Arable Market Report - 20 January 2025

Monday, 20 January 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

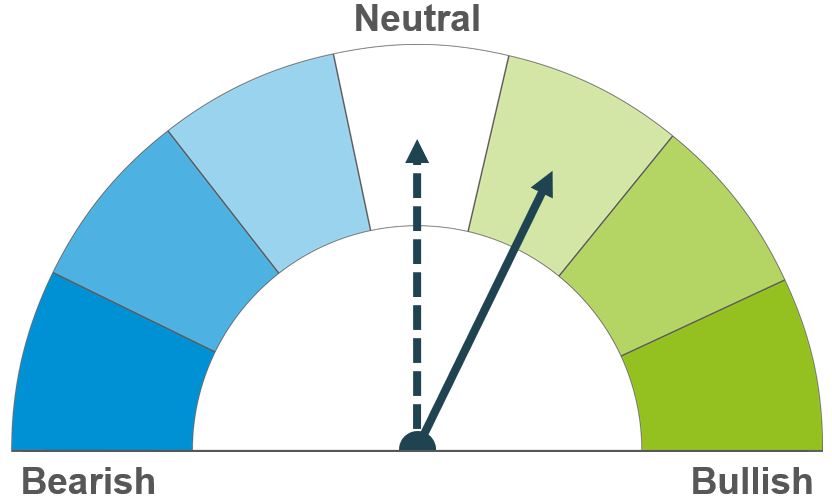

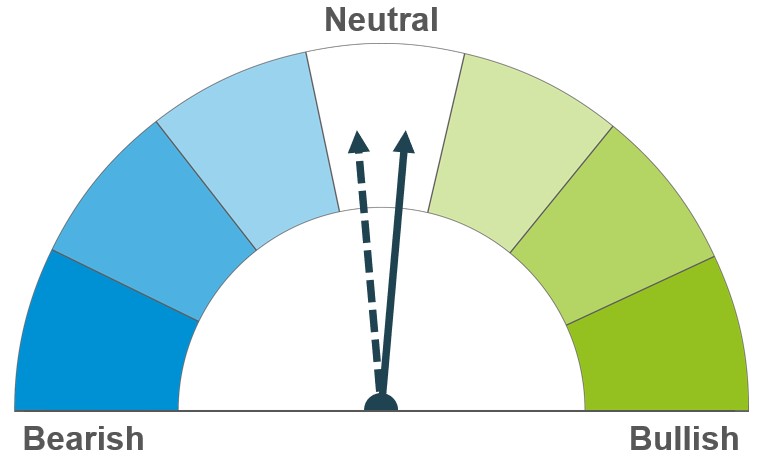

Firmness in maize markets and concerns about the US winter wheat crop provides support short-term. However long-term, market equilibrium could limit any significant price rises.

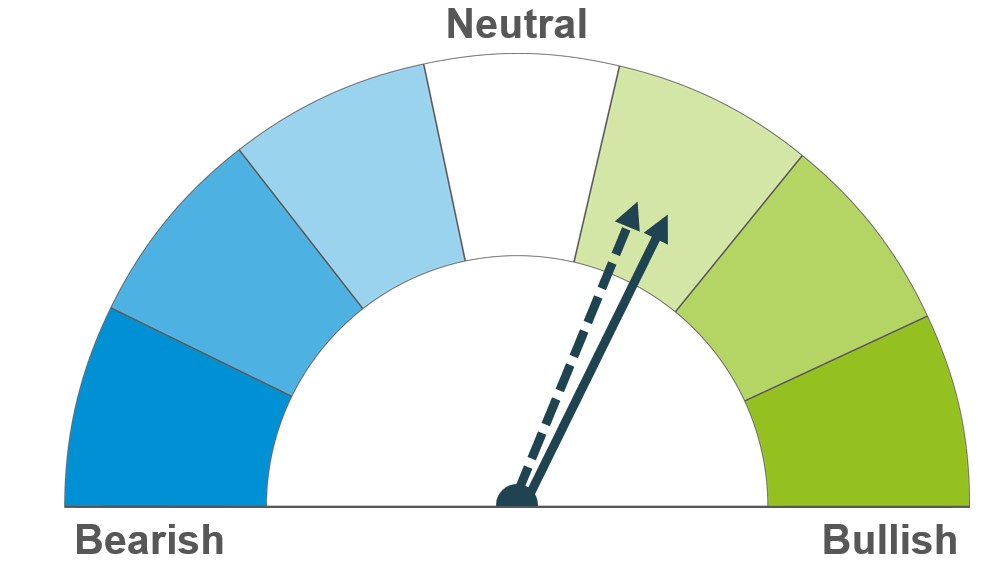

Lower production and stock estimates, along with potential optimism about US-China trade relations offers support short term. However, higher prices could pressure demand in the long run.

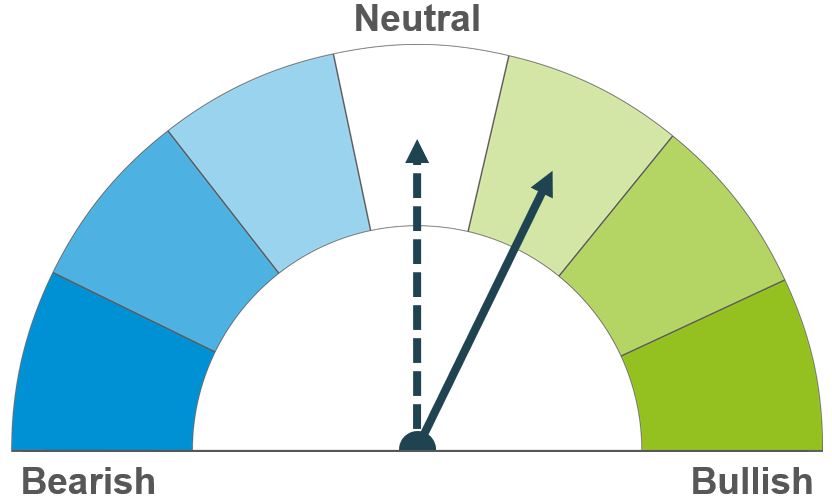

Currently, barley prices are supported by the firmness in maize prices. However, limited buyer activity might restrict potential gains.

Global grain markets

Global grain futures

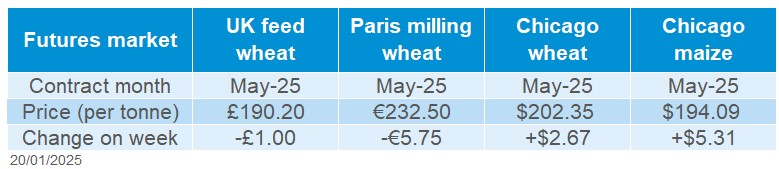

Last week, Chicago wheat futures (May-25) gained $2.67/t, closing at $202.35/t on Friday. Paris milling wheat futures (May-25) fell €5.75/t over the same period, ending at €232.50/t. Chicago maize futures (May-25) reached over 30-week highs, closing at $194.09/t on Friday, with a weekly gain of $5.31/t. The bullish USDA report released last Friday, and ongoing weather concerns in Argentina continued to support maize prices, with a positive impact on Chicago wheat.

The USDA’s January 2025 wheat outlook report released on Tuesday projects a 2% rise in winter wheat area planted, reaching 13.8 Mha for the 2025/26 marketing year. This reverses the long-term downward trend in US winter wheat area. The forecast for US wheat exports in 2024/25 remains unchanged at 23.1 Mt, a 20% increase on the year. Meanwhile, inadequate snow cover remains a major concern in some key wheat growing regions of the corn belt.

According to the USDA's weekly export sales report for the week ending 9 January, wheat net export sales reached 513.4 Kt, up from 111.3 Kt the previous week and 55% above the prior four-week average.

The International Grains Council (IGC) kept its forecast of the 2024/25 global wheat crop at 796.0 Mt, with a cut for Russia being balanced by an increase in Australia. However, the global maize crop estimate was reduced by 6.0 Mt to 1.23 Bt, primarily due to a smaller US estimate.

