Arable Market Report – 02 December 2024

Monday, 2 December 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

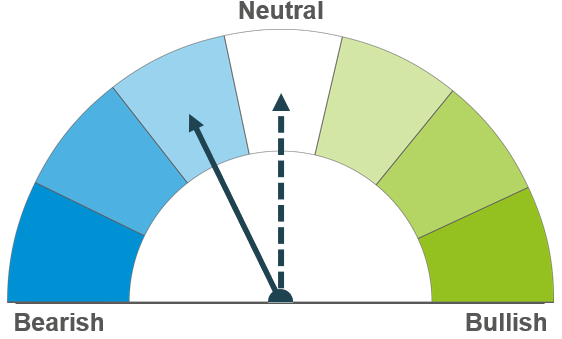

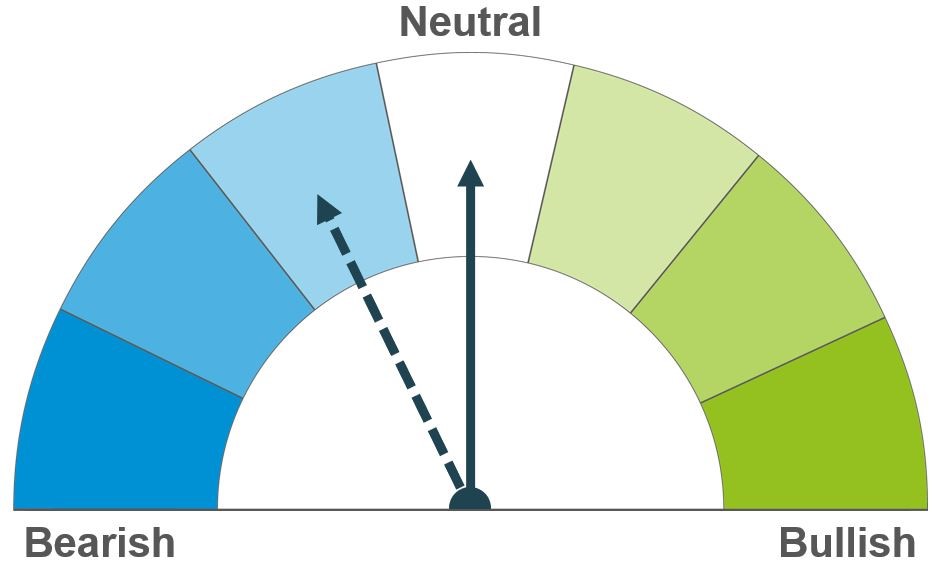

Wheat

Continued competition from Black Sea origins could weigh on the market in the short-term. Longer-term, favourable conditions in most of Europe aids winter wheat establishment but the Russian export quota lends support.

