Arable Market Report - 03 February 2025

Monday, 3 February 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

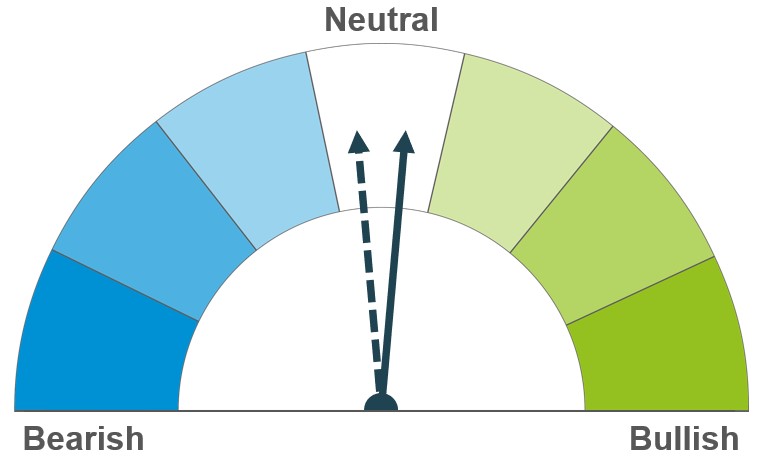

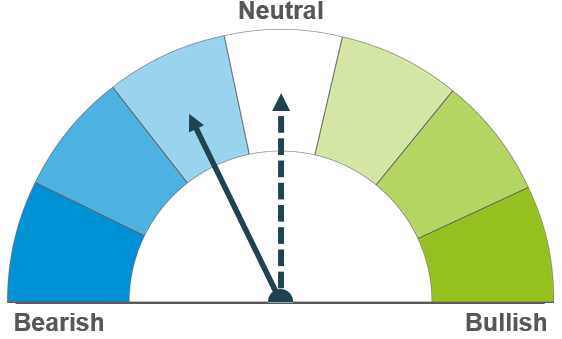

Wheat

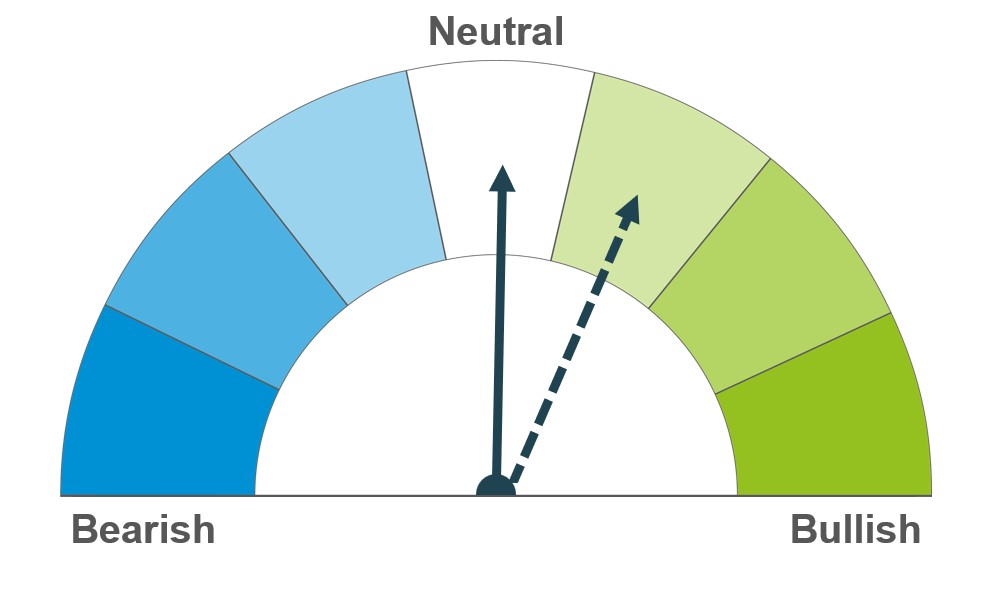

Maize

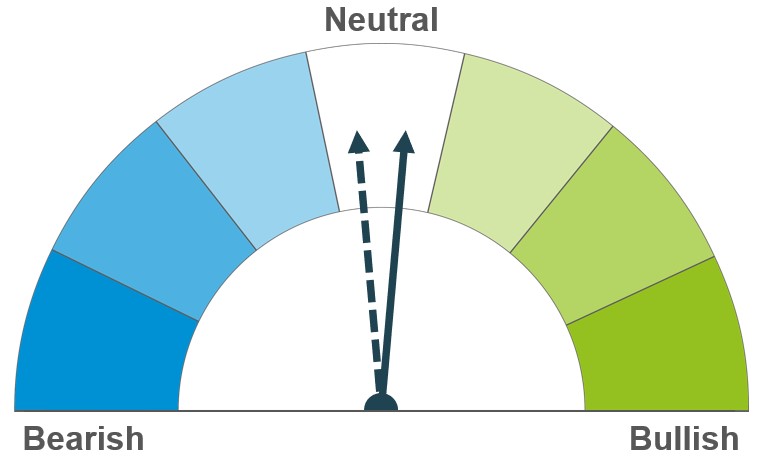

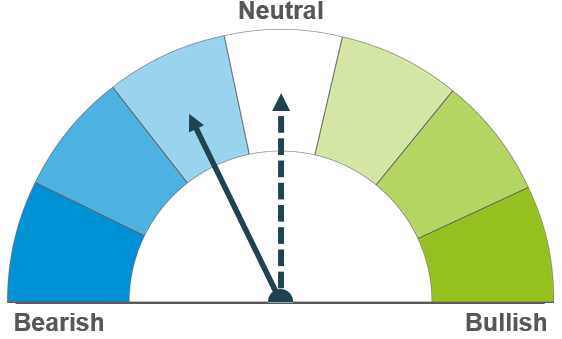

Barley

The US import tax could weigh in the short term. However, weather concerns about winter crop conditions in the Northern Hemisphere keep the outlook uncertain.

The US import tax could weigh in the short term, but lower global maize ending stocks could support prices in the medium term.

Feed barley prices are influenced by maize and feed wheat prices. However, a lower price differential between barley and other feed grains may limit any rises.

Global grain markets

Global grain futures

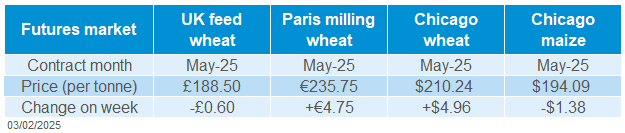

Last week (Friday–Friday), Chicago wheat futures (May-25) gained $4.96/t, to close at $210.24/t on Friday 31 January. Paris milling wheat futures (May-25) rose €4.75/t over the same period, closing at €235.75/t. The global wheat market was supported last week mainly by weather risks for winter crops in the Northern Hemisphere, export demand from the US and forecast lower exports from Russia.

Weather risks for winter wheat in US are still present due to a combination of low temperatures and limited snowfall this winter in parts of the US Plains and Midwest. India also has crop risks, with forecasts showing warm weather for all of February. India’s winter crops are planted from October to December and require cold weather conditions during their growth and maturity stages for optimal yields (LSEG).