Conab has slightly lowered Brazil's 2024/25 maize crop estimate from 119.63 Mt to 119.55 Mt, due to a reduced planted area and drought-related yield losses. Also, delays in the soybean cycle could affect the planting of the country’s second maize crop.

The Rosario grains exchange in Argentina has lowered its estimate for the 2024/25 maize crop from 50-51 Mt to 48 Mt due to ongoing drought. As at 15 January, the proportion of crops with optimal or adequate water conditions has decreased by 13 percentage points due to high temperatures and lack of rainfall in the central-eastern agricultural area. Although some rain is expected in the coming days, its impact is expected to be minimal.

Strategie Grains raised the EU’s 2024/25 soft wheat and maize crop estimates by 0.6 Mt and 0.7 Mt to 127.2 Mt and 60.3 Mt respectively. This is due to increased planting in Germany and a larger maize harvest forecast for Poland. Barley production was pegged at 50.5 Mt, down from December’s 50.6 Mt but up 0.6% year-on-year.

UK focus

Delivered cereals

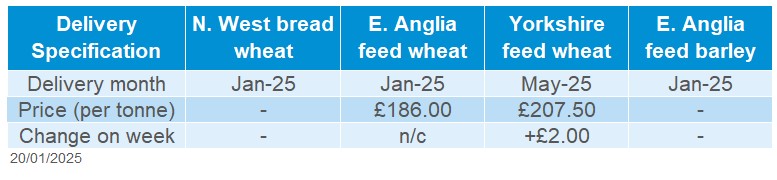

UK feed wheat futures (May-25) lost £1.00/t over the week (Friday-Friday) to close at £190.20/t. The Nov-25 contract fell by £0.45/t, settling at £194.70/t. Domestic feed wheat futures mirrored the Paris wheat futures market, which was pressured by a strengthening euro.

Feed wheat prices delivered into Avonmouth for January delivery were quoted at £187.00/t on Thursday, down £0.50/t on the week. Bread wheat delivered into Northamptonshire for February delivery was quoted at £222.00/t, with no weekly comparison.

Last week (Thursday), AHDB updated the UK human and industrial cereal usage and GB animal feed production datasets. UK flour millers (including for starch and bioethanol), the data shows that cumulative imported wheat milled from July to November reached a 10-year high of 678.5 Kt. Several factors contributed to this increase, including lower domestic wheat production and quality issues in 2024. On top of that, the historically higher level of sterling against the euro has supported grain and oilseed imports into the UK.

UK trade data for November, produced by HMRC, was published last Friday. Analysis on this will follow in tomorrow’s GMD.

Oilseeds

Rapeseed

Soyabeans

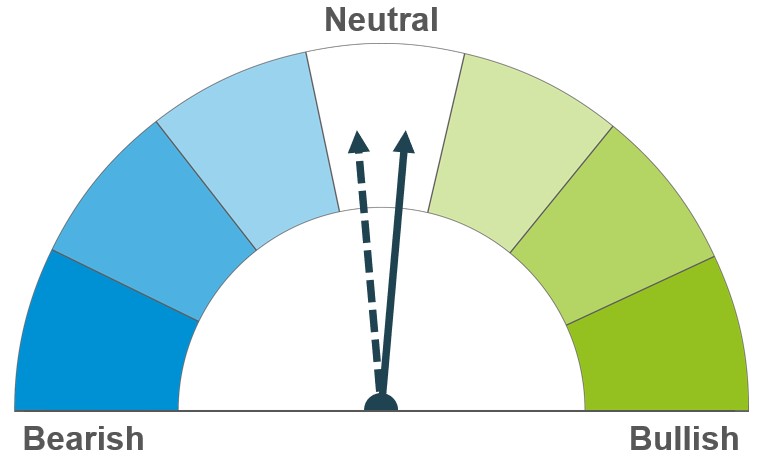

Limited sunflower oil supplies and a smaller EU crop could provide some support. However, expectations of a record soybean harvest in Brazil are limiting price gains both short and long term.

