Arable Market Report –10 February 2025

Monday, 10 February 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Following feedback, we have decided to make a few changes to improve our weekly grain and oilseed market report.

In place of our bullish/bearish dials, the new report provides more technical analysis of prices which, alongside key market information, gives you the tools to aid grain and oilseed marketing decisions. We have also added an ‘extra information’ section to the report, where we will be sharing key data and analysis releases with you.

Find out more about the graphs in this report, including how to use them. Also, look out for tomorrow’s Grain market daily, where we will highlight more information surrounding technical price analysis.

Grains

UK feed wheat futures (May-25)

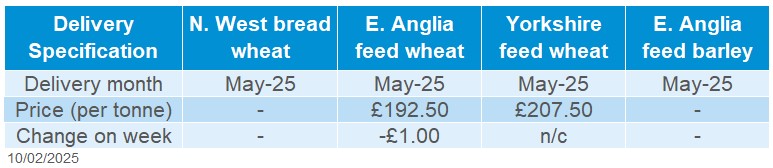

The global wheat market was supported last week, mainly due to weather concerns in the Northern Hemisphere, firming export demand in the US and Chicago wheat speculators short covering position.

Find out more about the graphs in this report, including how to use them.

Market drivers

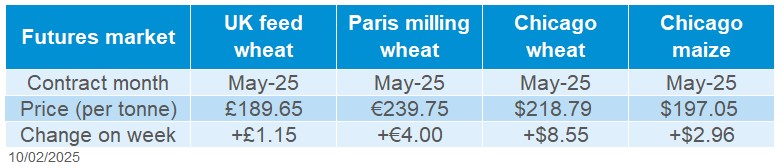

UK feed wheat futures (May-25) gained £1.15/t over the week (Friday–Friday) to close at £189.65/t. The Nov-25 contract gained £2.30/t, settling at £195.95/t. Domestic prices followed global market movement. Chicago wheat futures and Paris milling wheat futures (May-25) were up 4.1% and 1.7% respectively over the week (Friday–Friday).

Weather concerns continue in the Black Sea region, following lower soil moisture in the autumn, unfavourable snow cover over the winter, and now abnormally low temperatures forecast over the coming weeks. Consultancy firm IKAR revised down their 2024/25 Russian wheat export estimate by 0.5 Mt this morning, now at 43 Mt.

In France, export demand for feed wheat increased, but milling wheat export sales remained low (LSEG), and despite rises in the price of Black Sea grain, western European wheat generally lacks competitiveness.

The USDA export sales report for the week ending 30 January, showed net wheat export sales near the top of trade estimates at 438.9 Kt, up 41% from the previous four week average. For maize, the report showed net export sales near the top of trade estimates at 1.48 Mt up 32% from the prior four week average. The top buyers were Mexico (251.7 Kt) Japan (214.0 Kt), and South Korea (210.0 Kt).

Last Friday, Chicago maize futures (May-25) closed below the strong technical resistance level of $5/bushel ($196.84/t), which could limit further gains in the near term. For maize to break above the strong resistance, additional drivers are needed, such as Chinese buying activity or a lower than estimated USDA WASDE (11 February) global ending stocks figure.

Chicago maize speculators increased their net long position to a four-year high with future and options contracts at 364,217 as of 4 February.

Maize prices are also under pressure from the low soyabean/maize price ratio, which could encourage a larger US maize area for 2025.

UK delivered cereal prices

The feed wheat price for delivery into East Anglia in May was quoted at £192.50/t on Thursday, down £1.00/t on the week.

Despite reports of limited farmer selling, the basis for East Anglia delivered prices over May on Thursday was £2.50/t, slightly down on the week.

Rapeseed

Paris rapeseed futures in £/t (May-25)

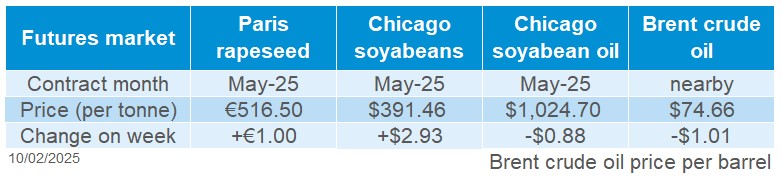

Temporary suspension of US tariffs on Mexico and Canada, weather risks in South America, as well as reduced canola stocks in Canada provided support on the week. However, heavy Brazilian soyabean supplies and likely rains in drought-hit areas in Argentina could limit price gains.

Find out more about the graphs in this report and how to use them.

