Canadian canola area increases for 2021/22…but below expectations: Grain market Daily

Wednesday, 28 April 2021

Market Commentary

- Old crop UK wheat futures (May-21) closed yesterday at £208.85/t, down £1.15/t on Monday’s close. New crop futures (Nov-21) closed down from their contract high on Monday by £0.55/t, to close yesterday at £190.75/t.

- Continued pockets of rain will alleviate dryness concerns domestically, but our new crop market will still be trading at import parity so global affairs will continue to directly drive our domestic values. The USDA 4%-point drop in U.S. winter wheat that was rated ‘good’ or ‘excellent’ reignited the focus on weather in the northern hemisphere.

- Chicago maize futures (May-21) closed yesterday at $273.81/t, up $5.91/t on Monday’s close. Driving this gain at the moment is the lack of forecast rain in southern regions of Brazil. Their second maize crop is seen as critical to replenishing tight global stocks.

- Another driver is the cold weather in the U.S. causing concerns over planting delays for their maize crop.

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Play a part in creating accurate data for your industry by completing the planting survey form. Five minutes of your time can provide huge value to our great industry.

Canadian canola area increases for 2021/22…but below expectations

As markets are in the midst of being very reactive to weather, crop area data can also drive prices for the 2021/22 marketing year.

Yesterday, Statistics Canada released their estimated area of principal field crops. With Canada being a net exporter of cereals & oilseeds, data like this can have implications on global markets.

To put this into perspective every marketing year they export over 70% of wheat produced and around 50% of canola (OSR).

The supply of wheat and canola from Canada will have indirect impact on our domestic ex-farm values. Further to that, the UK relies on a proportion of Canadian wheat due to its high protein.

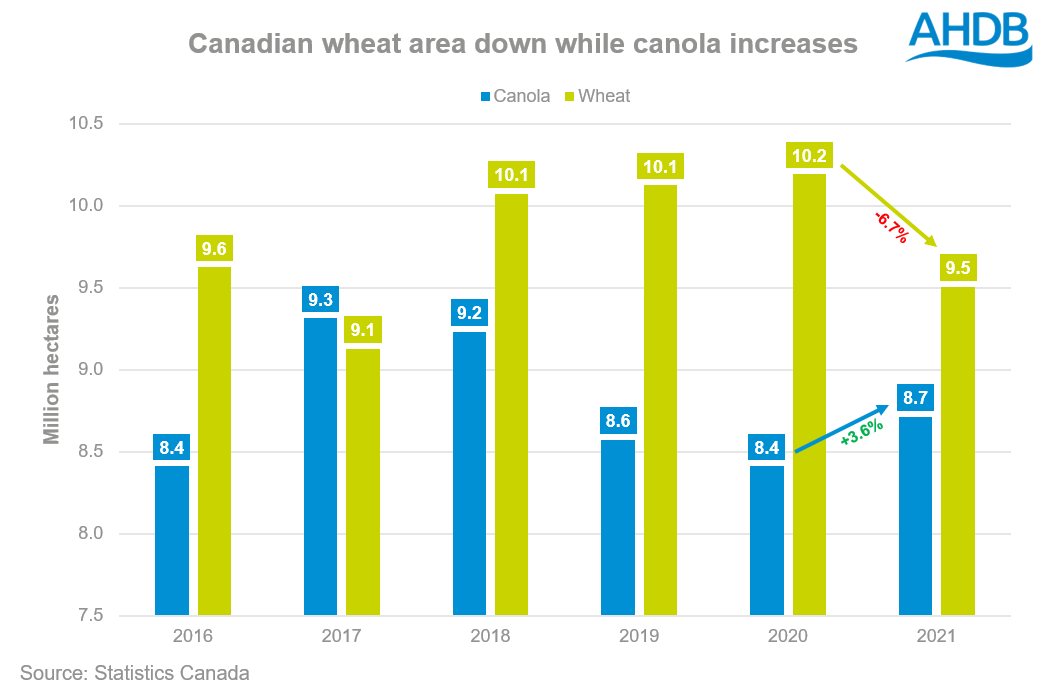

The area for canola is forecast to increase to 8.7Mha. An increase has been expected in Statistics Canada’s monthly outlooks, as tightening supplies combined with high prices have incentivised planting.

However, what is critical to note is that the area for canola is not as high as the trade expected of 9.1Mha. ICE canola futures Nov-21 contract hit a record high in yesterday’s trading session of CA$711.50/t.

The wheat area is expected to decrease to 9.5Mha. Despite this lower area for the next marketing year, exports are forecast to remain strong from Chinese demand.

They could be even stronger demand globally from both the EU for durum wheat and the US as Megan’s analysis explained yesterday.

Back into the weather cycle

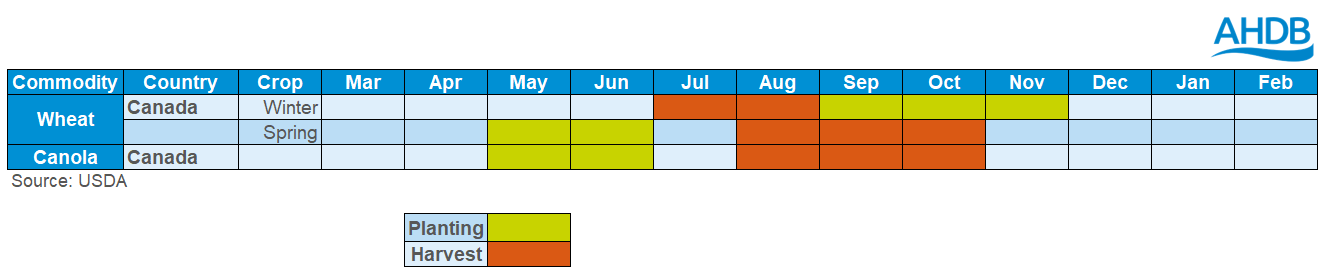

The Canadian crop in large isn’t even in the ground and linking to the start of this article the weather will continue to drive the market.

Canada is set to start commencing their planting of spring wheat and canola in the next couple of months, and the lack of sufficient rain will continue to be monitored, as pockets of the prairies have been dry.

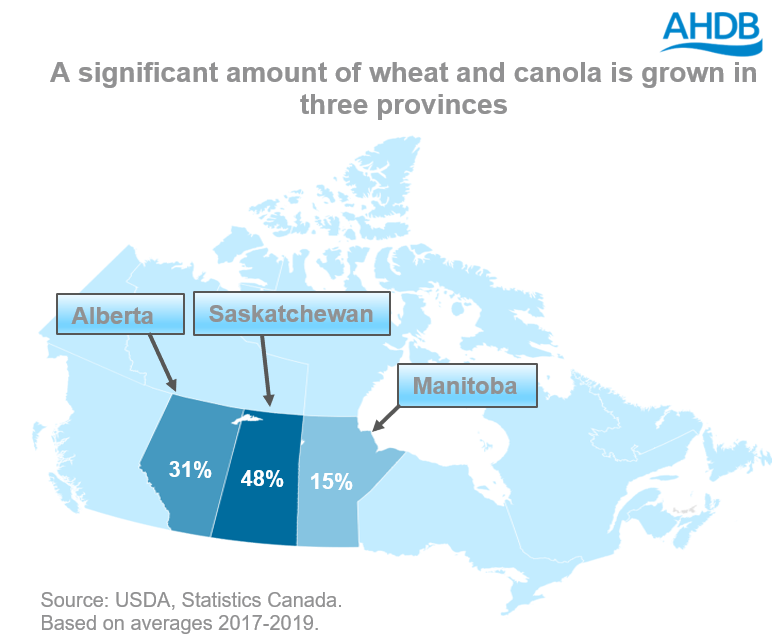

With nearly 95% of all wheat and canola grown in these three provinces, weather here is the watch point. The next significant month will be July when the canola starts to flower and will be very sensitive to moisture and temperature stresses.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.