High soybean crush levels and weather concerns in South America are supporting prices in the short term. However, uncertainty over trade policy following the inauguration of the US President is also weighing on the market.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures were supported last week (Friday-Friday), as the May-25 contract gained $2.48/t, to close at $383.84/t. The Nov-25 contract ended Friday’s session at $377.60/t, down $1.19/t across the week. Volatility in the oilseeds market increased last week due to weather and geopolitical factors.

The USDA weekly export sales report for the week ending 9 January, showed soyabean net export sales of 569 Kt, up 97% on the previous week, but down 27% on the previous 4-week average. The National Oilseed Processors Association (NOPA) reported record US crush data for December, which could support prices in the medium term. However, concerns about soyabean exports after the inauguration of the US president weighed. Chicago soybean speculators switch to a net long position in the week ending 14 January.

Competition between Brazil and the US to supply soyabeans to China will likely increase in the medium term due to unpredictable trade war tensions between the US and China. In addition, Brazil soyabeans look more attractive in term of export prices. Freight rates continue to fall steadily.

Palm oil imports in India, the world's largest importer of the vegetable oil, are at low levels in January as soyabean oil is more competitively priced.

European Commission data show soyabean imports in the 2024/25 marketing year had reached 7.38 Mt by 12 January, up from 6.47 Mt a year earlier. The main importers were the US (48.5%), Brazil (33.5%), Ukraine (11.5%) and Canada (5.9%).

.jpg)

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures fell on the week (Friday-Friday), with the discount to new crop reducing. The May-25 and Nov-25 contracts fell by €8.00/t and €2.50/t, ending at €530.25/t and €488.50/t respectively.

Rapeseed delivered into Erith for January 2025 fell £5.50/t across the week (Friday-Friday), quoted at £444.00/t. Delivered prices for the 2025 crop (Aug-25) decreased by £2.50/t, quoted at £410.00/t.

According to the EU Commission, rapeseed imports for the 2024/25 season (July to date) reached 3.28 Mt as of 12 January, up from 3.15 Mt a year earlier. Most of the imports came from Ukraine (63.5%), Australia (26.1%) and Canada (4.4%). EU rapeseed production for the 2025 harvest could be lower than expected due to a decrease in winter sown area.

APK-Inform has lowered its forecast for Ukrainian sunflower oil production in 2024/25 from 5.92 Mt to 5.83 Mt and for sunflower oil exports from 5.55 Mt to 5.48 Mt (LSEG). Limited sunflower oil supply from Ukraine could support global rapeseed oil prices.

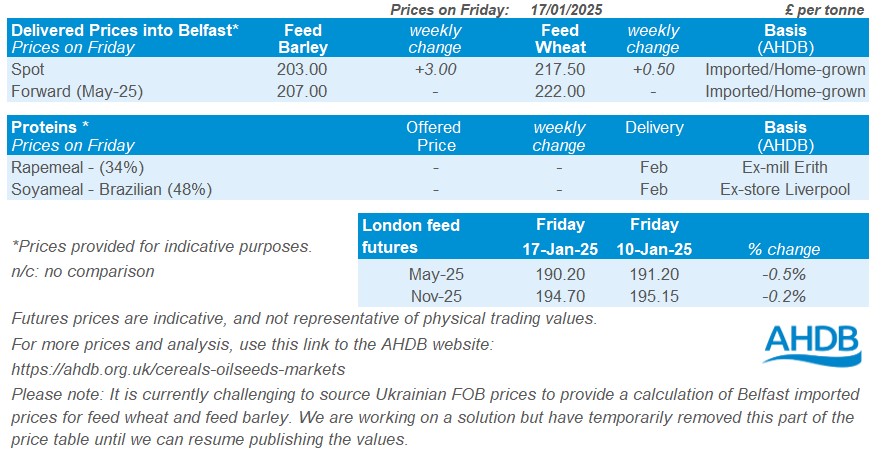

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.