The USDA export sales report for the week ending 23 January, showed net wheat export sales near the top of trade estimates at 456.1 Kt.

SovEcon trimmed its 2024/25 Russian wheat export estimate by 0.9 Mt from 43.7 to 42.8 Mt due to rising export taxes and slower export pace from early 2025. This fact could support the pace of EU wheat exports in the current marketing year.

Meanwhile, the USDA export sales report for the week ending 23 January, showed net maize export sales close to the average of trade estimates at 1.36 Mt. The top buyers were Japan (493.1 Kt), Mexico (426.9 Kt) and Spain (140.7 Kt).

Chicago maize futures (May-25) closed last Friday below the strong technical resistance level of $5/bushel ($196.84/t), which could limit further gains in the near term. Fundamentally, there are factors supporting maize prices, but President Trump signed executive orders imposing 25% tariffs on Canada and Mexico, and 10% tariffs on China on Saturday. As a result, Mexico will respond and though no details are available yet, imports of maize to Mexico from the US are underthreat.

UK focus

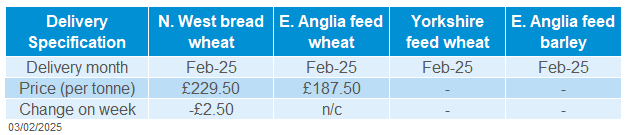

Delivered cereals

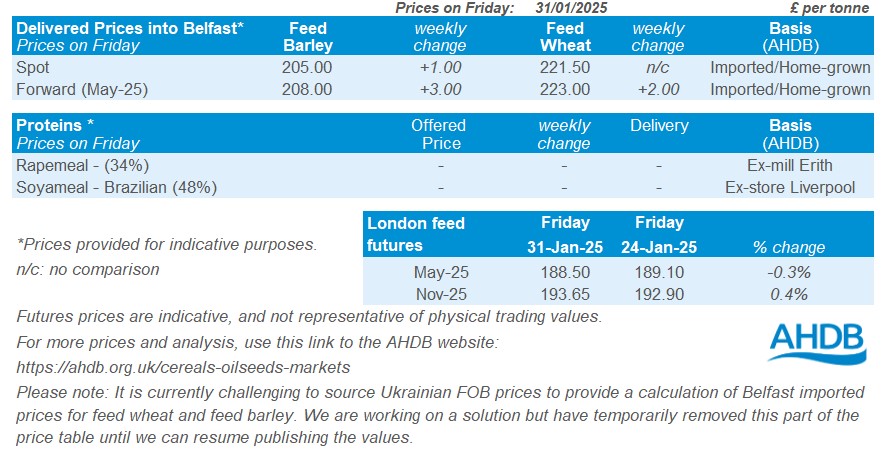

UK feed wheat futures (May-25) lost £0.60/t over the week (Friday–Friday) to close at £188.50/t. The Nov-25 contract gained £0.75/t, settling at £193.65/t. Domestic feed wheat futures for the 2024 and 2025 crops moved in different directions.

