Global grains continue to firm on Brazil crop concern: Grain market daily

Friday, 7 May 2021

Market commentary

- UK feed wheat futures (Nov-21) closed yesterday at a contract high of £192.00/t, a gain of £4.05/t on the previous close. The move in the UK market followed wider moves across Chicago and Paris wheat futures (Dec-21).

- Chicago maize futures continue to take the lead for grain markets, gaining 14.5% Thursday-Thursday. Alongside the speculative support for prices, concerns continue for the condition of the Safrinha maize crop in Brazil.

- French crop condition rating took another hit in the week to 3 May. For soft wheat, 79% of the crop is now rated “good” or “very good” down 2 percentage points (pp) on the week. The proportion of winter and spring barley crop rated “good” or “very good” stand at 77% (down 1pp) and 82% (unchanged), respectively.

Global grains continue to firm on Brazil crop concern

As we’ve highlighted for some time now, concerns around the condition of the new crop globally are continuing to support prices.

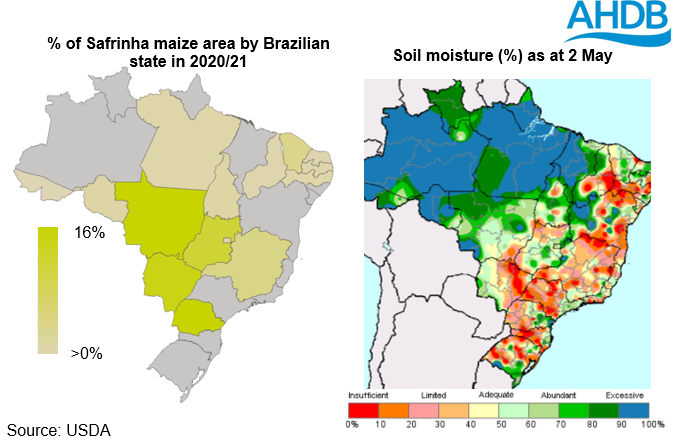

A key support factor for markets at present is the dryness affecting Brazil. Planting of the Brazilian Safrinha crop was delayed this season, and following the winter la Niña, conditions have remained dry.

USDA data suggests that soil moisture in key Brazilian maize growing states is severely lacking. Furthermore, there is little to no rainfall forecast for central and south Brazil in the next two weeks. This will continue to drive concerns for the size of the Safrinha crop at a time when global maize supply and demand is incredibly tight.

Weather is particularly important for the second crop maize at the moment, with much of the crop in key development phases. As at 1 May, 46.8% of the crop was flowering, while 34.8% of the crop was in a stage of vegetative development.

In one of the key regions for maize production in Brazil, Mato Grosso, production forecasts were cut earlier this week. On Monday, the Institute of Agricultural Economy for Mato Grosso (IMEA) estimated the region’s 2020/21 production at 34.6Mt.This is a 1.1% fall on the April report and a 2.4% fall on the year.

In Conab’s most recent report (8 April) maize production in Mato Grosso was estimated at 36.6Mt. With dryness for Brazil of late, production in the region will be a key watch point when Conab updates its forecasts next week.

Continued dryness in Brazil will continue to add support to prices if crop estimates fall. All eyes will be on the raft of supply and demand reports next week. On Wednesday both the USDA and Conab will release their latest forecasts. Many private forecasters have already cut their estimates of Brazilian maize. So the impact of any cuts next week will depend on the size of the crop relative to these estimates.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.