Arable Market Report - 13 May 2024

Monday, 13 May 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

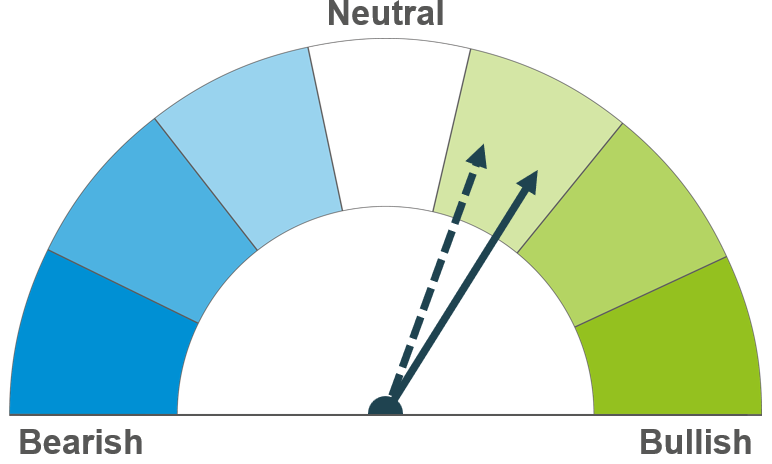

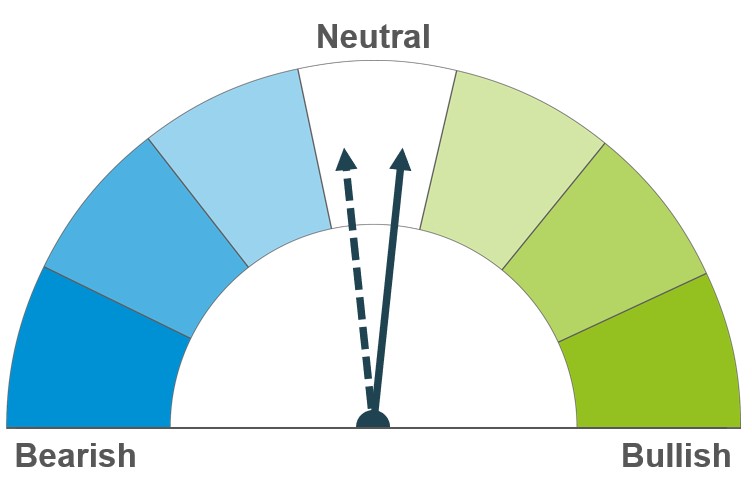

Wheat

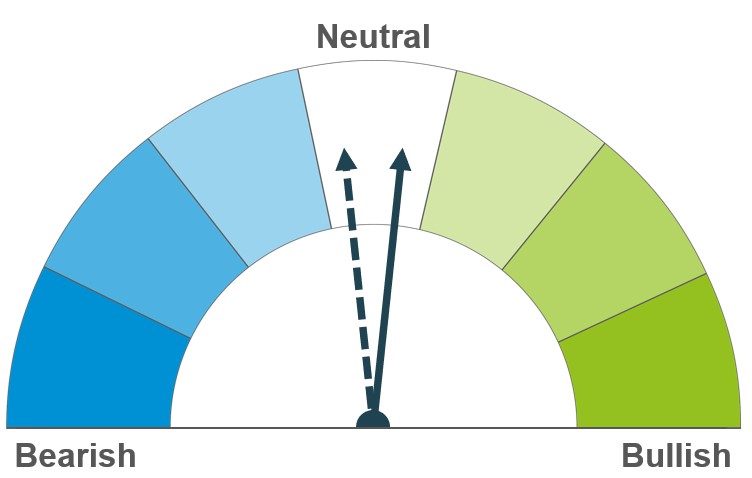

Maize

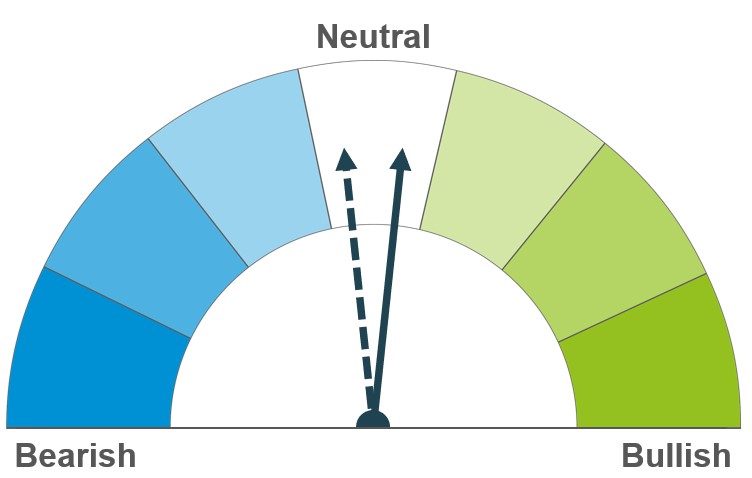

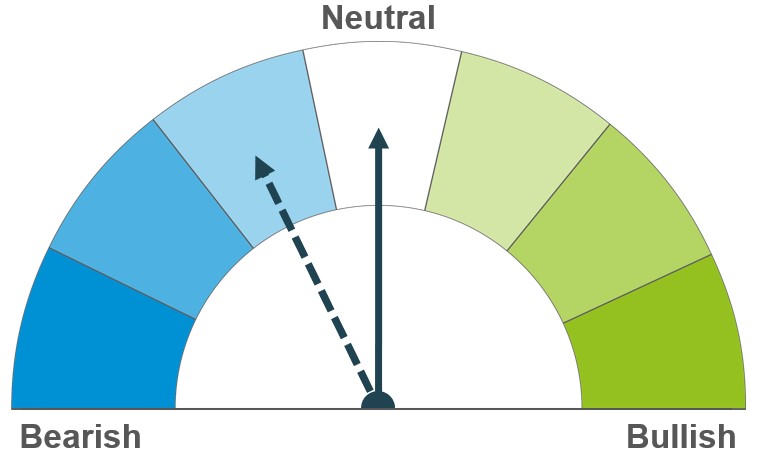

Barley

Adverse weather in Russia, as well as forecasts of tightening supplies in major exporting countries continue to drive prices up. Longer-term, a tighter looking 2024/25 outlook could continue to support prices.

Weather in South America remains a key watchpoint both short and longer-term. Further concern over wheat supplies could push further feed demand onto maize.

The condition of barley crops in the Northern Hemisphere remains a watchpoint. Though larger crops are currently forecast for 2024/25, this is expected to be matched by higher global demand. The wheat outlook it also a key influence in barley markets.

Global grain markets

Global grain futures

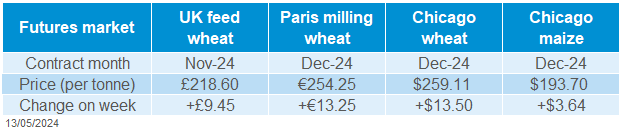

Global grain markets were supported last week, as weather concerns rose in Russia, and markets adjusted ahead of USDA’s May World Agricultural Supply and Demand Estimates (WASDE). Chicago wheat futures (Dec-24) and Paris milling wheat futures (Nov-24) both gained 5.5% last week (Friday to Friday). Both Chicago and Paris maize markets were up on the week.

Ahead of Friday’s WASDE release, poll estimates made by a range of market participants and forecasters varied. In the released figures, global wheat ending stocks for the 2024/25 season were pegged at 253.6 Mt, below the average analyst estimate of 257.4 Mt. US maize production for the 2024/25 season was estimated at 377.5 Mt, down 3.1% on the year, and slightly below what had been expected by analysts. This also meant that US ending stocks next season were down on poll estimates. These figures supported Chicago futures prices on Friday.

In terms of South American production this season (2023/24), the USDA revised down the Argentinian maize 2.0 Mt, to 53.0 Mt. This was higher than the expected 52.1 Mt, and remains much higher than the Buenos Aires Grain Exchange estimate of 46.5 Mt. The Brazilian maize crop was also revised down 2.0 Mt, to 122.0 Mt, below analyst expectations but still well above Conab’s estimate of 111.0 Mt.

Another bullish factor in the market last week was Russian weather. Following concerns over dryness in southern parts of the country, May frosts caused three of Russia’s key grain-growing regions to declare a state of emergency on Thursday due to damaged crops (LSEG). SovEcon said on Friday that it expects the country’s 2024 wheat crop to be 89.6 Mt, down from its previous forecast of 93.0 Mt in April, and the 92.8 Mt harvested this season (2023). Weather in Russian will remain something to watch over the coming days.

UK focus

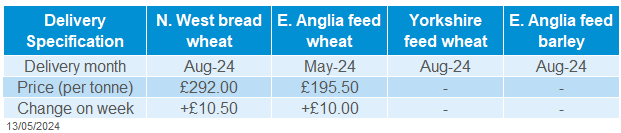

Delivered cereals

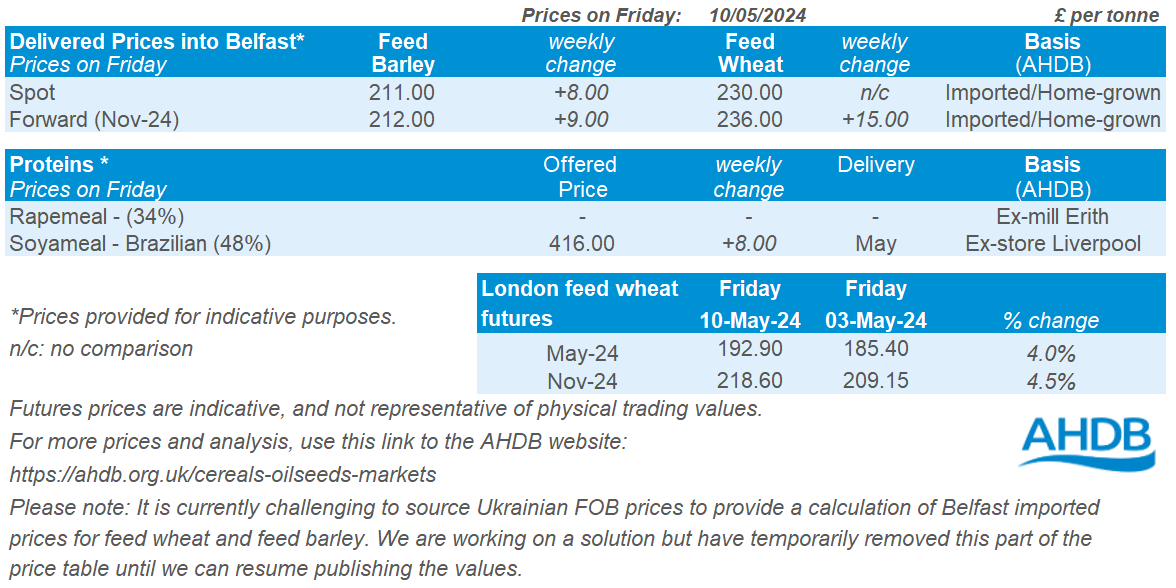

UK feed wheat futures (Nov-24) gained £9.45/t last week (Friday-Friday) to settle at £218.60/t as domestic prices tracked global wheat prices.

UK delivered prices followed futures price movement (Thursday-Thursday) last week. Feed wheat delivered into East Anglia for May delivery was quoted at £195.50/t on Thursday, up £10.00/t on the week. Bread wheat delivered into the North West at harvest was quoted at £292.00/t, up £10.50/t on the week.

Last week, AHDB released the latest usage figures for both GB animal feed production and human and industrial consumption up to the end of March. Analysis showed that GB animal feed production steadied in March. However, this season-to-date (Jul-Mar) total GB feed production has totalled 10.2 Mt, up 1.5% on the year, though remains at the second lowest level since 2015/16.

The latest data on cereal stocks held by merchants, ports and co-ops in the UK was published by AHDB on Thursday. Figures revealed a 9% growth in home grown wheat stocks as at the end of February, but a 2% reduction in imported wheat stocks. Also on Thursday, Defra released estimates of stocks held on farm in England and Wales. As a proportion of total production, on farm wheat stocks sat at 32%, up from 31% in 2023, and above the five-year average of 30%.

See the full cereal stocks dataset.

The latest HMRC UK trade data shows imports and exports up to the end of March. UK wheat imports (incl. durum) are up 63% this season to date (Jul-Mar) compared to the same period last year, driven by limited availability of quality wheat earlier in the year, as well as rising concerns over next season’s crop.

Oilseeds

Rapeseed

Soyabeans

Smaller rapeseed crops for 2024/25 in the EU and Ukraine are expected to be partially offset by higher production in Australia and Canada. With global production expecting almost no change year on year, this offers modest support for the short -and longer-term outlook.

For the short term, weather events in southern Brazil support the soyabean market. However, the ample global old crop supply and all time high new crop production forecast weigh on longer term outlook.

Global oilseed markets

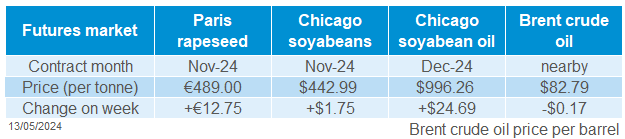

Global oilseed futures

It was a mixed week for Chicago soyabean futures. While initially gaining at the beginning of the week, old crop and new crop futures came under pressure until modest support on Friday.

Last Monday, Chicago soyabean futures (May-24) closed at a 14-week high. Heavy flooding in southern Brazil, the largest global producer and exporter of soyabeans, cast concerns for crops where harvesting is incomplete. The USDA reduced Brazil’s 2023/24 soyabean production by 1.0 Mt to 154.0 Mt in response to the flooding. Conab is expected to update to its figures tomorrow (14 May). With more rain forecasted to arrive over the region this week, this could continue to hamper the remaining harvest.

As at 05 May, US soyabean planting progress reached 25% complete, five percentage points behind last year. Surplus rainfall across key states has challenged planting progress and is something to monitor as some farmers may consider planting maize instead if unfavourable conditions persist.

In anticipation of the USDA WASDE report, soyabean futures came under pressure towards the end of last week as the market expected a heavy global balance of soyabeans for 2024/25. The report forecast global soyabean production at 422.3 Mt, up 6.4% from last year and an all-time high. Meanwhile, ending stocks are forecasted at 128.5 Mt, 15% up from last year, another all-time high and well above trade expectations.

Despite the bearish pressure from the WASDE report, soyabeans felt support due to the rise in soyabean oil futures on Friday. There was speculation that imports of used cooking oil from China into the US could become subject to increased tariffs. A decline of used cooking oil imports from China for biofuel production in the US could support soyabean crush margins.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures displayed a moderate disconnect to Chicago soyabean futures as new crop futures (Nov-24) gained €12.75/t on the week to close at €489.00/t. Soyabean futures prices were capped by higher ending stocks being forecasted for 2024/25 in the WASDE report. However, rapeseed futures were supported as global production 2024/25 is forecasted to be unchanged on the year. In addition, a strengthening of soyabean oil towards the end of last week also supported the vegetable oils complex.

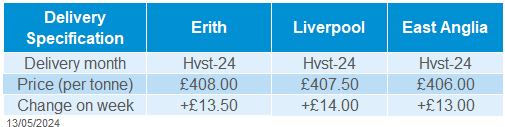

Rapeseed delivered into Erith for July delivery was quoted at £402.00/t on Friday, with no comparison on the week. Delivery into Erith for November was quoted at £418.00/t on Friday, gaining £12.50/t on the week.

The USDA forecasts global rapeseed production for 2024/25 at 88.3 Mt, down only 0.1% from last year and up 10.9% over the five-year average (2019/20 – 2023/24). For 2024/25, EU rapeseed production has been estimated at 19.0 Mt, down 5.0% from 2023/24, and Ukrainian production is forecasted at 3.7 Mt, also down from last year by 15.9%. However, estimated increases of rapeseed production year-on-year for Australia and Canada partially offset losses forecasted for the EU and Ukraine.

Last week, Statistics Canada reported that canola stocks as at 31 March 2024 were up 17.5% from last year at 8.3 Mt. This partially reflects a 36.0% season-to-date drop in Canadian canola exports to 3.7 Mt following higher global supplies of soyabeans and palm oil.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.