This week, the currency impact on grain and oilseed prices may increase due to the Bank of England's interest rate decision on 6 February 2025. The market forecast is for a cut from 4.75% to 4.5%.

Feed wheat price delivered into East Anglia in February was reported at £193.50/t on Thursday, with no weekly comparison. Bread wheat delivered into Northamptonshire in February was quoted at £218.50/t, down £4.50/t on the week.

On 30 January, we released the latest UK cereal supply and demand estimates. The release included a first look at wheat and barley exports this season, and a revision for the oat export forecast. Across all three major UK grown cereals, in 2024/25 exports are forecast well below usual levels. Steady exports mean heavier UK closing stocks.

This week (Thursday), we will update the UK human and industrial cereal usage and GB animal feed production datasets.

Oilseeds

Rapeseed

Soyabeans

Higher US tariffs on Canadian canola (rapeseed) oil and meal, plus crude oil imports could pressure rapeseed prices in the short term. However, the small global 2024/25 rapeseed crop and mixed forecasts for 2025/26 offer some support longer term.

Potential for retaliatory measures (to US tariffs) to reduce export demand for US soyabeans could pressure prices in the short term. However, weather concerns in Argentina and a large crop in Brazil, despite the slow harvest, may help prices stabilise longer term.

Global oilseed markets

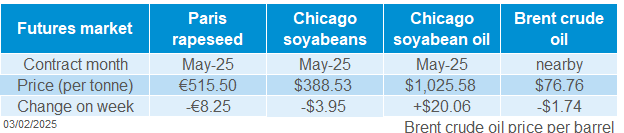

Global oilseed futures

Chicago soybean futures were mixed last week (Friday–Friday). The old crop (May-25) fell $3.95 to $388.53/t, while the new crop (Nov-24) gained $0.83 to $386.14/t. Chicago soybean oil futures (May-25) rose $20.06, closing at $1025.58/t. The market was influenced by uncertainty over US tariffs on Mexico, Canada and China, along with a slow Brazilian harvest and drought in Argentina.

The expectation of US tariffs, along with potential retaliatory measures and supply chain disruptions, created market uncertainty, leading to profit-taking at the end of last week. On Saturday 1 February, President Trump confirmed 25% tariffs on imports from Mexico and Canada, along with 10% tariffs for China.

Concerns over South American supplies continued last week. Rain in Argentina provided little relief for drought-hit soybean areas, while showers in Brazil further delayed the harvest. Despite the slow pace, there remains optimism for a bumper crop in Brazil, with any losses from Argentina's hot and dry weather expected to be offset by Brazil's production. Forecasts show limited rainfall for Argentina and more rain in already wet areas of Brazil over the next week.

Last week, US soybean exports were weak, with net sales of 438 Kt for the week ending 23 January, 33% below the average of the past four weeks. This was also at the lower end of trade estimates, which ranged from 0.45 Mt to 1.7 Mt, according to a pre-report poll by Reuters (LSEG).

Malaysian palm oil markets saw some support last week from stronger Chicago soy oil prices and a weaker Malaysian ringgit against the US dollar. These helped offset concerns about a decline in Indonesia's crude palm oil exports in January and the US tariff threat. However, lower crude oil prices, which make palm oil less attractive for biodiesel, limited the gains.

Rapeseed focus

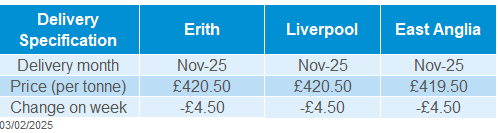

UK delivered oilseed prices

The weakness in Chicago soyabeans (May-25), Winnipeg canola (rapeseed) and crude oil futures prices filtered into rapeseed prices last week (Friday-Friday). Old crop (May-25) Paris rapeseed futures ended the week at €515.50/t, down €8.25/t from the previous Friday. The Nov-25 contract saw lesser losses, down €1.00/t on the week, ending Friday’s session at €486.75/t.

Rapeseed delivered into Erith in May was quoted at £441.50/t, down £14.50/t from the previous week. Delivery to East Anglia in May was quoted at £440.50/t, also falling £14.50/t. Please note the survey is usually conducted mid-late morning on Friday, so can show differences from Paris futures closing prices.

Stratégie Grains raised its forecast for the 2025 EU rapeseed production to 19.0 Mt, from 18.7 Mt last month and now 13% higher than the current 2024/25 season. The increase is attributed to good weather and more land being planted.

LSEG has kept its 2025/26 Ukraine rapeseed production forecast at 3.2 Mt despite weather concerns. Warm and dry weather conditions over the past two weeks have reduced soil moisture levels to a six-year low.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.