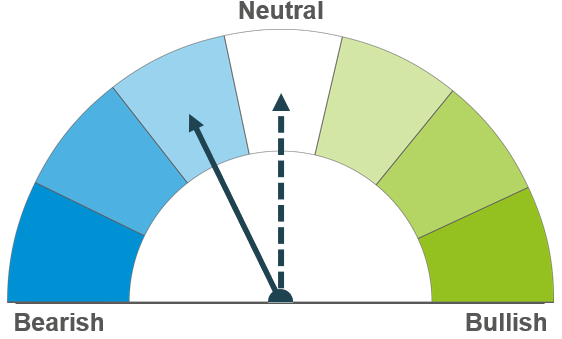

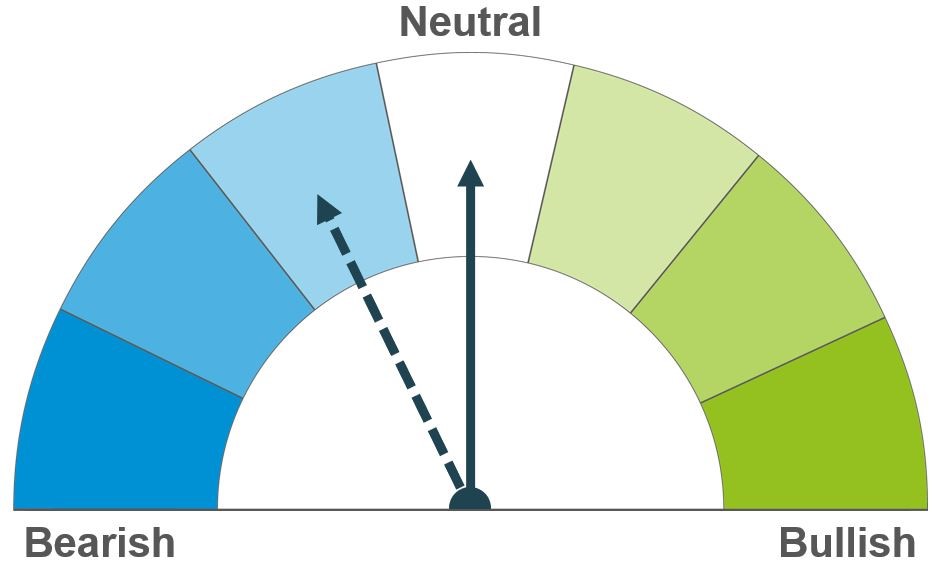

Maize

Forecast rains in southern Brazil could improve planting conditions for areas which are reporting insufficient moisture. Russia’s wheat export quota could offer longer-term support to the wider cereals complex.

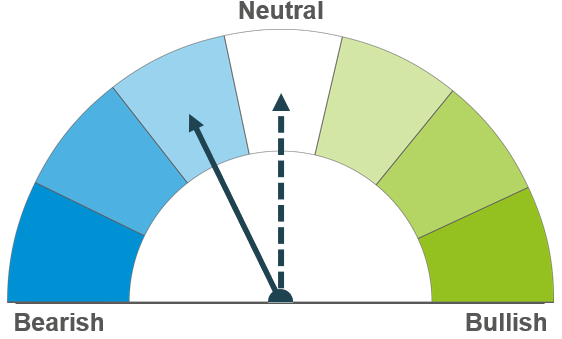

Barley

Weakness in the wheat market is likely to spill pressure over to the barley market for short-term but follow the more neutral outlook longer-term.

Global grain markets

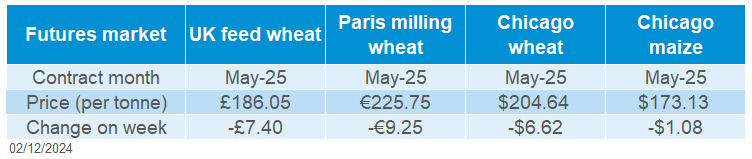

Global grain futures

Global grain markets were pressured last week (Friday-Friday). The announcement of the Russian wheat export cap did lend some support to the market, however Russian wheat continues to price competitively. Planting conditions improved across most of Europe in November and while Trump’s proposed 25% tariff on imports from Mexico stirred maize markets, conditions regarding the maize crop in Brazil remain generally positive.

Russian wheat continued to price competitively against European origins, pressuring the European wheat market. However, in response to a further sanction from the US, the Russian rouble has fallen to its weakest value since March 2022, which could slow the Russian export pace further. SovEcon cut its Russian wheat export forecast by 1.8 Mt to 44.1 Mt, which is now 8.3 Mt less than last season (52.4 Mt), but still above the five-year average of 40.9 Mt. This was in anticipation of Russia implementing a wheat export quota, which was announced on Friday (29 Nov), of 11 Mt from 15 February to 30 June 2024.

Last Monday, the EU MARS report for November highlighted that drier and warmer conditions across most areas of Europe supported the respective harvesting and/or sowing campaigns for those countries (e.g. France, Germany, Benelux). On Friday, FranceAgriMer reported the French wheat planting campaign 93% complete as at 25 Nov, two percentage points ahead of the five-year average.

