Will the UK food-to-go market get back to growth post pandemic?

Wednesday, 2 March 2022

Before the coronavirus pandemic, the food-to-go industry was evolving and extending its scope. However, a legacy behaviour of the pandemic is the rise in remote and hybrid working.

This change in lifestyle has had a huge impact on the foodservice market, most notably for food-to-go. Pre-pandemic food-to-go represented almost a quarter of the value of the eating-out market, but contracted by nearly a third during 2020. According to IGD, the UK food-to-go market was worth £15.6bn in 2021, up 16.5% on 2020 but still much smaller than £18.9 of 2019. It is predicted to be one of the slowest parts of the market to recover, potentially only bouncing back during 2023 as busier lifestyles resume (Lumina Intelligence, UK Food-to-go Report) but IGD predict it will reach £22.7bn by 2026.

While many are still working some days remotely, one in three workers are unable to work from home, along with 21% who are eager to get back out to the workplace (definitely not or probably not going to increase the amount of days they work from home, according to the AHDB/YouGov Consumer Tracker, February 2021). This means for city centre locations targeting commuters is still important, through innovative grab-and-go meals, office delivery options such as Uber for Business and Deliveroo for Work, as well as offering dine-in options which cater for group meetings and remote lone working.

Channels particularly hit were workplace, travel hubs and city centre quick-service retail, sandwich retailers and coffee shops. This is reflected in the High Streets Recovery Tracker, which shows that certain cities – such as London, Milton Keynes and Oxford – are struggling to get footfall back to pre-COVID levels.

Share of foodservice occasions pre-COVID that were food-to-go

As we live without restriction, one-third of working adults are still working from home at some point during the week (ONS, w/e 31 October 2021). According to the AHDB/YouGov consumer tracker, 38% of workers claim they definitely will, or probably will, increase the amount of days they work from home compared with pre-pandemic (February 21). Home-based workers should not be overlooked by the foodservice market. They still venture out, especially when in-home meal fatigue kicks in. However, food-to-go operators need new strategies to cater to this lifestyle change:

- Greater opportunities lie in new suburban locations, or utilising existing locations through partnerships. Recent examples include Pret A Manger trialling concessions in Tesco supermarkets, and Carluccio’s (cafés, counters and restaurant hubs) opening in Sainsbury’s

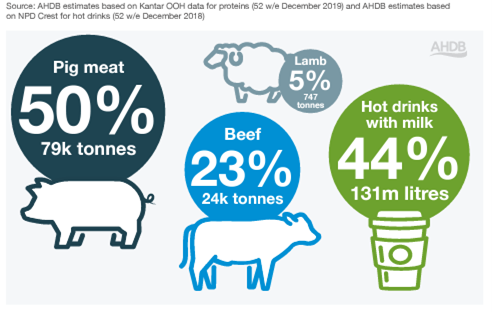

- Alternative routes to market are key, including delivery, takeaways and drive-thrus. Delivery/takeaway at-home lunch occasions have tripled since 2019, representing a staggering 574 million occasions in the last year (Kantar OOH, 52 w/e 3 October 2021)

- Food-to-go options need to stand out to ensure consumers step back from their fridges; innovation should focus on fresh, healthy offerings, both hot and cold, covering breakfast, lunch and snacking

- Value propositions are vital; meal deals, promotions and loyalty schemes will entice

This is an extract from our resent research. To see full details of the trends currently affecting the foodservice market, see out foodservice: recovery, challengs and opportunities report.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: