Arable Market Report – 25 November 2024

Monday, 25 November 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

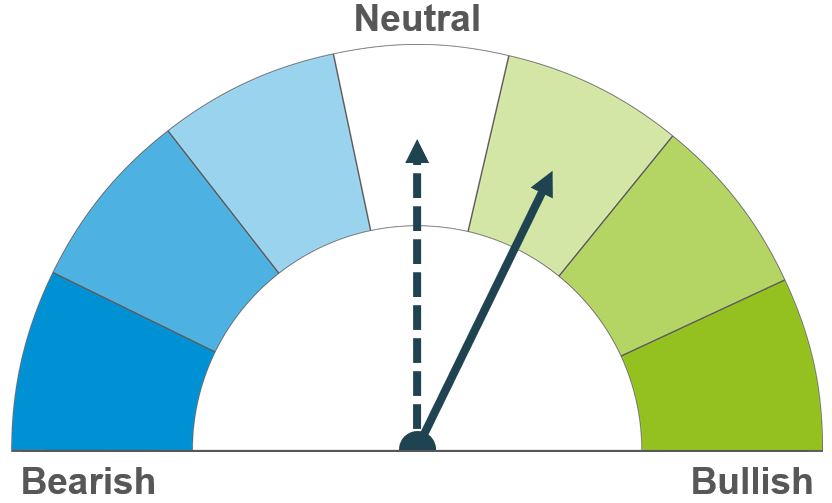

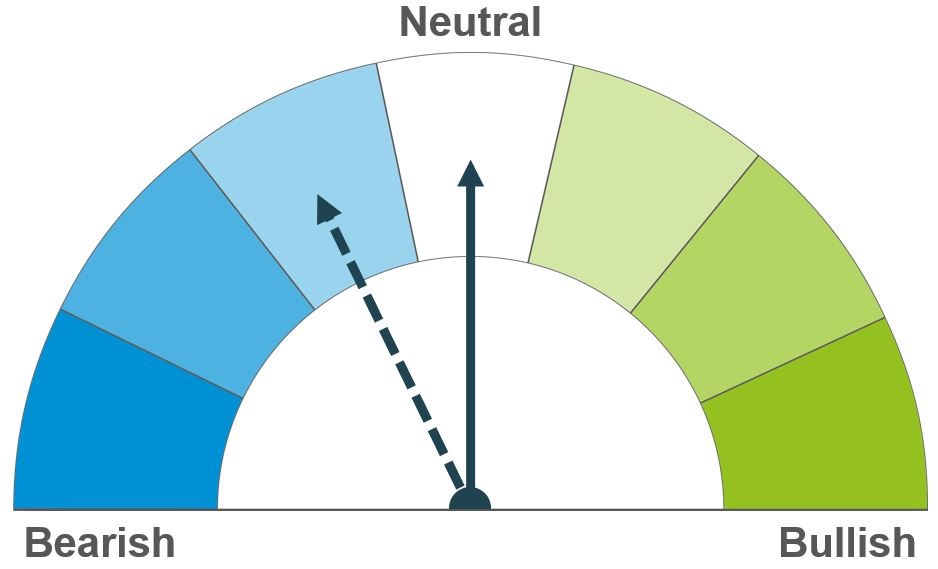

Global supply uncertainties, underpinned by the escalation of the conflict in the Black Sea region and lower production outlooks, could support prices in the short term. However, favourable weather in the US and larger crop forecast in Australia could stabilize prices longer term.

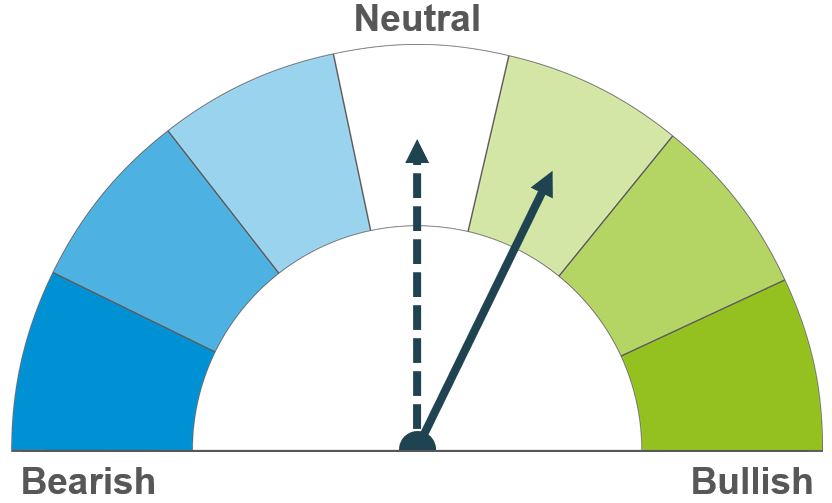

Stronger demand for US maize and potential supply risk for wheat could support prices in the short term. However, in the longer term, ample global supply forecasts are expected to keep price increases in check.

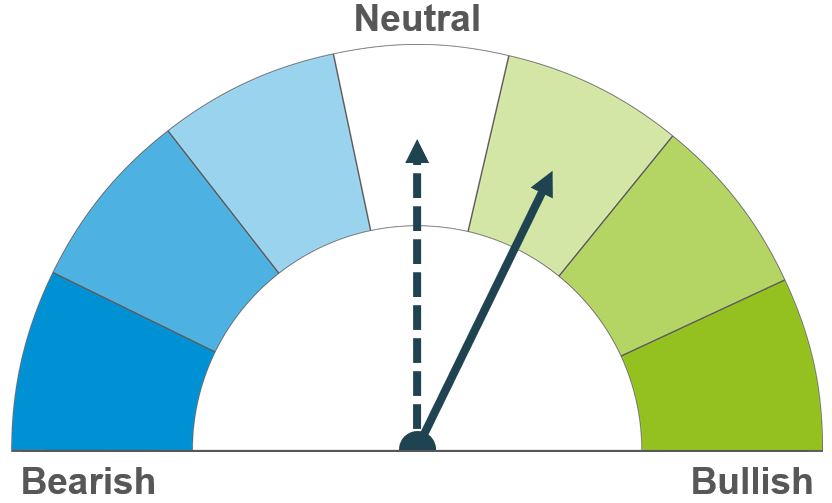

Short term feed barley prices are being supported by demand in the Middle East and the broader grains market. But, overall positive Southern Hemisphere yield prospects cap the longer-term outlook.

Global grain markets

Global grain futures

Global grain prices edged higher last week (Friday-Friday). Dec-24 Chicago wheat and maize futures rose by 1.5% and 0.4%, to close at $199.96/t and $167.52/t respectively. Paris milling wheat futures (Dec-24) increased by 1.3% over the period, closing at €219.00t. An escalation of the conflict between Ukraine and Russia supported prices for most of the week. However, a stronger US dollar and profit taking towards the end of the week restricted price rises.

Ukraine launched missile attack into Russia after US government lifted restrictions, and Russia reportedly retaliated by firing an Intercontinental Ballistic Missile (ICBM) into Ukrainian territory (Refinitiv). This prompted short covering by speculative traders as it increased concerns about potential disruption to the global grain supply.

The International Grains Council (IGC) tightened its global wheat outlook on supply concerns, while consumption remained firm. The IGC forecasts global wheat production for 2024/25 to edge lower by 2.0 Mt from last month to 796 Mt. However, world maize output is now expected to reach 1,225 Mt in 2024/25, up by 1.0 Mt from October.

In France, the winter planting pace has firmed. FranceAgriMer reports that 90% of the winter wheat planting had been completed as at 18 November, up from 78% a week earlier and above last year’s 73%. Also, the winter barley planting campaign is now 96% complete. Meanwhile, maize harvesting has reached 82%, up from 71% previous week but below 97% a year earlier.

Winter wheat is developing well in the US, with last week’s USDA’s crop report showing a notable improvement in crop conditions. Today’s report will be closely monitored for further updates.

LSEG reduced its forecast for Australia’s 2024/25 wheat production by 4%, now estimated to 29.5Mt. This will remain a key watchpoint. In September, Australia’s government expected the crop at 31.8 Mt this year, which is about 20% higher than both last year and the ten-year average.

UK focus

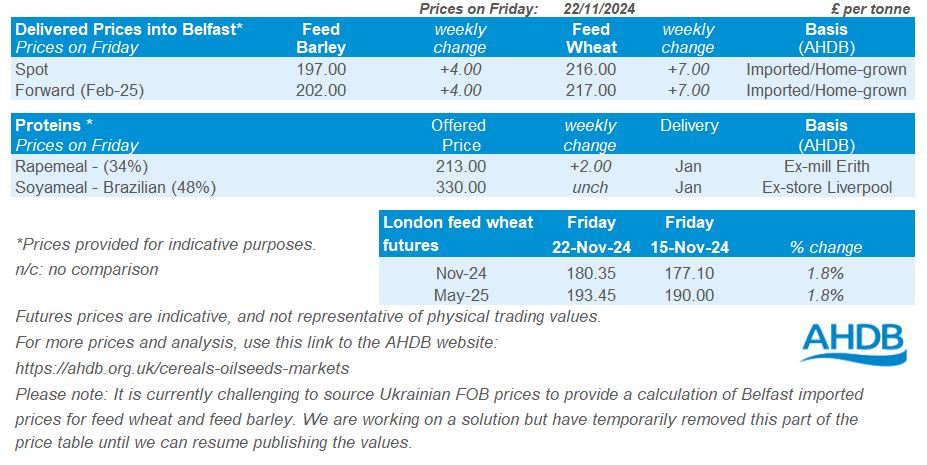

Delivered cereals

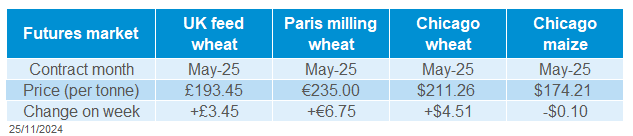

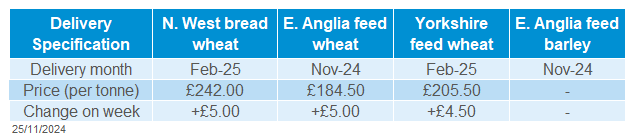

UK feed wheat futures tracked the upward movement of global wheat markets over the week (Friday – Friday). The May-25 contract rose £3.45/t to close at £193.45/t.

Domestic delivered wheat prices also gained across the week (Thursday – Thursday). Feed wheat delivered into East Anglia for November delivery was quoted at £184.50/t, £5.00/t more than the previous week. Bread wheat delivered to the North West for February delivery also gained £5.00/t over the same period, quoted at £242.00/t.

On Thursday, AHDB’s published its Early Bird Survey. The survey provisionally projects the UK wheat and total oat areas to rise for harvest 2025, but the winter and spring barley areas to fall. The overall wheat area is forecast to rise by 5.4%, all within the winter crop, after last autumn’s challenging weather sharply reduced the area. Most data were collected by 11 November, though results were received up to 15 November.

Colder-than-expected weather forecasts have led to a higher-than-usual need for natural gas. During the week, UK natural gas futures (Dec-24) reached their highest level this year. Fertiliser prices firmed slightly in October and need to be watched, as natural gas is a key feedstock for fertiliser production.

Updated estimates of UK wheat and barley supply and demand, plus the first for maize, oats, and other cereals in 2024/25 are planned for this Thursday (28 November).

Oilseeds

Rapeseed

Soyabeans

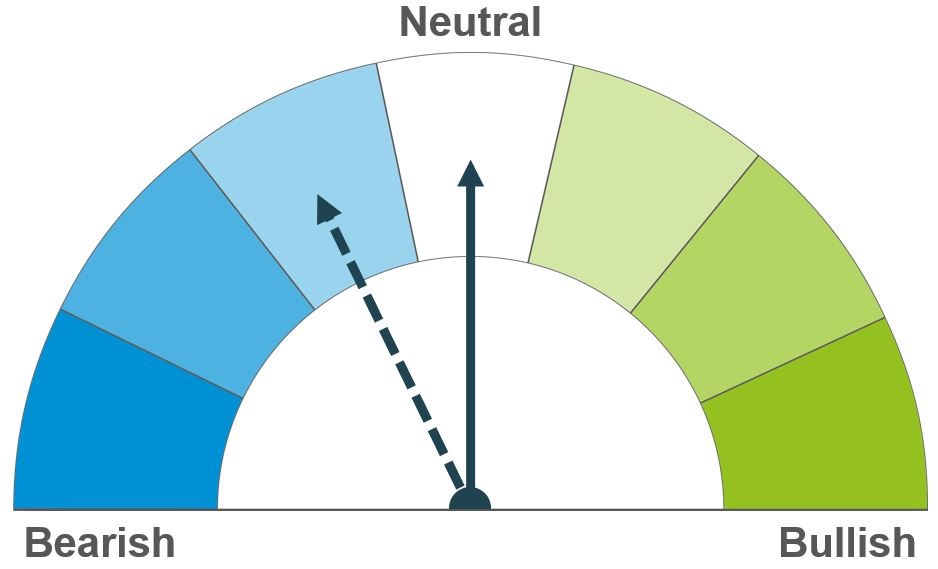

Weakness in soyabean oil prices and speculative profit taking have been weighing on prices in the short term. However, a possible correction after falling prices and lower world production levels this year, could keep rapeseed prices steady. In the medium term, the Australian harvest could add pressure.

