La Niña could drive grain markets (again): Grain market daily

Wednesday, 29 September 2021

Market commentary

- Our Grain Market Outlook conference is fast approaching. If you want to join us on 12 October, find out more and sign up here.

- UK feed wheat futures (Nov-21) closed yesterday at £195.60/t, gaining £1.45/t on Monday’s close. The May-22 contract closed at £201.60/t, gaining £1.65/t over the same period.

- Chicago maize futures (Dec-21) closed yesterday at $209.65/t, down $2.75/t on Monday’s close.

- Slight pressure in the maize market comes as the US dollar strengthens, US harvest progresses, and crude oil prices slip. Nearby brent crude oil closed yesterday at $79.09/barrel, down 0.55%.

La Niña could drive grain markets (again)

Global grain & oilseeds prices were somewhat supported throughout 2020/21 due to a La Niña weather event that occurred in the South Pacific from October 2020 to March 2021. The La Niña caused production issues, particularly for the Brazilian second maize crop. Off the back of global market support, nearby UK feed wheat futures increased by £23.90/t in this period.

Could a successive La Niña be on the cards?

As we head into this period for 2021/22, Sea Surface Temperature (SST) anomalies in the South Pacific become a watchpoint, to help predict another La Niña weather event.

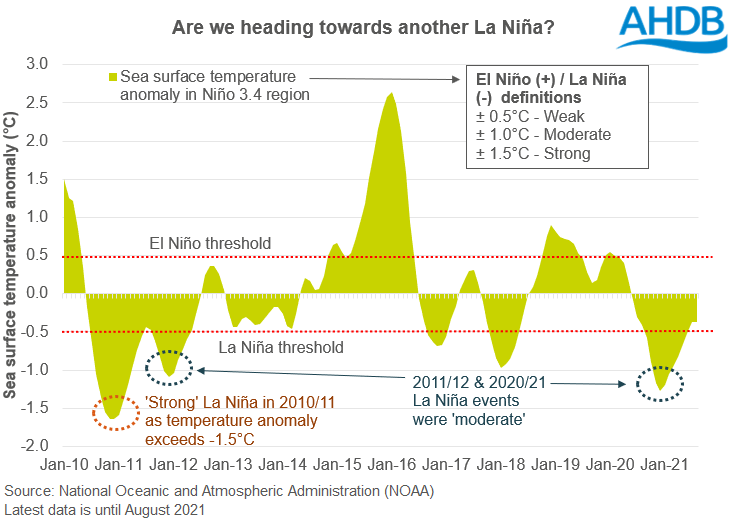

A La Niña weather event is when the South Pacific temperature drops more the 0.5°c below normal for the time of year. The cooler temperature will define the severity of the La Niña event, as demonstrated below.

Currently, by definition, the Pacific Ocean is in a neutral climatic state. However as of August 2021, the SST was at 26.9°C which is -0.45°C cooler than anticipated for the time of year. This means we are currently on a La Niña watch. The National Oceanic and Atmospheric Administration (NOAA) now anticipate there is a 70-80% chance of a “weak” La Niña in the South Pacific.

What does this mean for crops?

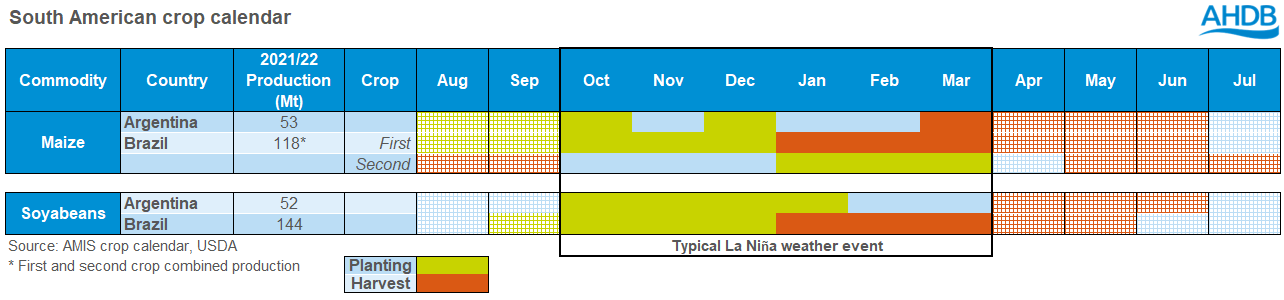

Typically, a La Niña causes dryness in South America. In La Niña years, such as 2010/11 and 2020/21, Brazilian Safrinha maize yields dropped 13% & 27% respectively, year-on-year.

As demonstrated by the table above, we are about to enter a very crucial time for South American plantings. If a second La Niña weather event occurs it could tighten South American maize production again. The current global grains outlook for 2021/22 is tight and therefore there is some reliance on decent South American crops to aid supply towards the end of the marketing year.

If South American crops don’t reach expectations, it would likely offer support to global grain prices similarly to the 2020/21 marketing year. In turn, this could also offer further support to domestic ex-farm prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.