Analyst Insight: How long will maize and ethanol markets be under pressure?

Thursday, 9 April 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £157.80/t, up £0.60/t on Tuesday’s close. New crop UK wheat futures (Nov-20) gained £0.90/t, to close at £167.65/t. New crop UK wheat futures (Nov-20) are at a premium of £56.63/t to new crop US maize futures (Dec-20) currently, gains to wheat markets will likely be limited unless maize futures are supported.

- Paris rapeseed futures (May-20) closed yesterday at €371.00/t, this contract has gained €7.25/t since last Friday’s close off the back of proposed OPEC+ talks which will take place today.

- Brent crude oil (nearby) closed yesterday at $32.84/barrel, this contract has gained $8.10/t since the start of the month, today’s production meeting with OPEC+ members will determine if this successive gain continues or subdues.

- Be sure to read James’ latest article which analyses how rice has been supporting wheat prices.

How long will maize and ethanol markets be under pressure?

Global economy downturn pressuring maize

As the coronavirus pandemic slows the global economy, this has drastically reduced the use of agricultural commodities in the energy sector.

One implication of the virus-related restrictions is that people are driving much less than before, which means the use of fuel and ethanol is currently declining.

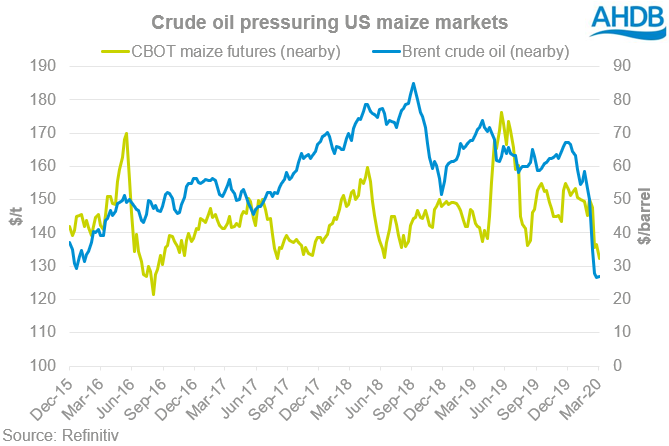

Therefore, as global lockdowns transpire (reducing energy demand) and energy exporters cannot agree outputs (increasing stocks), we have witnessed many agricultural commodities pressured in line with crude oil and the global economy. As Peter’s article discussed last week; falling oil prices are pressurising maize markets as 37% of US maize is used to produce fuel.

In this article, I have answered three questions;

- What are the implications of the economic downturn on maize markets?

- What does the recent downturn mean for new crop maize planting in the US?

- Is there a longer-term recovery in sight for prices?

This is important to analyse as a pressured global maize market could significantly affect our domestic new crop pricing as we progress throughout the year.

Further to that, if a recovery is in sight off the back of stable oil prices, we could see the domestic rapeseed price supported.

The light at the end of the tunnel

The impacts on energy markets from coronavirus are evolving daily at the moment, and the fluctuations in energy prices are having an effect on agricultural commodities. What will be the key for supporting global prices is stabilising oil markets.

The OPEC+ production conference being held today could possibly give us clarity to crude oil prices going forward. If we see agreements made, we could see domestic rapeseed prices supported further.

The affect may take longer to filter to maize markets, as the global economy is stationary, and the longer-term implications of the coronavirus are still unknown.

Another key parameter to consider is that if maize prices stay subdued, we could see the growth in the global wheat markets stunted, which will cap new crop UK wheat futures.

A short-term forecast reduction in ethanol demand

As the medium to longer term impacts of the coronavirus are currently unknown, we can only provide a forecast on the limited information around the impacts of this pandemic.

