Arable Market Report - 27 January 2025

Monday, 27 January 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

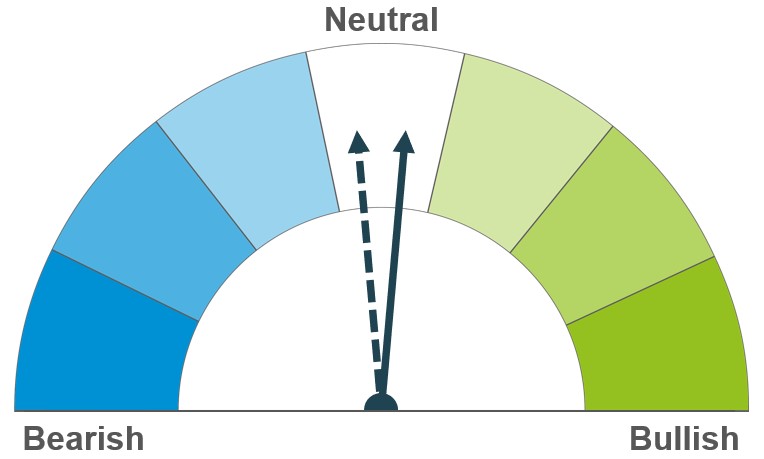

Lower export demand and Argentina’s declining export tax could weigh in the short term. But weather concerns about winter crop conditions in the Northern Hemisphere keep the outlook uncertain.

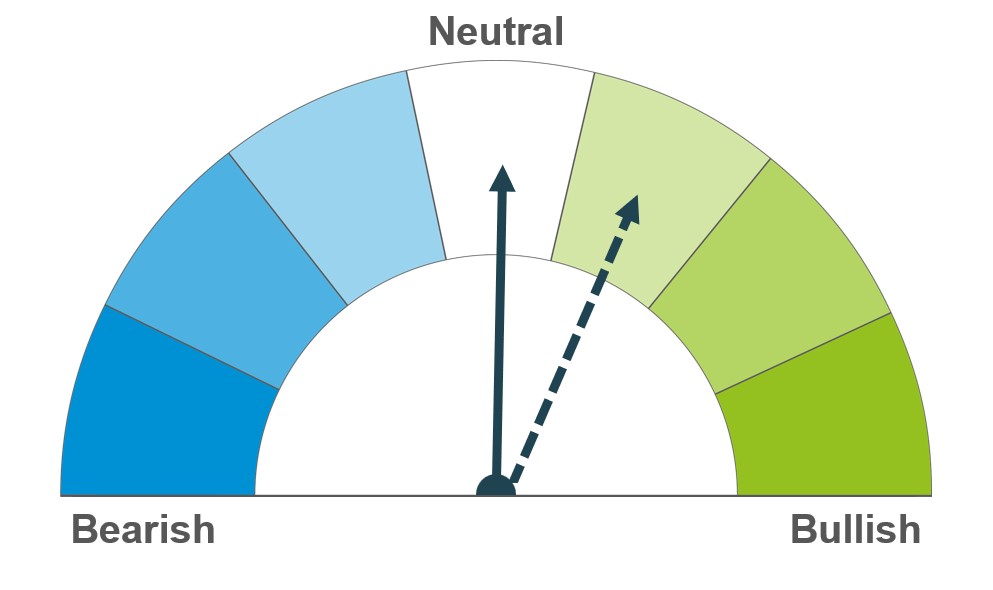

Cuts to Argentina’s production and strong US exports are supportive to markets, however, Argentina's declining export tax could exert some pressure in the short term.

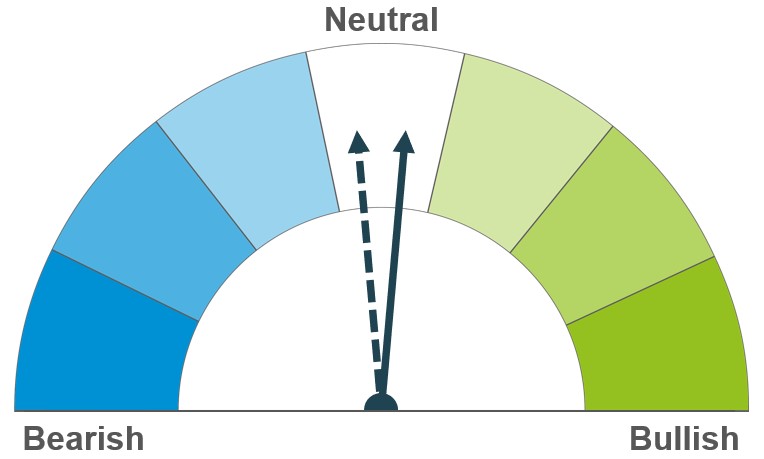

Barley prices are being supported by the firmness of maize prices but further price movement will require more active buying by the major importers.