Donald Trump announced his intensions to impose a 25% tariff on imports from Mexico. This led to speculation that, in response, Mexico may purchase less US maize. On average, over the past five marketing years, Mexico has accounted for 32% of US maize exports and so concerns were raised about how this could impact the US maize export campaign.

In Brazil, 59% of the first corn crop was planted by 24 Nov, ahead of the pace for last year of 55% (Conab). Agroconsult also forecasted the total Brazilian maize crop at 132.7 Mt, greater than forecasts from Conab and the USDA of 119.8 Mt and 127.0 Mt respectively.

UK focus

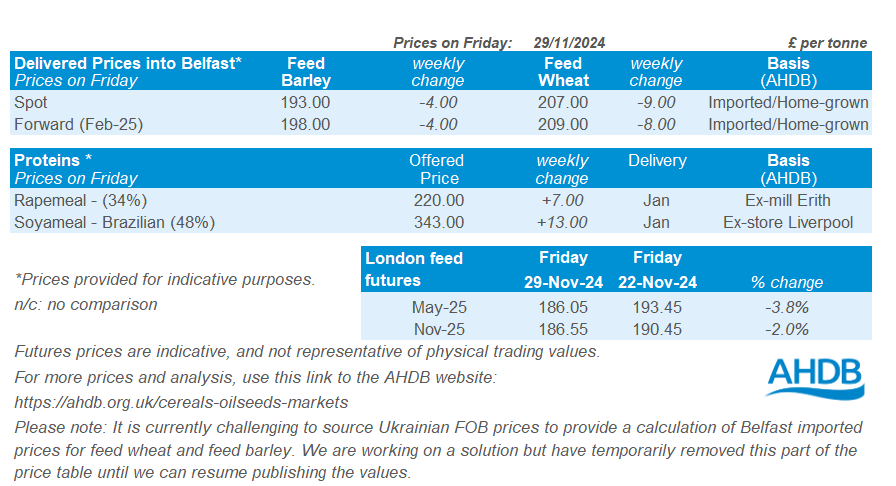

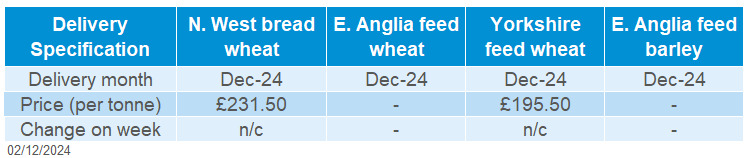

Delivered cereals

UK feed wheat futures tracked the direction of global wheat markets. The May-25 contract lost £7.40/t over the week (Friday-Friday) to close at £186.05/t, while the Nov-25 contact closed at £186.55/t, falling £3.90/t over the same period. Prices were also weighed on by the strengthening of sterling across the week in response to a weakening in the US dollar as markets reacted to Donald Trump’s tariff promises and Treasury secretary appointment.

Domestic delivered wheat prices fell across the week (Thursday-Thursday). Feed wheat delivered into Avonrange for December delivery was quoted at £182.50/t, £7.00/t less than the previous week. Bread wheat delivered to the North West for December delivery was quoted at £231.50/t with no comparison on the week, while February delivery lost £6.50/t on the week to £235.50/t.

On Friday, AHDB published the first official UK supply and demand estimates for wheat, barley, oats and maize for the 2024/25 season. This year the UK will rely on a greater volume of imported grain than last season and the previous five-year average. Full-season wheat imports are estimated to reach 2.75 Mt, up 13% on the year, while maize imports in 2024/25 are forecast down slightly on the year.

Oilseeds

Rapeseed

Pressure from price competition with soyabean and Winnipeg canola contrasts with lower world rapeseed production levels this year, which could keep rapeseed prices steady in the nearest term. In the longer term, the Australian harvest and higher estimated production in 2025 in the EU could add pressure.

