Global weather continues to drive grain markets: Feed market report

Wednesday, 26 May 2021

By Anthony Speight

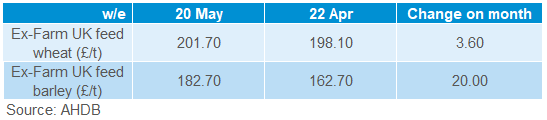

Grains

Throughout the month of May, domestic prices were very reactive to global affairs, with weather being the main driver of global markets.

At the start of May, price support was off the back of cold and dry weather in both the US and EU, which had potentially downwards implications for US spring planting progression and EU winter cereal forecast yields.

EU wheat production for next season has since been revised down by the EU commission. As a result, ending stocks for the 2021/22 season have been lowered.

Another key supporting factor for the market throughout May has been Brazilian dryness. Planting of the Brazilian Safrinha crop was delayed this season, and now following the winter la Niña, conditions have remained dry.

Rains eventually arrived in the US and the EU after a cold and dry April. Much needed rains arrived in Northern US states and parts of the Canadian prairies this month, reducing soil moisture deficits. Further to that, the rains throughout the UK in May have had a positive impact on our domestic crop outlook for many.

The release of the latest USDA world supply and demand estimates provided insight in the next marketing year for global grains. The global stocks-to-use (excluding China) for wheat and maize is only expected to partially recover, from 30.3% in 2020/21 to 31.4% in 2021/22. However, between now and then there are a lot of factors that could change these initial estimates.

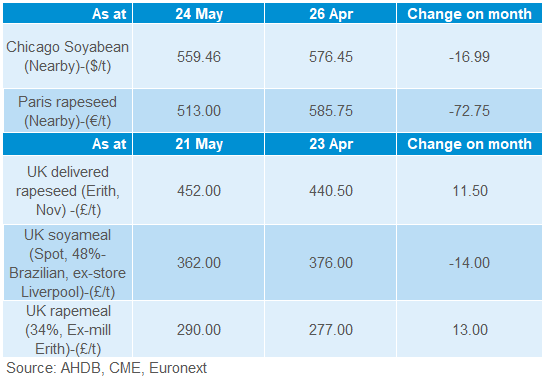

Proteins

As we draw towards the end of this marketing year, the supply of rapeseed is getting increasingly tighter. Last Friday’s delivered prices were offering £511.50/t (Erith, June delivery).

Throughout May, delivered rapeseed prices have been reaching record levels. The previous record high new crop (Erith, November delivery) price was reached in June 2011, at £432.50/t.

On Friday 07 May, we recorded Erith (Nov-21) at £477.00/t, surpassing the 2011 November high by £44.50/t.

Prices have dropped since; however, the balance of supply and demand is expected to again be tight in 2021/22.

Latest reports show that the Canadian canola area isn’t going to be at high as anticipated, according to the Statistics Canada estimated area of principle field crops. Further to that, until recently the Canadian prairies lack soil moistures. However, rains arriving in the third week in May helped alleviate some concerns, to help with initial development of crops.

This season delivered rapeseed prices have seen substantial support from rising vegetable oil values and high soyabean prices.

The May USDA supply and demand report gave us an insight into the 2021/22 marketing year. Global oilseed supplies (stocks and production) for 2021/22 are projected to increase 3% from 2020/21. Inflated prices throughout 2020/21 have incentivised the expansion of the oilseed area.

The US is estimated to produce a soyabean crop of 119.9Mt, the largest since 2018/19. Despite this large crop, its stocks are expected to only marginally increase to 3.8Mt, up from 3.3Mt in 2020/21. Persistent Chinese demand for large quantities have impacted stock volumes.

For rapeseed, global production is forecast to increase by 1.8Mt, to 73.2Mt. A large driver of this is the increased Canadian area (mentioned above).

Global ending stocks are forecast at 5.5Mt, down from 5.8Mt in 2020/21. There is also a tightening global stock-to-use ratio from 7.9% to an estimated 7.5% in 2021/22.

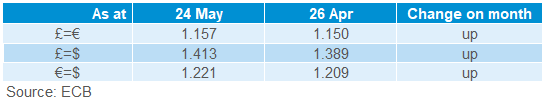

Currency

From the 26 April to 24 May, sterling strengthened against both the euro and dollar, the UK’s strong performance with the covid-19 vaccination programme driving much of this movement.

The dollar weakened against both sterling and the euro across the month. Joe Biden’s economic relief bill, signed in March, is speculated to have contributed to inflation and therefore dollar fluctuations.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.