Global grain markets

Global grain futures

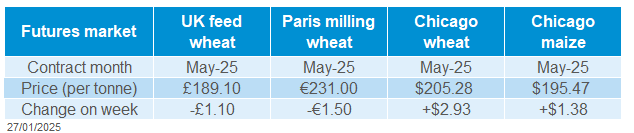

Last week, Chicago wheat futures (May-25) gained $2.93/t, to close at $205.28/t on Friday. Paris milling wheat futures (May-25) lost €1.50/t over the same period, closing at €231.00/t. The divergent direction of Chicago and Paris wheat futures was due to the weakening of the US dollar against the euro. Technically, Chicago maize futures (May-25) closed last Friday below the strong resistance level of $5/bushel ($196.84/t), which could limit further gains in the near term.

Argentina is cutting its export tax on wheat and maize from 12% to 9.5% and there's been pressure on the markets since last Friday (24 Jan) as a result.

However, the unfavourable weather in Argentina is a concern and the two factors could more or less offset each other. Last Thursday, the Buenos Aires Grain Exchange lowered its estimate of maize production to 49.0 Mt from 50.0 Mt (USDA January: 51.0 Mt). Indeed, as of 22 January 2025 only 30% of the maize was in good and excellent conditions, down from 40% a year ago.

The USDA weekly export sales report for the week ending 16 January, showed net wheat export sales below the trade estimates at 164.84 Kt, which pressured the Chicago wheat market. Conversely, maize export sales were close to the top of trade estimates at 1.66 Mt and up 68% from the previous four-week average.

In Ukraine and Russia, there will be a higher temperature anomaly (WorldAgWeather) for the next week. This will have an impact on winter crop development due to the potential for increased disease and risk of winter kill should a cold period follow. Some regions also have a deficit of soil moisture.

S&P Global Commodity Insights forecast that US farmers would plant 3.2% more maize in 2025 than in 2024.

Barley importers have been more active in recent weeks, for example Jordan and Iran holding tenders last week. Demand for barley has increased thanks to rising maize prices.

UK focus

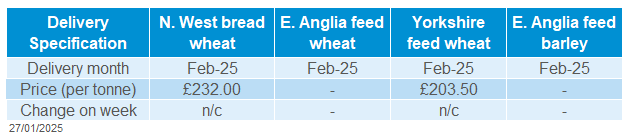

Delivered cereals

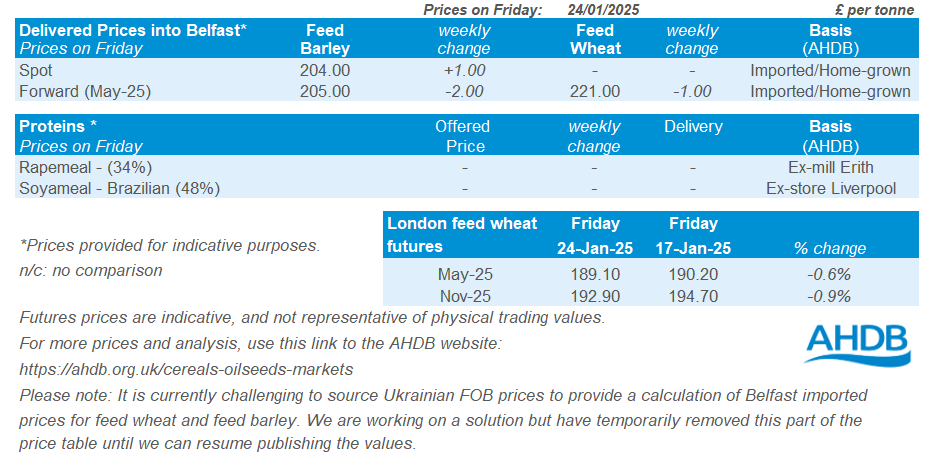

UK feed wheat futures (May-25) lost £1.10/t over the week (Friday-Friday) to close at £189.10/t. The Nov-25 contract fell by £1.80/t, settling at £192.90/t. As a result, the spread between UK feed wheat futures for the 2024 and 2025 crops narrowed. Domestic feed wheat futures followed the Paris wheat futures market, which was pressured by low export demand and a strengthening euro.

