Milling wheat premiums continue to ease: Grain market daily

Friday, 15 November 2024

Market commentary

- UK feed wheat futures (Nov-24) ended yesterday’s session at £174.85, up £0.80/t from Wednesday’s contract low. The May-25 contract also gained £0.80/t over the same period, to close at £187.40/t.

- Domestic wheat futures remain close to contract lows as pressure from a rally in the US dollar continues to impact global grain markets. Favourable conditions for new crop plantings in major exporting countries, as well as competitive Black Sea supplies are also weighing on wheat prices.

- The May-25 Paris rapeseed futures contract closed at €525.50/t yesterday, down €3.75/t from Wednesday’s close.

- Following a recent rally, European rapeseed is losing ground from pressure in the wider oilseeds complex. US President-elect Donald Trump is expected to bring in policies that could hinder the US biofuel market, and as such, traders are assessing the potential impact on soyabean and soya oil demand.

Milling wheat premiums continue to ease

The gap between the UK monthly average ex-farm spot prices for bread and feed wheat sat at £42.20/t in October. This is down from £50.20/t in September, and £59.60/t a year earlier. Though it’s important to note that this is still higher than the previous five-year average for October of £35.74/t.

However, the ex-farm milling premium does look to have eased further more recently. In the week ending 7 November 2024 (latest data), UK spot ex-farm bread milling wheat averaged just £29.90/t over feed wheat.

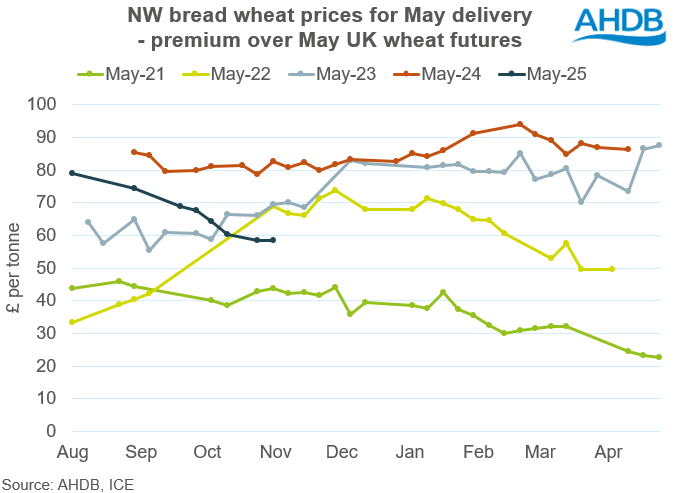

The delivered price premium for bread wheat, which includes haulage and other costs, has also eased. Bread wheat to be delivered into the North West in May was quoted at £249.50/t last Thursday, at a £57.45/t premium to May-25 futures. This is down on the same point last year, when the premium for May-24 delivery over May-24 futures was £82.45/t.

As has been well reported, difficult planting and growing conditions last season meant we saw a much smaller wheat crop in 2024, currently estimated at 11.1 Mt, down 21% on the five-year average. However, the size of the crop was not as small as some in the industry had feared earlier in the year, and we likely saw some pressure in premiums as a result.

Further to this, while results from AHDB’s Cereal Quality survey confirmed that the 2024 crop produced notably lower-than-average protein content, overall a higher proportion of the sampled crop met the typical group 1 milling wheat specification than in 2023.

Another factor pressuring premiums is the expectation of a slight pull back in demand for milling wheat. In AHDB’s Early Balance Sheet wheat usage by flour millers was forecast down slightly on the year for the 2024/25 season, on the back of a slow start to the season, and industry reports suggesting the steady demand would continue.

Finally, it is of course important to note that competitively priced milling wheat imports are also a factor driving easing premiums. In July and August, the UK imported 607.5 Kt of wheat, more than double the amount imported at this point last year, and up 95% on the five-year average. While we do not have a breakdown of milling versus feed wheat, over half of what has been imported to date this season has come from Germany or Canada, which is likely to be of milling quality. September trade data is due to be published by AHDB later today.

Looking ahead

Looking ahead, as we progress through the season, it’s likely that domestic premiums will continue to be influenced by how competitively priced imports are and what that means for availability. However, given the size of the domestic crop this harvest, a heavier flow of imports will need to continue, and it is unlikely premiums will return to last year’s levels in the short-term.

Attention is now also turning to new crop, with drilling progressing across the UK. Our Early Bird Survey of planting intentions, due out next Thursday, will give a first insight into what wheat area we can expect for harvest ’25, with implications for premiums longer term.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.