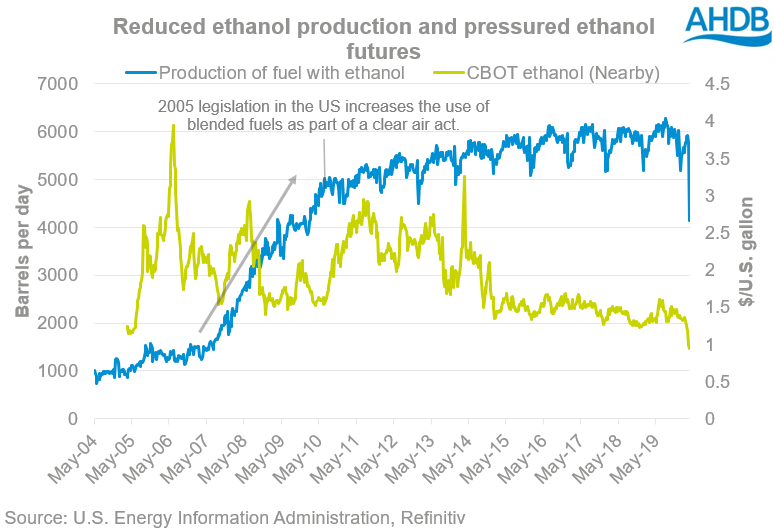

In the immediate short-term we can foresee the production of fuel blended with ethanol will be drastically reduced. As we can see in the graph below; nearby Chicago ethanol prices are pressured, so is the output of finished conventional fuel that is blended with ethanol.

A recent study on ethanol demand reduction during the coronavirus pandemic has been conducted by the Department of Agricultural and Consumer Economics, at the University of Illinois.

The study has utilised past consumption data to predict how current consumption will be altered as a result of coronavirus. They have then use that to calculate the reduction in maize use, which is predicted to be 6.5Mt. This will significantly increase the US ending stocks for the 2019/20 marketing year.

However, what is critical to consider with this study, is that the assumption is based on national lockdowns in the US being relaxed by the end of May. Furthermore, consumption trends are understandably based on limited data.

Weak ethanol demand, but what about US maize supplies?

Adding to this bearish outlook for maize was the USDA’s release of the latest prospective plantings for the 2020/21 marketing year, which estimates a year-on-year rise in both maize and soyabean plantings, 8% and 10% respectively. If planting progresses as intended, we could potentially see one of the largest US maize crops on record.

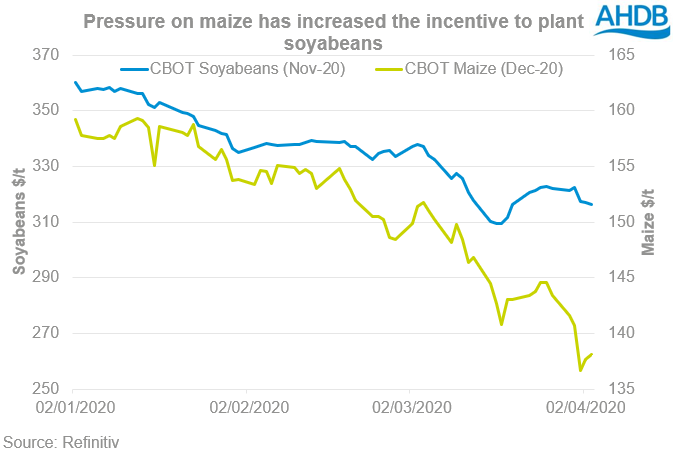

Since the start of 2020, we have seen the pricing relationship between both Chicago futures contracts of maize (Dec-20) and soyabeans (Nov-20) mainly favour maize. But year-on-year increase in both crops was due to adverse climatic conditions last year.

However, as maize futures are pressured due to the USDA outlook and coronavirus, the price ratio between the two contracts has been diverging, increasing the attractiveness of planting soyabeans.

It is worth noting that the USDA’s planting intentions is just a snapshot of data that was collected before the pandemic took hold, and at this time maize was the favoured crop, but circumstances have changed this.

Moreover, to what extent will a farmer in the US suddenly change their intentions, as the December futures contracts of maize stagnates around the cost of the production?

Is producing maize an economically viable option?

