Cold weather having an impact on EU and US grain crops: Grain market daily

Tuesday, 27 April 2021

Market commentary

- New crop London feed wheat (Nov-21) gained £6.05/t yesterday, to close at £191.30/t.

- Chicago maize futures nearby gained $9.84/t yesterday, to close at $267.91/t. Meanwhile, Chicago wheat futures (nearby) gained $10.74/t, to $271.69/t. Maize prices have been strengthening on weather concerns in Brazil and the US. South American forecasts continue to look dry.

- Feed manufacturers in China, South Korea and Vietnam are said to be switching from maize to wheat in animal rations. This year, these countries are forecast to have taken 26.4% of global maize imports. Though, now they are purchasing more wheat from the Black Sea and Australia as maize prices climb higher.

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops.

Cold weather having an impact on EU and US grain crops

As we have reported over the past few weeks, cold and dry weather has been causing concern for new-crop grains supply, fuelling the current rally.

Daily gains have now been seen across the global grains complex, with nearby Chicago maize prices rising 16% over the past 6 days, to close at $267.91/t yesterday.

UK feed wheat futures too have seen support from new crop concern. The Nov-21 contract has gained 15% in the last 10 days, closing yesterday at £191.30/t.

What impact has the cold weather had so far?

European Union

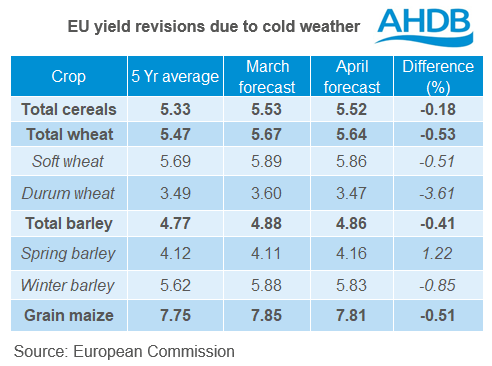

Yesterday, the European Commission released its latest EU crop monitoring (MARS) report, detailing conditions to 21 April. Recent colder-than-usual weather has reportedly delayed development of winter crops across Europe. The colder, dry conditions have also delayed the sowing and emergence of spring drilled crops.

Some small cuts have been made by the Commission to forecast yields, especially in France. Countries including the UK, France and Spain have been identified as areas of rain deficit.

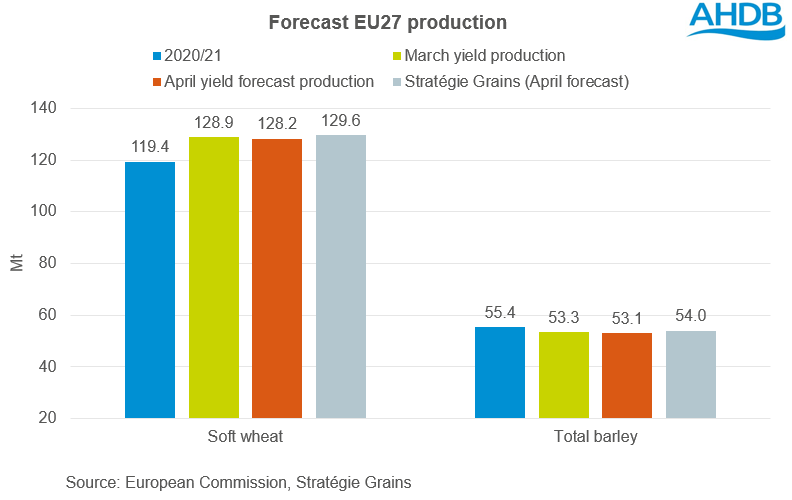

The report gives yield forecasts for total barley and soft wheat, as such we can apply these to EU crop areas forecast by Stratégie Grains and estimate production. While the yield cuts in the report have impacted on potential production, levels remain well above the 2020 harvest.

For the UK, the report concluded winter crops are in ‘fair to good condition’. Spring barley drilling is now said to be complete in the south and almost complete in the north. There are concerns surrounding dry weather for later drilled winter crops and spring crops going forward, should weather remain dry. Though one positive to cold weather has been a noted lack of pest and disease pressure.

United States

The USDA also released their latest crop condition report yesterday. As at Sunday, 17% of maize had been planted, up on the week before, but 7 percentage points (pp) behind last year and 3pp behind the 5-year average. Iowa, Missouri, and Illinois are states identified as behind average planting progress. Collectively, these states represent 36.2% of the US maize crop.

For winter wheat, crop conditions had fallen week-on-week. The percentage of crops rated ‘good’ or ‘excellent’ reduced to 49%. This was a fall of 4 pp week-on-week, and 5pp down on the same point last year. Reductions were seen in Ohio, Texas, Washington, Montana, and Oklahoma (collectively 32% of US winter wheat production). Spring wheat and barley planting is ahead of average at 28% and 35% drilled, respectively.

Can we expect prices to continue to rise?

Global cold and dry weather has been strengthening grain values in recent weeks and is likely to continue to do so until enough physical rain arrives to ease concerns. Some welcome rain is forecast for the UK (a shower arriving for some this morning), Europe, and the some of the US in the coming weeks, though how much actually falls will be key.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.