On-the-go breakfasts bring growth

Thursday, 10 May 2018

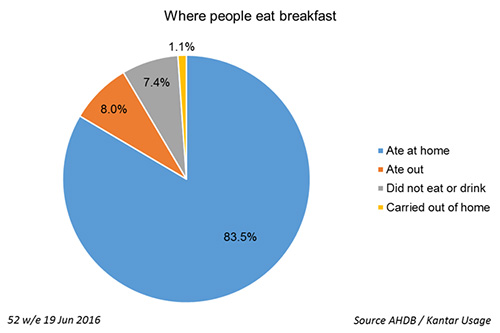

More people are eating breakfast, with the number of occasions up 0.7% to 21 billion. Most of these are eaten in-home but, while morning goods and cooked breakfast consumption are up, cereals and bread are struggling to find growth. Meanwhile, one in ten breakfasts are eaten on the go. Foodservice options and products that can be carried out of home are helping drive the growth in this meal occasion.

The number of breakfasts eaten is slowly on the rise, with 21 billion breakfasts eaten last year up 0.7%. Fewer people are skipping this first meal of the day, but that doesn’t necessarily mean they’re having that meal at home. Instead, nearly one in ten breakfasts are being eaten on the go (Kantar Usage).

Mixed performance for in-home breakfasts

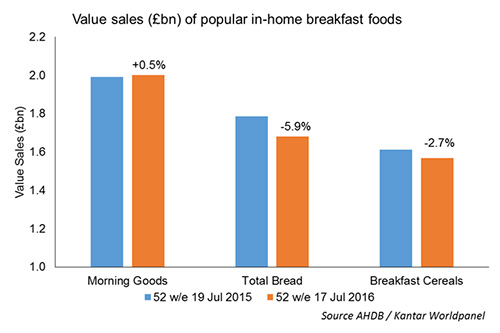

Cereals are struggling to find growth in the breakfast market. In the year to 17 July 2016, price cuts have helped to stabilise volume sales (0% growth), but value spend was down £44m on the year (Kantar Worldpanel, 52 w/e 17 July 2016). Recent negative publicity regarding sugar are likely to have had an impact on sales. Within this category, granola-based cereals have managed to buck the trend and are in growth, up 14% in the 52 weeks to 21 May 2016 (The Grocer/IRI).They have benefited from being perceived as a healthier option.

Bread is facing a similar struggle, featuring in 1.2% fewer breakfasts year on year (The Grocer/Kantar). Meanwhile, morning goods, baked goods such as crumpets and pastries, are slightly up, appearing in 10% more breakfasts in the same period. This category has benefited from new product development and some large advertising campaigns, with 2.6% growth in volume sales for the 52 weeks ending 17 Jul 2016 (Kantar Worldpanel).

Cooked breakfasts are also on the rise, up 29.7% in the last two years and largely driven by an increase in egg-based dishes. Fry-up staples bacon and sausages are also featuring more often, in 5% and 2.6% more breakfasts, respectively. However, volume sales of bacon and sausages are both down 2% (Kantar).

Carried-out breakfasts on the rise

Although it comes from a small base, there has been a 15.6% increase in the number of breakfasts carried out in the last year (Kantar Usage, 52 w/e 19 Jun 16). These days, there is a range of portable goods on offer to meet the needs of the consumer. Spend on cereal and fruit bars is up 2.7% (Kantar Worldpanel, 52 w/e 17 Jul 16). Breakfast biscuits have also become well established, dominated by BelVita, who had sales of £70.8m in the 52 w/e 21 May 2016, up 6.2% year on year (The Grocer/IRI).

Another category for carried out breakfasts is breakfast drinks. Breakfast drinks are those that aim to contain a whole meal within their carton, providing protein and fibre as well as energy. This relatively new category has seen 73.5% growth in the last year, with sales of £14.1m in the 52 weeks ending 21 May 16 (The Grocer/IRI).

Breakfast the fastest growing meal in foodservice

Purchasing breakfast out of the home is becoming increasingly popular. Foodservice data from NPD Crest shows that the number of breakfast servings has grown 3.4% in the last year, ahead of other meal occasions. Over the last five, years it has grown by an impressive 17.5%.

Notable contributors to the growth in breakfast foodservice servings have targeted busy workers on the go by supplementing their breakfast offerings with promotions on coffee. For example, Greggs bakeries has been running their breakfast meal deal, where you can buy a coffee for £2 with your breakfast food items, for six years now.

In-home still the firm favourite

Despite the traditional cereal and toast struggling to grow, they still represent a large part of the in-home breakfast market, which itself makes up 90% of all breakfasts eaten. Meanwhile, out-of-home breakfasts are definitely a growing area that appeals to increasingly time-poor consumers, who are willing to pay extra for that convenient option.