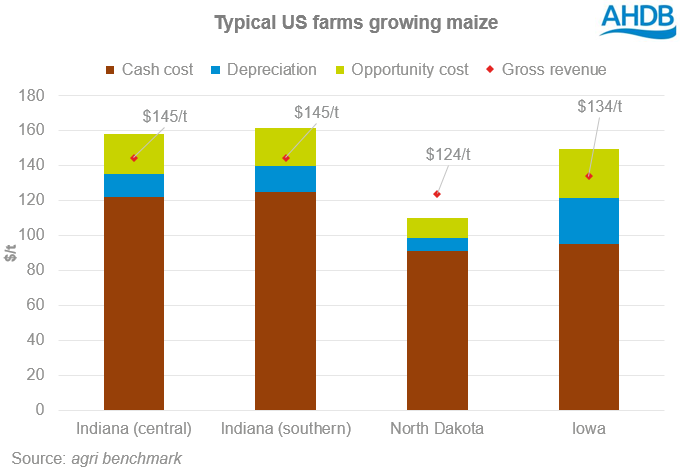

In this section I sought to assess if a farmer in the US would currently switch to soyabeans from maize (assuming they are able to do so), as the futures contract price is not significantly supporting growing maize, as of yesterday’s close US maize futures (Dec-20) were at $137.49/t.

The graph below displays the gross revenue per tonne from a typical farm in the US growing maize. The data used to formulate this figure is from agri benchmark in 2018.

As we can see from this graph the typical cost of producing a tonne of maize exceeds current futures contract prices in most scenarios.

The US federal government offers many subsidies for agricultural production that can incentivise production of some crops that may otherwise be uneconomic to produce.

Further to that, there are many crop insurance schemes offered in the US that can pay-out if the market is below the cost of production or your crop has been ruined in a natural disaster.

Therefore, I would question how big a switch in US spring planting intentions we could see, even with the price relationship favouring soyabeans.

Is there hope for maize and ethanol?

Demand for fuel at the moment remains low and for the foreseeable future will probably be low, until we have clarity on the length of time that the coronavirus will affect the global economy.

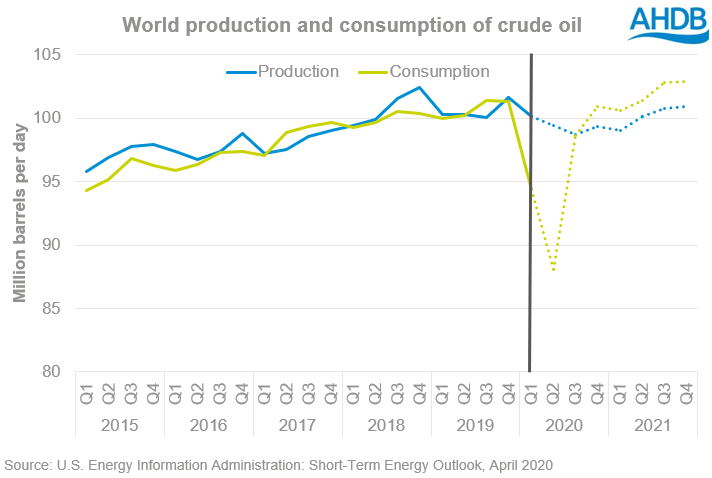

The U.S. Energy Information Administration (EIA) anticipates the production and annual growth for crude oil will stagnate more than biodiesel and ethanol.

Furthermore, post-coronavirus the global economy will be business as usual, inherently the cogs of capitalism will turn again, and the globe will produce and consume more crude oil than ever.

There are predictions that global petroleum and liquid fuel demand will decrease by 5.2 million barrels per day in 2020, but then increase by 6.4 million b/d in 2021.

Furthermore, the EIA predicts that Brent crude oil will average $33/barrel in 2020, $10/barrel lower than last month’s prediction. Also, they expect prices will average $23/barrel during the second quarter of 2020 and increase to $30/barrel during the second half of 2020.

Evidence is starting to unfold that global economy is severely being affect by the coronavirus, with reduced productivity and less travel. Going forward it’s a case of waiting to see how politics and recovery from this pandemic play out.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.