

Delivered cereals

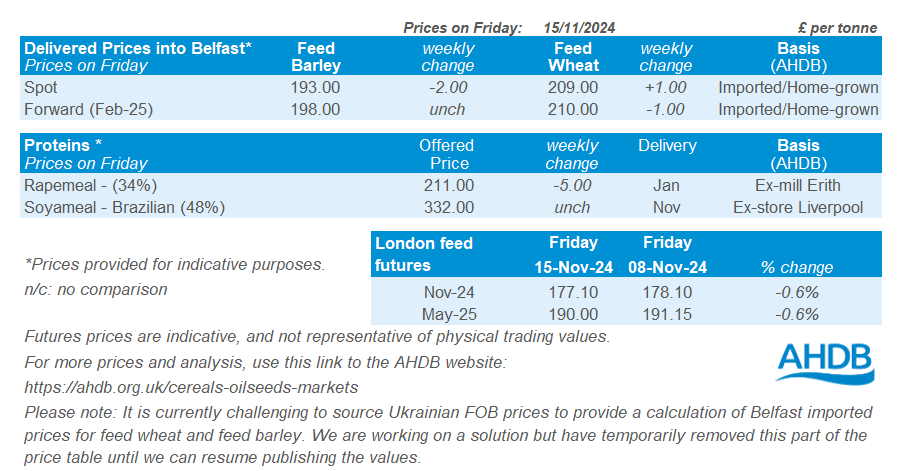

UK feed wheat futures tracked pressure in global wheat markets last week (Friday – Friday). Domestic futures were affected by the weakening of sterling against the US dollar and the euro. The Nov-24 contract lost £1.00/t over the period to close at £177.10/t, and the May-25 contract fell £1.15/t to close at £190.00/t.

UK delivered wheat prices also lost value across the week (Thursday – Thursday). Feed wheat delivered in East Anglia for November delivery was quoted at £179.50/t, £5.00/t less than the previous week. Bread wheat delivered to Northamptonshire for November delivery lost £7.00/t over the same period, quoted at £223.50/t.

Last Tuesday, AHDB released the Cereal Quality Survey for wheat and barley. The Cereal Quality Survey confirmed lower protein for wheat and lower nitrogen for barley. The average protein levels for UK Flour Millers group 1 varieties in 2024 is 12.5%, down from the 2023 average of 12.7%. However, milling wheat premiums continue to ease. Low nitrogen levels present more of a challenge to achieve the malt specification that most brewers need. It may also make it more challenging to export malting barley due to higher continental nitrogen requirements.

On Friday, AHDB published further thoughts on the budget, analysing further the impact of the erosion of funding and tax implications on the farming industry.

Oilseeds

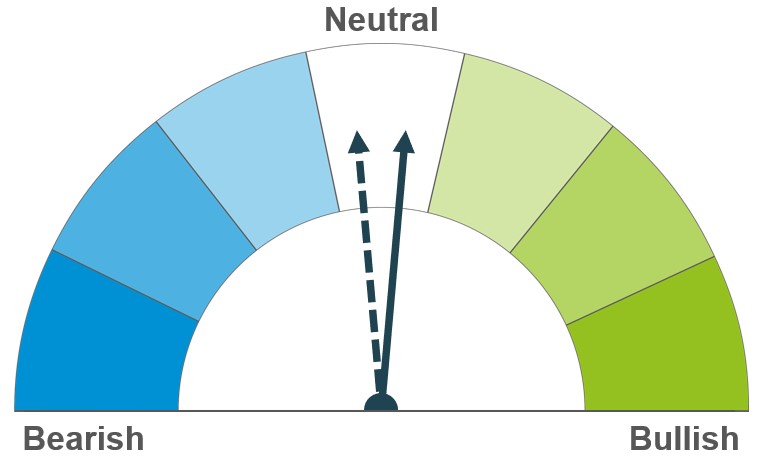

Rapeseed

Soyabeans

Weakness in soyabean prices will likely filter through to rapeseed prices short term. However, potential seasonal recovery in the vegetable oils complex, along with lower production levels this year, could keep rapeseed prices steady in the long term.