Feed wheat price delivered into Yorkshire in February was reported at £203.50/t on Thursday, with no weekly comparison. Bread wheat delivered into Northamptonshire in February was quoted at £223.00/t, up £1.00/t on the week.

The latest trade data showed record high wheat imports to date this season (July-November)and record low barley exports.

On 30 January, AHDB will be releasing the next UK cereal supply and demand estimates. This will include export and stock projections for wheat and barley for this first time this season, as well as updated estimates for 2024/25 usage and imports.

Oilseeds

Rapeseed

Soyabeans

There remains underlying support for rapeseed from the small 2024/25 global crop, and recently uncertainty over soybean production. Going forward, 2025/26 rapeseed production prospects will have an increasing influence on the outlook.

The slow pace of harvest in Brazil, higher US export demand, and weather concerns in Argentina are offset by Brazil's expected ample crop and the potential for increased exports from Argentina.

Global oilseed markets

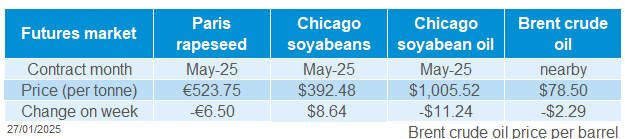

Global oilseed futures

Support for Chicago soyabean futures continued last week (Friday to Friday), with the May-24 contract reaching a three-months high of $396.01/t on Tuesday. The contract settled at $392.52/t on Friday, still up $8.64/t on the week. The Nov-25 contract also gained $7.72/t, ending the week at $385.31/t. Contributing to the support were weather concerns in Argentina, the slow pace of the harvest in Brazil, and a weakening US dollar.

The ongoing drought in Argentina remains a key concern. The Buenos Aires Grains Exchange revised its 2024/25 soybean crop estimate down by 1.0 Mt to 49.6 Mt due to hot weather and lack of rainfall. The light rains predicted for the coming weeks are not expected to have a significant impact.

Agricultural consultancy AgRural reported that Brazil's soybean harvest for the 2024/25 season reached 1.7% of the planted area as of 16 January, the lowest for this time of year since 2020/21. The slow pace is primarily due to heavy rains in Mato Grosso, Brazil's top grain-producing state.

USDA reported 1.49 Mt of US soybean sales for the 2024/25 crop in the week ending January 16. This was above the four-week average of 529 Kt and at the higher end of the analysts' expectations (600 Kt to 1.8 Mt). China was the top buyer (889 Kt).

However, there remains optimism over Brazilian output. The Brazilian association of vegetable oil industries (Abiove) raised the country’s 2025 soyabean production estimate to 171.7 Mt, up from 168.7 Mt in December.

The Argentina government is reducing its soybean export tax from 33% to 26%, while the tax on soyabean meal oil will drop from 31% to 24.5%, beginning from this week through June (LSEG). This may increase Argentina’s soyabeans export competitiveness and put a downward pressure on prices in the long term.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures displayed a moderate disconnect from Chicago soyabean futures following a strengthening of euro against the US dollar last week. Old crop futures (May-25) lost €6.50/t on the week (Friday to Friday) to close at €523.75/t.

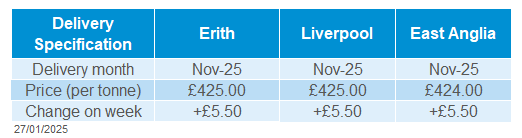

Rapeseed delivered into Erith in January was quoted at £447.50/t on Friday, up £3.50/t on the week, with only some support offered by sterling weakening against the euro. Also, delivery into Erith in November was quoted at £425.00/t, rising £5.50/t on the week. Please note that the surveys are struck during the trading day on a Friday so may not fully reflect closing prices.

The European Union’s imports of rapeseed for the 2024/25 season reached 3.41 Mt as of 19 January, up from 3.24 Mt a year earlier. The main sources of rapeseed imports origins remain Ukraine and Australia. Meanwhile, rapeseed EU exports have dropped by 40% year-on-year over the same period to 229 Kt.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.