Feed grain report: 28 October 2021

Thursday, 28 October 2021

By Megan Hesketh

Grains

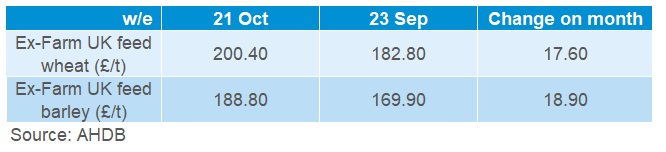

Tight global wheat supply and demand continues to strengthen UK ex-farm feed wheat prices. Ex-farm barley prices have also continued to track wheat gains. With a tight UK supply and demand outlook for barley, price rises over the month have been larger than that of wheat to narrow the discount. On 21 October, the discount of barley to wheat totalled £11.60/t, down from £12.90/t on 23 September. Issues with logistics and lack of liquidity in supply may also be playing into price gains for barley.

In October, we saw a further tightening of wheat stocks of major global wheat exporters. The USDA’s latest world agricultural supply and demand estimates (WASDE) saw crop estimate reductions for the US, Canada, and the Middle East. Though we did see some smaller cuts to forecasted consumption, the stocks-to-disappearance ratio for major exporters is now at the tightest point since the USDA first published collective EU data, in 1999/2000.

Strong global demand has also supported wheat prices in October. To 17 October, the EU had exported 8.67Mt of soft wheat. These levels are 36% ahead of 2020/21, with Romania, Bulgaria, and Germany the largest origins. Though more recent weeks have seen slightly slower export levels in line with 2019/20 levels. The EU remains competitive with a weakening euro and tight supplies in rival exporter Russia, with Russian export prices continuing to rise on tight supply. The market now awaits large southern hemisphere crops, of which Australian harvest is just beginning. If yields do not match high market expectations, we could see further price rises.

However, we have started to see some demand rationing. GASC, the national wheat buyer in Egypt, cancelled a tender mid-October due to high prices. The tender received offers from France, Romania, Ukraine, and Russia.

Wheat prices have continued to climb in October, despite pressured maize markets. The global supply outlook for maize has been boosted this month, with improved EU and US crop prospects. Plus, large South American crops are expected. Though conditions should be watched closely, especially Argentina with ongoing dry weather, as the La Niña watch is raised to alert levels which could trim yields.

This month, we saw Defra release provisional UK production figures for harvest 2021. The UK wheat production figure fell below many expectations, at 14.0Mt. How does UK supply and demand look for wheat and barley now? Find out by reading the newly released early 2021/22 balance sheet figures.

Proteins

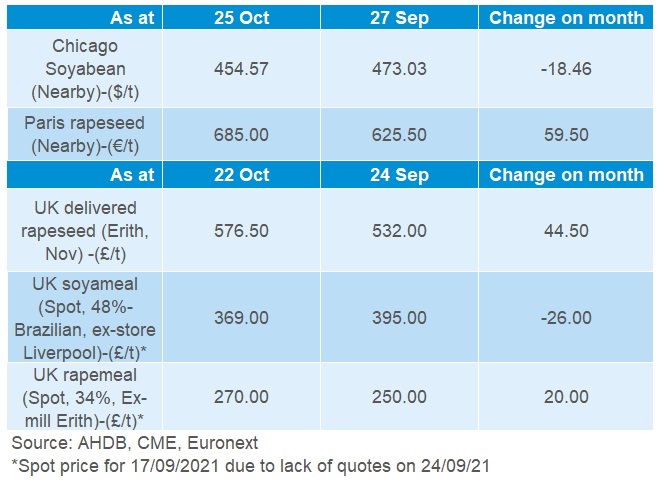

Rapeseed and rapemeal prices continued to strengthen in October, despite easing soyabean prices. It is often observed that a fall in soyabean prices can pull rapeseed prices down. However, this hasn’t been happening in October.

With tight supply and demand, rapeseed prices are set to remain supported until large quantities of new season crop come available in summer 2022. Australia’s large 5.0Mt canola crop, currently being harvested, although welcome is unlikely to remove tightness in supply and demand for this season. Global stocks are expected to drop to 6% of annual demand in 2021/22 (USDA), with demand for rapeseed considered relatively inelastic.

Whereas, we have seen prices ease back for soyabeans in October. The US harvest is underway, and yields are better-than-expected. Chinese purchasing of US soyabeans has been strong for small periods, though would need to be sustained to prevent further price falls. South American crops too are forecasted to be large. Conab’s 2021/22 Brazilian soyabean production forecasts suggest a rise of 2.5% year-on-year, to a record 140.8Mt, following an increase in area by the same degree.

Though like for maize prices, La Niña events will need to be watched closely for any changes to forecasted yields.

Rising vegetable oil prices have played a large supporting role for rapeseed in October too. Tight supply and demand in Malaysian palm oil specifically, have strengthened rapeseed prices in recent weeks. Strong global demand has been met with lower Malaysian palm production from labour shortages.

Going forward, the rising values of crude oil and vegetable oil values may provide further support for prices this season. Though increases in production of key oilseeds are expected for this season (2021/22), which may limit gains in the longer-term outlook.

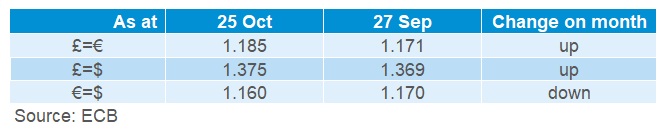

Currency

Pound sterling has gained ground against both the euro and US dollar through October, gaining from the success of the vaccination rollout and comparatively strong performing domestic economy. With interest rate hikes suspected to begin in 2022, we could see the pound continue to strengthen but arguably this may now be factored into positions. But if inflation continues and interest rate hikes are not introduced, we could see a change in positioning in November.

The US dollar fell substantially mid-October, down to poor performance of the US treasury bonds and high inflation. Though the currency has gained some ground since large falls. Whereas the EU has suffered from inflationary pressures in October, from rising energy prices.

Subscribe to our Dairy Market Weekly newsletter and receive market updates in your inbox every Thursday

Subscribe to our Cattle and Sheep Weekly newsletter and receive market updates in your inbox every Friday

Subscribe to our Pork Weekly newsletter and receive market updates in your inbox every Friday

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.