Cold weather drives up natural gas prices: Grain market daily

Tuesday, 19 November 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £179.55/t, up £2.45/t from Monday’s close. New crop (May-25) futures closed up £2.45/t over the same period, to end the day at £192.45/t.

- Domestic wheat futures continued their rally from the end of last week on Monday, tracking global markets. Support came from the potential escalation of tensions in the Black Sea region after the US government lifted restrictions that had previously prevented Ukraine from using US missiles to strike deep within Russia.

- Paris rapeseed futures (May-25) felt some support yesterday, gaining €1.00/t, to close at €535.75/t from Monday’s close.

- European rapeseed prices were boosted by a rebound in canola prices yesterday. Winnipeg canola futures (May-25) rose by 0.2% yesterday on technical buying and spillover support from a late rally in soya oil, which helped offset the pressure from a significant decline in palm oil prices.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Cold weather drives up natural gas prices

As winter approaches, the demand for heating naturally increases. Colder-than-expected weather forecasts have led to a higher-than-usual need for natural gas.

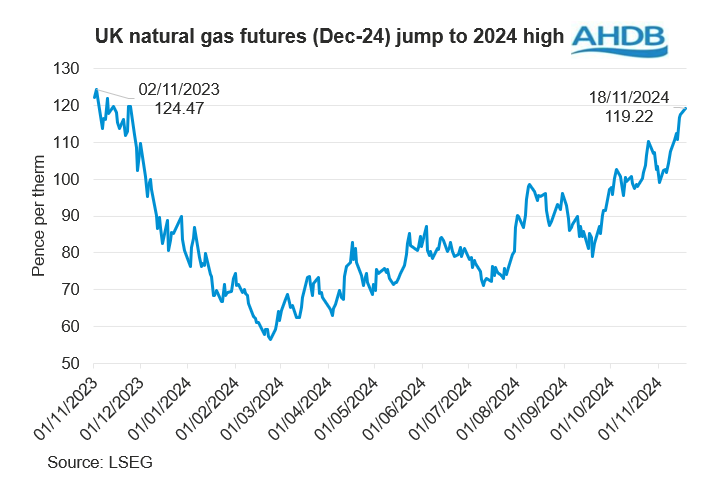

Since the last update in September, natural gas prices have continued to rise. This trend has increased more rapidly since the start of November. European natural gas futures (Dec-24) gained €7.73 per megawatt hour (MWh) from 1 November to settle at €46.9/MWh yesterday (18 November), their highest level since November 2023.

Domestic futures have also tracked the upward trend in continental prices. Yesterday, UK natural gas futures (Dec-24) reached their highest level this year at £119.22 p/therm. The UK natural gas futures have increased by 20.2% so far in November, further reflecting the rising demand due to the drop in temperature.

Supply chain uncertainties

Current heating demand is putting additional pressure on supply chains already facing uncertainties. Recently, Austria’s OMV warned of a potential halt to Russian pipeline gas supply. This follows an arbitration award that led OMV to stop payments to Gazprom, Russia's state-owned natural gas company. As a result, there is an expectation that the contractual relationship between OMV and Gazprom may deteriorate further.

Another concern in the European market is a major contract for transporting Russian gas through Ukraine, which is set to expire at the end of December. This contract, between Russia's Gazprom and Ukraine's Naftogaz, has been key for delivering Russian gas to Europe. Contract expiry could have substantial implications for Europe's gas supply and market dynamics. Although gas buyers are closely monitoring this situation, anticipating a potential increase in LNG demand at the start of 2025.

Impact on fertiliser prices

Fertiliser prices have also firmed, as natural gas is a key feedstock for fertiliser production. UK produced AN (34.5% N) rose by £5/t from September, averaging £341/t in October (highest price reported this year). Imported AN with the same nitrogen content averaged £334/t in October, an increase of £3/t from September (highest price since April).

Looking ahead

While the main driver for the current rally in natural gas prices is demand-pull seasonality, the price outlook remains supported due to ongoing supply chain uncertainties. These uncertainties may even intensify, especially with Ukraine now having access to US missiles capable of striking deep into Russia.

With the outlook suggesting that prices may stay elevated as we progress through winter, further rises in fertiliser prices and other farm costs are possible.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.