- Home

- News

- Falling soya meal prices provide some respite for UK livestock producers: Grain Market Daily

Falling soya meal prices provide some respite for UK livestock producers: Grain Market Daily

Wednesday, 22 April 2020

Market Commentary

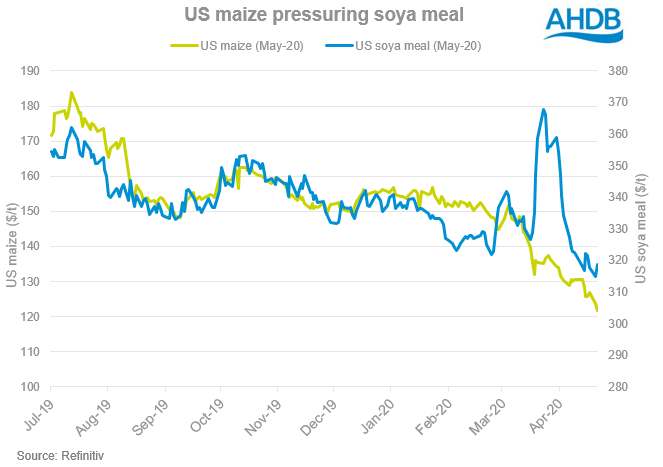

- US maize futures closed lower again yesterday. Sustained pressure from expectations for reduced ethanol demand in the short/mid term future and falling crude oil prices are continuing to impact the market. The nearby contract (May-20) closed at $121.75/t, down $6.60/t from last Tuesday.

- Palm oil prices have also seen declines, following muted demand expectations for the upcoming Ramadan and Eid religious festivals. Catering and hotel services have seen closures in keeping with state lockdowns. Malaysian palm oil exports for March were down 27% from last year, the lowest volume since 2016. Vegetable oil markets are likely to see pressure from falling palm oil prices.

Falling soya meal prices provide some respite for UK livestock producers

During March, soya meal markets recorded elevated levels of support in the face of coronavirus. Global demand for feed increased, while global availability fell. Countries that had first entered lock-downs experienced large-scale logistical disruptions. Recently, with global soya supply at a high, soya meal prices have since retraced back to pre-March levels. This has provided some respite for the UK livestock industry, which makes use of imports for protein feed sources.

Panic buying of food supplies at the end of March resulted in many countries increasing imports of animal feed supplies, particularly soyabeans and soya meal to supplement feedstocks. Reports of logistical delays at Argentinian ports increased global supply concerns and soya meal prices to a point. Brazilian exports of soyabeans reached record levels for March at 13.5Mt, benefiting from the reduced value of its currency.

Since then, news is more bearish for the short/mid term. This has contributed to the recent declines in the soya meal price. At the continued sluggish US soya export pace, it hitting its global and Chinese ‘Phase-one deal’ targets seem unlikely. Combining this with a likely increase to US soyabean planted area, at the expense of maize, US stocks of soyabeans could hit near-record levels come harvest in September. My colleague Anthony recently explored the pressures surrounding maize and what this could mean for US soyabean area In addition, despite a moisture deficit in Brazil, the country is still on course for a record soyabean harvest.

However, there remains long-term support for soya meal. With China beginning to open up again onto the world stage, the country is resuming the recovery of its pork production. Chinese officials expect a significant recovery to its pig herd in 2020, although this could well be hampered by coronavirus and the African Swine Fever outbreak that began in 2018.

From a UK view, this sentiment has helped drive the direction of delivered (48% Pro) soya meal prices. On 27 March, prices were quoted at £375.00/t for May delivery into Liverpool. As of 17 April, prices had declined £48/t to be quoted at £327.00/t for May delivery into Liverpool.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

Topics:

Sectors:

Tags: