Analyst Insight: La Niña could keep domestic wheat prices supported going into 2022

Thursday, 14 October 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £204.25/t, down £4.25/t on Tuesday’s close. The May-21 contract closed at £210.00/t, down £4.50/t on Tuesday’s close.

- Wheat markets fell yesterday on an element of profit taking after the slightly bullish October WASDE report.

- Driving a lot of sentiment is Chicago maize, which had another day of pressure. The Dec-21 contract closed down 1.96% on Tuesday’s close.

- US maize supplies are above market expectations, and there are questions of demand, especially from China. But, USDA figures still peg China’s maize imports at 26Mt and soyabeans imports at 101Mt in 2021/22.

- General Administration of Customs data showed yesterday that Chinese soyabean imports in September 2021 were 6.9Mt, down from 9.8Mt for the same period last year. Poor crush margins are cited to curb demand.

The first UK 2021 Defra area and yields figures were released this morning. Some of the key highlights include:

- UK wheat area is estimated at 1,788Kha, with a national yield at 7.8t/ha, estimating UK production at 14.02Mt.

- UK total barley area is estimated at 1,149Kha, with a national yield at 6.2t/ha, estimating UK production at 7.11Mt.

- UK oilseed rape area is estimated at 306Kha, with a national yield at 3.2t/ha, estimating UK production at 977Kt.

There will be more analysis of these figures in tomorrow’s Grain Market Daily. Final results will be published by Defra on 16 December 2021.

La Niña could keep domestic wheat prices supported going into 2022

The AHDB Grain Market Outlook, presented on Tuesday, provided an insight into what could happen throughout the 2021/22 marketing year. A live stream of the event can be watched here.

The outlook highlighted that the global grain market is relying on the Brazilian maize crop to ease the bullish spur in grain markets. In this analysis I explore the possible implications of the potential La Niña weather event on Brazil’s second maize crop.

The planting and growing season of this crop will run into 2022. So, information surrounding this crop could influence ex-farm grain values in the UK in the second half of the 2021/22 marketing year.

Where are we at with global maize & Brazil?

This marketing year (2021/22) stocks in major exporting countries are set to increase year-on-year from 9.8% to 12.3% of demand (domestic and export). Large drivers of this rise are the year-on-year production increases in Brazil (+32.0Mt) and the US (+23.0Mt). This should allow both nations stocks to increase.

A substantial driver of the Brazilian replenishment is its second maize crop, with area and yields expected to rebound to trend averages in 2021/22. Conab’s latest release pegs this crop at 86.3Mt, up 42% year-on-year.

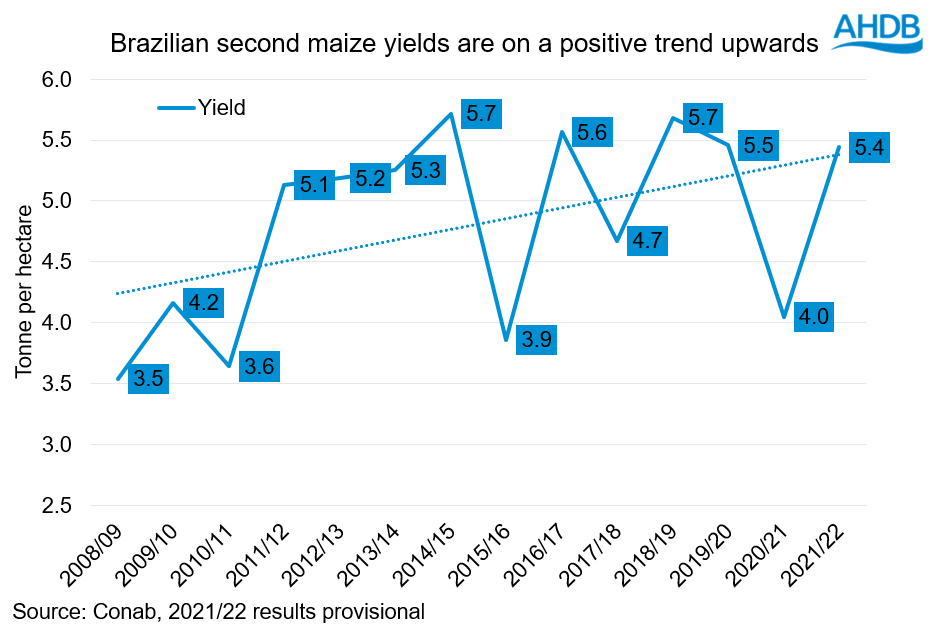

Brazilian second crop maize yields have been improving over the years. This season, Conab forecasts yields at 5.4t/ha, rebounding back in line with the linear trend.

However, this crop isn’t even in the ground yet. So, what could a possible successive La Niña do to yields and production?

Brazilian second maize and La Niña

Due to the seasonality of the El Niño (warm ocean) and La Niña (cooler ocean) the greatest impacts are to the second maize crop, which is usually planted from January onwards. Extreme El Niño and La Niña weather events can cause Brazil’s second maize crop yields to drop below trend.

When temperature anomalies surpass ± 1.0°C moderate to extreme El Niño or La Niña events occur (read more here on this). These events impacted the second maize yield notably in 2010/11, 2015/16 and 2020/21.

However, the correlation between El Niño / La Niña events and poor second maize crop yields is not absolute. For example, in 2011/12 the second La Niña did not cut yields, if anything they surpassed the trendline (see graph 2).

La Niña and loss to maize production?

With global maize stocks tight, any adverse weather impacts on this second maize crop will keep a relative element of support for prices.

The likelihood of a La Niña weather event occurring this Autumn is 70-80% and currently sea temperatures are still in a neutral state. Scientists are predicting are that, if it occurs, this La Niña event will be weak.

With this information in mind, the only recent event that is comparable is the 2017/18 La Niña as this was weak and short-lived. This caused second maize yields in Brazil to be 0.36t/ha below the trend line.

If the same level of impact occurred this marketing year, we could be looking at yields revised down to 5.1t/ha. Although not catastrophic, this small reduction could take 5.7Mt (2021/22 area and 5.1t/ha) off the Brazilian second maize crop. In turn, it could leave a gap in global production, which would not be replenished until Northern Hemisphere maize harvests in Sep-Nov 2022.

Conclusions

To conclude, this weather event playing out or not will be one of the key drivers in domestic wheat prices for the second half of the 2021/22 marketing year. As mentioned at the start, global grain markets are relying on this second maize crop to fulfil global demand at the start of 2022 and stabilise prices.

Although the predicted La Niña is weak, if yields are revised down, we could see maintained support in the market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.