Expectations of a drop in demand under Trump’s administration, coupled with favourable weather in South America are weighing on prices. However, stronger crushing demand in the US and a further climb in Chinese purchasing, ahead of Trumps presidency, could limit the price fall longer term.

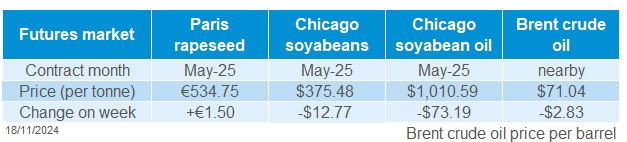

Global oilseed markets

Global oilseed futures

Last week (Friday to Friday) soyabean prices experienced overall pressure, with Chicago soybean futures (May-25) falling by £12.77/t to close at £375.48/t on Friday. Chicago soyabean oil futures (May-25) fell 6.75% over the same period. This downward trend was mainly driven by the expectations of a drop in demand from the biofuel industry, attributed to policy changes under the new Trump administration. Despite a rebound in prices later on Friday, due to short covering and reports of a potential shift in China's export policy on used cooking oil, the recovery was insufficient to offset the week's overall decline.

Earlier in the week, US president-elect Donald Trump named his candidate for the head of the US Environmental Protection Agency (EPA). The nominee is widely perceived as unsupportive of the biofuel industry, which has raised significant concerns about future demand for soyabean oil, a major feedstock for biofuels.

The USDA reported last week that the US soyabean harvest had reached 96% completion as at 10 November, up from 94% the previous week and ahead of the five-year average of 91%. Meanwhile, US soyabean exports for the week ending 7 November totalled 2.34 Mt, down 3% week-on-week but up 2% from the previous four-week average, with China (1.61 Mt) as the main export destination.

The National Oilseed Processors Association (NOPA) reported an all-time high US soybean crush in October. The association recorded a rise of 12.8% compared to the previous month and up 1.6% on trade estimates.

China’s soybean imports could drop to 98.8 Mt in the year up to September 2025, down from 109.4 Mt the previous year, according to a COFCO executive (LSEG). Again, this decline is partly due to concerns about potential trade policy changes under Trump’s administration.

Favourable planting conditions in South America have improved soybean crop prospects in the region. In Argentina, the Rosario Grains Exchange has slightly revised its soybean forecast upwards to 53.5 Mt from the previous 53 Mt, due to welcomed rains in the second half of October. Also, in Brazil, the planting pace has picked up, with Consultancy AgRural reporting that soybean planting reached 80% by 14 November, up from 67% the previous week and 68% recorded a year earlier.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures saw gains over the week from Friday to Friday. The May-25 contract gained €1.50/t, closing the week at €534.75/t. This increase came despite declines for most of the week due to general weakness in the vegetable oil complex.

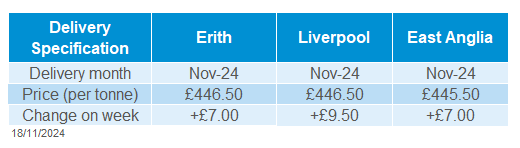

Rapeseed delivered into Erith for November 2024 delivery was quoted at £445.50/t on Friday, rising £7.00/t on the week. Delivery into Erith for February 2025 was quoted at £451.50/t, up £5.00/t on the week. Please note that the delivered prices survey was conducted on Friday morning. Therefore, it does not account for the price movements of Paris rapeseed futures throughout the entire day on Friday.

Rapeseed imports into the EU have continued to rise. According to the latest EU commission data, as of 10 November, rapeseed imports this season (from July to date) have reached 2.22 Mt. This represents a 15% increase compared to 1.93 Mt during the same period last year.

The German oilseeds association UFOP projects that the area planted with winter rapeseed in Germany for the 2025 crop will fall slightly by 40 Kha from the 2024 harvest, to between 1.05 Mt and 1.09 Mt.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.