Falling vegetable oil prices and favourable weather in South America are weighing on the outlook for soyabean prices. However, limited supply from South America until the large 2024/25 crops are harvested and import demand from China could limit price falls in the short term.

Global oilseed markets

Global oilseed futures

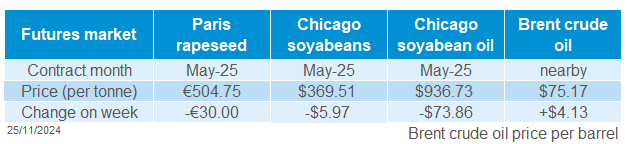

Last week (Friday to Friday) Chicago soybean futures (May-25) fell 1.6%. Chicago soyabean oil futures (May-25) fell 7.3% over the same period. The vegetable oil complex was weighed down last week, with palm oil futures (May-25) on the Bursa Malaysia Derivatives Exchange falling sharply by 6.9% last week on estimates of weaker demand in the near term. Managed money still holds a net long position in Chicago soyabean oil futures, which has occasionally supported prices in recent weeks. However, the price falls mean a risk of profit-taking, which could add downward pressure in the near term.

US soyabean exports for the week ending 14 November totalled 2.45 Mt, up 5% week-on-week, with China (1.51 Mt) as the main export destination. In Chicago soybean futures, speculators increased their net short position in the week ending 19 November, adding further pressure to the market.

In Brazil, soyabean production and exports are forecast to increase by 9.4% and 5.9% respectively in 2024/25 marketing year, compared to the last season, according to updated estimates from the trade association ABIOVE. On the other hand, domestic crushing is forecast to be 4.6% higher than last season. Brazilian farmers have sown 83.3% of the soyabean area expected for 2024/25, up from 74.7% at this time last year (Patria Agronegocios, LSEG).

One of the factors supporting Chicago soyabeans futures recently has been US exports to China. China’s soyabean imports for the first 10 months of 2024 totalled 89.9 Mt (lion’s share from Brazil), up 11.2% year-on-year and close to last year's total imports of 99.4 Mt (LSEG).

European Commission data show that in the 2024/25 marketing year soybean imports had reached 4.75 Mt by 17 November, up from 4.36 Mt a year earlier. The main origins are Brazil (50.4%), the US (36.9%), Ukraine (8.8%) and Canada (3.1%). Due to competitive prices for US soyabeans, the share of this origin in EU imports may increase.

Rapeseed focus

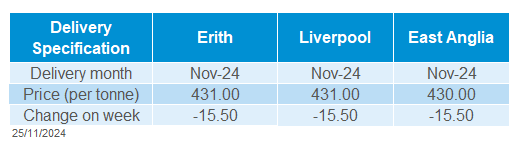

UK delivered oilseed prices

Paris rapeseed futures fell over the week from Friday to Friday. The May-25 contract down €30.00/t (5.6%), closing the week at €504.75/t. Winipeg canola futures (May-25) sharply decreased by 8.3% during last week. After such a long period of resilience, Paris rapeseed futures declined sharply last week. This drop was influenced by pressure from soybean prices and an increasing price spread between Paris rapeseed and Chicago soybean futures.

Rapeseed delivered into Erith for November 2024 delivery was quoted at £431.00/t on Friday, down £15.50/t on the week. Delivery into Erith for February 2025 was quoted at £436.50/t, down £16.00/t on the week. The domestic market came under heavy pressure from fall in Paris rapeseed futures last week, particularly on Thursday.

According to the latest data from the EU Commission, rapeseed imports this season (from July to date) have reached 2.34 Mt as of 17 November, up from 2.02 Mt during the same period last year. The main origins are Ukraine (70.0%) and Australia (20.3%). Australia is now in the rapeseed harvesting campaign and will have an impact on the EU market in the medium term.

AHDB’s Early Bird Survey provisionally projects a 17% fall in the planted area for oilseed rape in 2025. If confirmed, this would reduce the oilseed rape area to its lowest area in the UK for 42 years. Most data were collected by 11 November, though results were received up to 15 November.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.