Soyabeans

Falling vegetable oil prices and favourable weather in South America are weighing on the outlook for soyabean prices. However, limited supply from South America until the large 2024/25 crops are harvested and import demand from China could limit price falls in the short term.

Global oilseed markets

Global oilseed futures

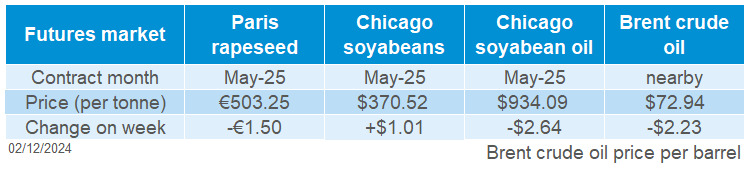

Last week (Friday to Friday) Chicago soyabean futures (May-25) gained 0.3%, supported by export demand and crush numbers in the US. However, favourable weather for soyabeans in Brazil and Argentina and the inauguration of the next US president could put pressure on prices early in 2025.

Generally, the vegetable oil complex was supported last week, with palm oil futures (May-25) on the Bursa Malaysia Derivatives Exchange increasing by 6.1%. Prices rose due to fears about a decline in palm oil production. The potential decline in palm oil production could be offset in the medium term by lower export volume.

Chicago soyabean oil futures (May-25) were down 0.3% last week. But the oil has some resilience now as it is trading at the on the widest discount to palm oil in 40 years (Oil World, www.oilworld.biz).

US soyabean exports net sales for 2024/25 for the week ending 21 November totalled 2.49 Mt, up 34% week-on-week. The net sales included China (+1.09 Mt), Mexico (+0.34 Mt), Germany (+0.20 Mt), Spain (+0.14 Mt), and Egypt (+0.12 Mt). Net export sales of soyabean oil and meal for 2024/2025 were also up noticeably from the previous week.

In Brazil, Agroconsult forecast soyabean production for 2024/25 at 172.2 Mt, 3.2 Mt higher than the USDA’s November forecast. We are awaiting the USDA’s December report next Tuesday. AgRural said that planted soyabean area in Brazil is 12% greater than at this time last year.

European Commission data shows that in the 2024/25 marketing year soyabean imports had reached 4.95 Mt by 24 November, up 7% from 4.62 Mt a year earlier. As we explained in our last report, due to competitive prices for US soyabeans, the share of this origin in EU imports may increase.

For sunflower, Stratégie Grains estimates production in 2025 at 10.5 Mt, up 25% from 8.4 Mt in 2024. This could put additional pressure on the 2025 crop Paris rapeseed futures.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures were steady Friday to Friday, but with volatility high within the week as the market tried to find a direction for further price movement. The May-25 contract closed the week at €503.25/t, down marginally (0.3%) from 22 November.

Winipeg canola futures (May-25) were under pressure last week falling 3%. Following Donald Trumps’s announcement last Tuesday, traders are concerned that the new US presidential administration will impose tariffs on goods imported into the US from Canada (LSEG). This could particularly effect Canadian canola oil and meal exports to the US.

Rapeseed delivered into Erith for December 2024 delivery was quoted at £423.50/t on Friday, down £9.50/t on the week. Delivery into Erith for February 2025 was quoted at £427.50/t, down £9.00/t on the week. The domestic market followed the high volatility of the Paris rapeseed futures last week; the survey was undertaken on Friday morning. In addition, sterling closed last Friday at its highest level against the euro since 14 November 2024.

According to the latest data from the European Commission, rapeseed imports this season (from July to date) have reached 2.40 Mt as of 24 November, up 8% from 2.22 Mt during the same period last year. The main origins are Ukraine (70.0%) and Australia (20.3%).

Stratégie Grains said on Friday in its first rapeseed forecast that the 2025 crop in the EU will be 18.7 Mt, up 12% from 16.7 Mt in 2024. Increased production was expected in Romania, France, Germany and the Baltic countries.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.