UK ex-farm feed wheat premium lower in December: Grain market daily

Wednesday, 29 January 2025

Market commentary

- May-25 UK feed wheat futures closed at £187.95/t yesterday. This is up £0.70/t from Monday’s close. New crop (Nov-25) contract gained £0.95/t to close at £193.95/t over the same period.

- Domestic wheat futures followed global wheat markets up yesterday. Chicago wheat futures (May-25) rose by 1.6% due to technical trading and concerns about winter wheat conditions. Paris milling wheat futures (May-25) increased by 1.74% on higher demand and relative stability of prices in the wider grains market.

- Paris rapeseed futures (May-25) closed at €511.50/t yesterday, a drop of €5.25/t on the day, while Nov-25 prices gained €1.25/t to close at €484.75/t.

- The oilseeds markets continued to focus on the South American soybean crop, with traders readjusting positions while awaiting news on whether US President Donald Trump will impose tariffs on imports from Mexico and Canada on 1 February.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK ex-farm feed wheat premium lower in December

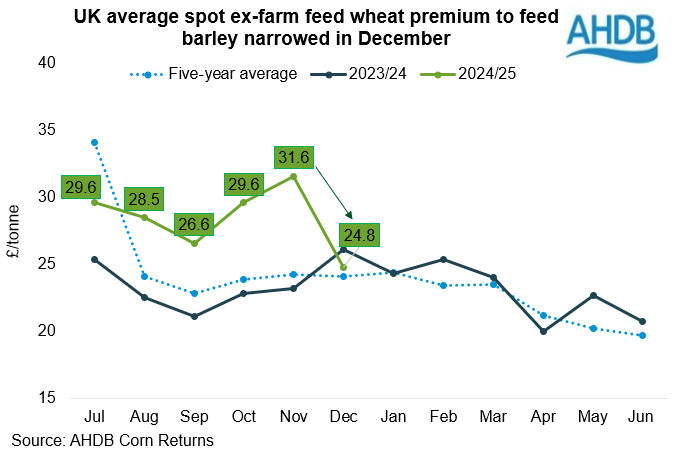

In December, the gap between UK monthly average ex-farm spot prices for feed wheat and feed barley narrowed to £24.8/t, down from a two-year high of £31.6/t in November and £26.1/t in the same month last year. However, it remains above the five-year December average of £24.1/t.

The larger gap (discount) in November made barley a more attractive option than wheat for feed rations, as the average ex-farm barley price dropped by 4% to £151.8/t, compared to wheat, which fell by 2% to £183.4/t. However, a shift in the price relationship in December resulted in more recovery for wheat usage. Average ex-farm feed barley prices increased by 5% to £159.6/t while ex-farm feed wheat prices rose by less than 1% to £184.4/t.

The change in price relationship is partly due to the domestic supply and demand balance, with more wheat expected to be available following a significant rise in carry-in stocks and a record import campaign so far this season. Additionally, the lack of competitiveness in the export market is putting downward pressure on wheat prices. Globally, barley prices rose in December due to higher demand from the feed sector, as stronger maize prices shifted some animal feed demand to barley. This support likely filtered through to UK prices.

What can we expect moving forward?

Despite being the lowest premium this season, the December premium remains historically high, with an average of £25.0/t since 2014. Maintaining this level is likely to keep barley featuring in animal feed rations at the expense of wheat.

However, the premium may decrease further as the season progresses and possibly into next year. Our latest Early Bird Survey showed a drop in the total barley area for harvest 2025, but an increase in the wheat area.

Look out for our next update on UK supply and demand estimates, which will be released tomorrow (Thursday, 30 January).

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.