Market drivers

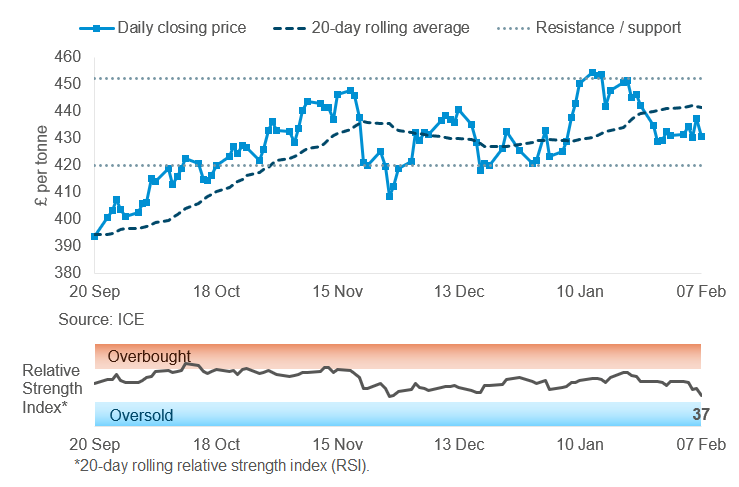

Old crop (May-25) Paris rapeseed futures ended the week at €516.50/t, up €1.00/t from the previous Friday. The Nov-25 contract saw greater gains, up €2.75/t on the week, ending Friday’s session at €489.50/t.

Paris rapeseed followed both Chicago soyabean and Winnipeg canola futures up on the week (Friday–Friday), gaining 0.8% and 3.0% respectively. Support in price came from the 30-day suspension of US tariffs on Mexico and Canada, as well as weather risks for South American crops, including drought in Argentina and excess rain in Brazil.

The 25% tariff on imports from Mexico and Canada into the US were delayed for 30 days, causing prices to rebound after the prior week’s drop. However, the 10% tariffs on China are still in place, and China has imposed new tariffs on US goods.

Rain in Argentina has helped soyabean crops in the central region, according to the Rosario Grains Exchange. However, more rain this week is needed to improve the condition of crops in the country. The Buenos Aires Grains Exchange predicts a soyabean harvest of 49.6 Mt in 2024/25, 2.4 Mt below the USDA’s forecast of 52.0 Mt.

Brazil’s Agriculture Ministry reports soyabean exports in January reached 1.07 Mt, down from 2.85 Mt last year. The soyabean harvest in Brazil has been slow due to heavy rains, but the country is still expected to produce a record crop this year.

The Statistics Canada stock report on 7 February shows a 19.2% year-on-year decline in canola (rapeseed) stocks, driven by higher exports and domestic demand. Canada’s rapeseed exports pace is currently above the three-year average.

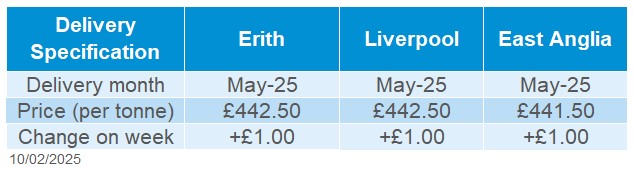

UK delivered rapeseed prices

Rapeseed delivered into Erith in May was quoted at £442.50/t on Thursday, up £1.00/t from the previous week. Delivery to East Anglia in May was quoted at £441.50/t, also rising £1.00/t. Please note the survey is usually conducted mid-late morning on Friday, so can show differences from Paris futures closing prices.

Extra information

Last Thursday, AHDB updated the UK human and industrial cereal usage dataset. The latest figures showed that wheat usage for bioethanol production remains low, with consistent declines in usage since October. Read more analysis on wheat usage for bioethanol production.

On the same day, the latest GB animal feed production data was published, showing usage up to the end of December. As could be expected, wheat usage remained steady for the first half of the season, due to its relative price against barley and imported maize.

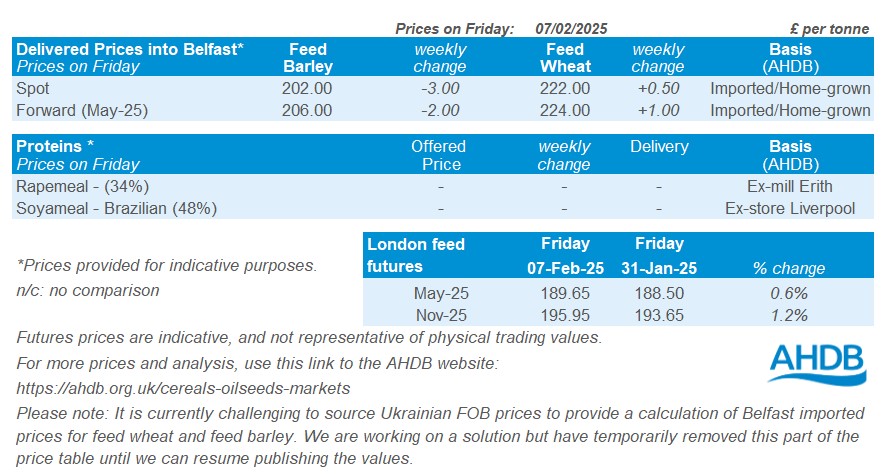

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.