Analyst Insight: Falling oil prices pressurising maize

Thursday, 26 March 2020

Market Commentary

Currency and Financial markets

- The value of the pound has continued to find a degree of support and recover slightly against the dollar, moving to £1 = $1.1885 yesterday and breaking above £1 = $1.1928 this morning.

- The slight recovery in the value of the pound has also translated into marginal gains relative to the euro over the course of the last week. From lows of £1 = €1.0635 on the 18 March, the pound recovered to £1 = €1.0916 yesterday.

Grain & oilseed price impact

US Chicago wheat futures found further support yesterday. Nearby demand lent support to wheat futures, with May-20 closing at $213.11/t, up $6.80/t. However, should demand prove to be short term, then this support could be removed as the longer term implications of the economic slowdown become known.

Support in US wheat futures filtered through to UK feed wheat futures, May-20 gaining £2.20/t, closing at £165.70/t, with the gains subdued by the strengthening of the pound. New crop Nov-20 also gained support, up £2.50/t to close the day at £175.50/t.

Oil markets have continued to remain under pressure. Nearby Brent crude has continued to trade below $30/bbl since the 17 March, with the global fall in demand continuing to outweigh any prospects for possible production cuts.

Following crude oil markets, Paris rapeseed has been subdued, tracking sideways unable to close above €350.00/t since 16 March. Unless crude oil markets reverse and receive support then rapeseed could well remain under pressure for the foreseeable.

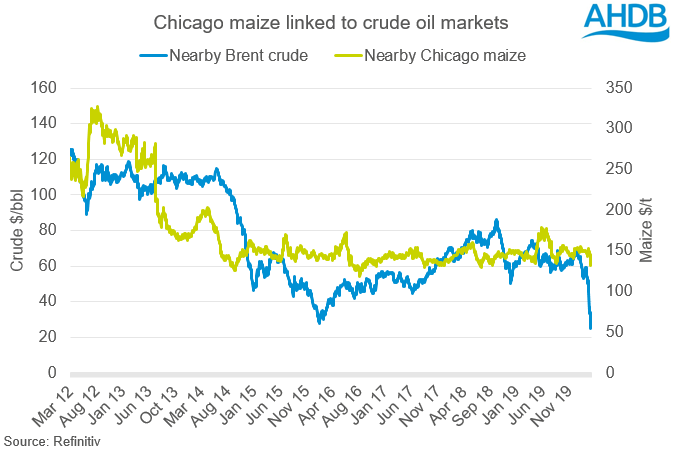

Falling oil prices pressurising maize

Amid the current global pandemic, economic downturn and depressed oil market, it is worth looking at the wider links between agricultural products and larger trends.

In the US, the usage of maize for ethanol in fuel has increased, driven by US governmental mandates and economics. Subsequently, production of maize has risen in response, with 37% of maize grown in the US now used for fuel.

2005 legislation in the US mandated 4 billion US gallons of ethanol to be produced, increased to 6.1 by 2009 then 7.5 billion by 2012, with plans to extend again as part of a clean air act. The increasing use of maize and decision to bring in mandates for fuel use has led to the linking of not just oilseeds, but global grains, to the crude oil market and global economy.

The mandates, while setting a theoretical lower limit on the volume of maize used in US fuel, fail to prevent crude oil market led pricing. With such a large proportion of maize now used for fuel, downward pressure from crude and ethanol markets has come to be one of the largest factors for US maize price direction. Downward pressure from oil is also being combined with demand cuts. The combination of a falling oil market, and lower fuel demand has led to a reduced demand for ethanol. With demand for ethanol falling, the margins for producing ethanol have fallen and turned negative, leading to halts in production and maize demand cuts. Due to a combination of credits, deferrals and waivers for smaller refineries from blending obligations, these refineries have the ability to reduce the ethanol demand at times of challenge, independent of mandated volumes.

With maize underpinning all grain markets, including wheat, the underlying link between not just rapeseed, but also wheat, with oil may well also lead to longer-term wheat pressure should the short term buying support diminish.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.