Cereal Quality Survey confirms lower protein and nitrogen contents: Grain market daily

Tuesday, 12 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £177.60/t yesterday, falling £0.50/t from Friday’s close. The May-25 contract fell slightly (-£0.05/t) over the same period, to close at £191.10/t.

- Last week, changes in interest rates continued to influence markets. At Monday’s close sterling strengthened against the euro but weakened against the US dollar. Chicago wheat futures were under pressure as rains forecast in the US this week could help improve winter crop conditions as well as the US dollar strengthening.

- Paris rapeseed futures (May-25) closed at €535.50/t yesterday, up €2.25/t from Friday’s close. The Aug-25 contract fell €0.25/t over the same period, to close at €500.25/t.

- Paris rapeseed futures gained yesterday, despite the fall in US soyabean oil and crude oil markets. Support for Paris rapeseed comes from rising Palm oil prices and the euro weaking against the US dollar. Chicago soyabean futures fell yesterday, after hitting near one month highs on Friday, on the back of profit-taking and weakness in soyabean oil markets.

Cereal Quality Survey confirms lower protein and nitrogen contents

The 2024 AHDB Cereal Quality Survey confirms harvest reports of low protein for wheat and low nitrogen levels in barley. Persistent wet conditions through the autumn and winter, plus much of spring meant it was difficult for farmers to get onto fields and apply nutrients. The conditions also increased nitrogen leaching over winter, making it harder for plants to access the nutrients that were applied.

Protein and small crop restrict bread wheat availability

The average protein levels for UK Flour Millers group 1 varieties in 2024 is 12.5%, down from the 2023 average of 12.7%. It is also the lowest level since 2014, when proteins declined to the dilution effect of high yields.

However, as suggested by reports during harvest, other criteria for wheat in 2024 are improved with higher specific weights and Hagberg Falling Numbers. Average moisture levels are also lower year-on-year, reflecting the generally dry conditions for large parts of the wheat harvest period in England.

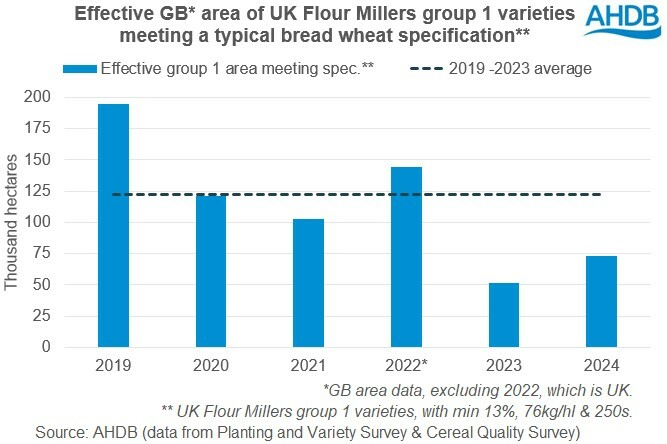

In 2024, 20% of group 1 milling wheat samples met the typical group 1 bread wheat specification (specific weight of 76kg/hl, protein content of 13.0%, and HFN of 250 seconds or more). While this represents an uptick from 2023 (13%), availability is still likely to be restricted.

AHDB’s Planting and Variety Survey showed a drop in the area of group 1 varieties for harvest 2024. When the information from the two surveys is combined it suggests the area of group 1s effectively meeting spec this season would still be well below average. UK wheat yields were also provisionally lower than in 2023, which could also reduce production. Plus, while not captured by this survey, it’s important to note that this year’s challenges with ergot also add to the difficulties for growers and the supply chain.

In past seasons with lower protein levels, we have usually seen increased wheat imports with higher contents to blend with UK supplies. AHDB’s Early Balance Sheet forecasts a further increase in imports of wheat, up 163 Kt from 2023/24’s already elevated level, to 2.6 Mt in 2024/25.

Contrasts for winter and spring barley

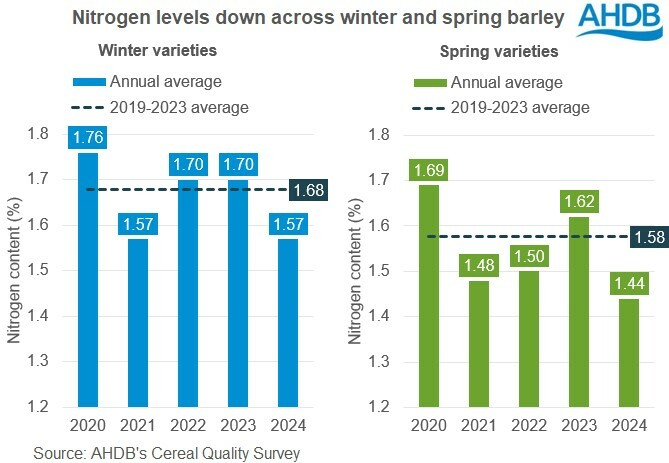

The survey shows lower nitrogen across winter and spring varieties but contrasting pictures between winter and spring on specific weights and screenings.

For winter barley, the nitrogen content averaged 1.57%, down from 1.70% in 2023, but similar to 2021. In addition, specific weights are lower. Winter barley varieties average 63.8kg/hl, down 1.1kg/hl from 2023 and likely the lowest in electronic records (starting from 1996). Average retentions over a 2.5 mm screen, though up on the year, remain below average.

Spring barley samples had an average nitrogen content of 1.44%, also down from 1.62% in 2023 and the lowest in electronic records (starting from 1996). But there are also improved specific weights and higher retentions over a 2.5mm screen.

Low nitrogen levels present more of a challenge to achieve the malt specification that most brewers need. It may also make it more challenging to export malting barley due to higher continental nitrogen requirements. This said though, industry reports are still positive about the 2024 crop quality, particularly after the 2023 crop.

It’s also worth noting that barley moisture levels were notably higher this year, which would have increased drying costs.

The full results of the survey are available from the AHDB Cereal Quality Survey page.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.