Natural gas prices are rising again: Analyst Insight

Thursday, 5 September 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £182.90/t, up £0.80/t from Tuesday’s close. The May-25 contract ended the session at £196.20/t, up £0.95/t over the same period.

- Domestic wheat futures tracked global wheat prices up yesterday. Support came from a combination of factors, including short covering by speculative traders, weather concerns for US maize and the harvest setback in Western Europe. However, cheaper exports from the Black Sea are contributing to limit gains.

- Nov-24 Paris rapeseed futures closed at €466.50/t yesterday, losing €3.25/t from Tuesday’s close. The May-25 contract declined by €5.25/t over the same period, ending at €467.75/t.

- European rapeseed prices followed the wider vegetable oil market down yesterday despite the recent downward revisions to EU rapeseed. However, Chicago soyabeans futures extended gains yesterday on support from short-covering and the dry weather risk. The possibility of Chinese tariffs on Canadian canola and hopes that China could buy more soyabeans from the US is helping to support soyabean prices.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Natural gas prices are rising again

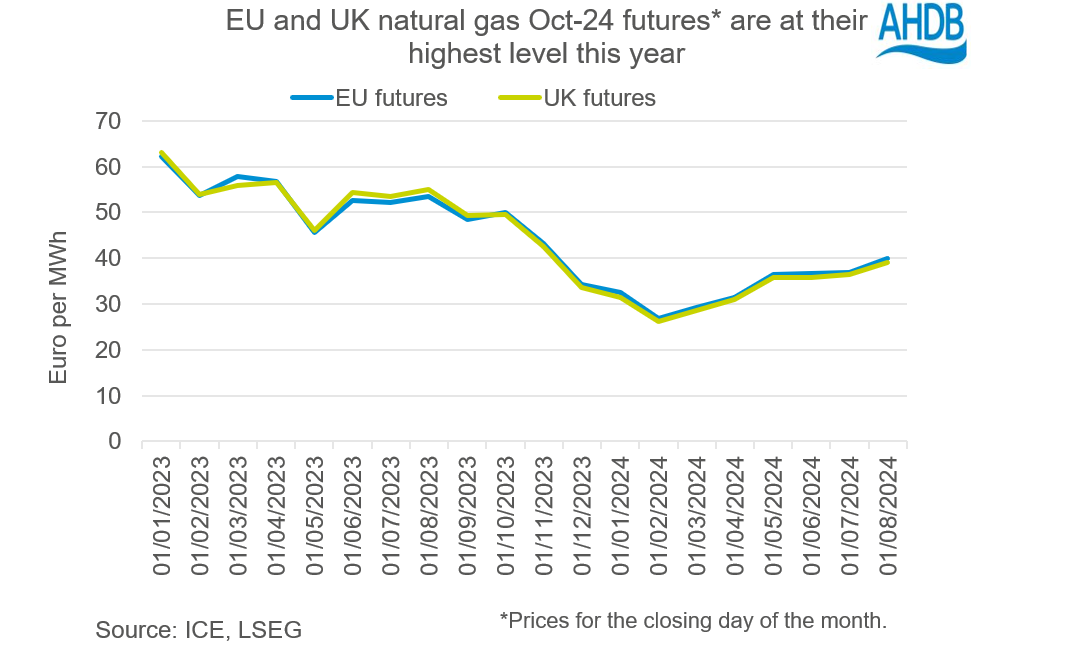

Natural gas prices in Europe have risen noticeably in recent weeks. The European natural gas futures for October 2024 reached €45.15/MWh on 9 August, the highest since December 2023 and 36% more than the average price this year (1 Jan – 4 Sep). While this was lower than the price at the same point last year, it is notable because gas prices were relatively stable before the recent steep increase.

The main reason for the recent surge in gas prices is geopolitical tensions, including the escalation of conflict in the Middle East and concerns over potential supply disruptions at the Russian-Ukrainian border due to the ongoing conflict. These factors have heightened anxiety in the gas market, leading to more volatility.

Between 31 July and 30 August, both Oct-24 European and UK natural gas futures gained 10% each to settle at €44.1/MWh and 96.15p/therm, respectively.

What does this mean for fertiliser prices?

Fertiliser prices have historically tracked movements in the gas markets because natural gas is a key input in the production of nitrogen fertilisers. Although fertiliser prices have remained relatively stable this year and are still significantly lower than the last two years, they may start to rise if the increase in gas prices continues.

However, whilst gas prices play a key role in the cost of producing nitrogen, fertiliser prices will need to find appeal with farmers. With relatively low grain prices and a challenging growing season in 2024, the fertiliser market finds itself between the rock of volatile gas prices and the hard place of challenging farm cash flow.

In July, UK-produced AN (34.5%) for spot delivery averaged £338/t, which is £5/t (2%) higher than June’s price and £15/t (4.2%) lower than the same time last year. The average price for imported AN in July was £332/t, up 0.6% from June’s figure and a 3.5% decrease year-on-year. Information on the prices for August are scheduled to be released next week.

Looking ahead

Looking forward, and with the geopolitical tensions likely to remain, weather changes are another key factor affecting gas prices in Europe that needs to be closely monitored. In the coming days, temperatures in the UK and northwest Europe are expected to fall below normal levels, which could potentially increase demand and further drive up gas prices.

Despite this, Europe appears to have a significant reserve of natural gas, with supplies being replenished ahead of the coming winter. According to Gas Infrastructure Europe data, the continent’s gas storage levels have reached 91.60% capacity as at 27 August, achieving the November target two months in advance.

Also on the supply side, Europe and the UK have become increasingly reliant on the importation of Liquefied Natural Gas (LNG) as alternative source of energy, since the outbreak of the Russia-Ukraine conflict. So, any additional interruption to Russian gas flow through Ukraine, combined with a harsh winter, could further strain the already tight LNG market.

While the solid reserve may provide some cushion against supply shocks going into winter, the current elevated gas prices remain a key factor to monitor when planning for the new season due to the lag effect on fertiliser prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.