The organic market and its shoppers

Tuesday, 19 June 2018

The organic market in the UK has been building momentum since 2015 and hit the £1 billion spend mark in the last 52 weeks. However, growth has slowed more recently to behind total grocery performance and it is still only worth 0.9 per cent of the market. While consumers understand the overarching meaning of organic (free from added chemicals such as pesticides), a lack of perception around further benefits could be hindering the large price premium currently commanded. It is key, therefore, to recognise these consumer perceptions to help understand the long-term opportunities for this market.

The following article is based on a piece of research AHDB commissioned from Kantar Worldpanel; you can download the full report below.

Overview of the organic market

Consumer spend hit £1 billion for the organic market in the last 52 weeks ending February 2018. This is a growth of two per cent versus the same time a year ago. However, despite steady growth since 2015, performance is slowing and currently lags behind the total grocery market.

Organic is an established market, but when comparing to the more recently launched ‘free from’ market, the lower levels of momentum are clear and, overall, organic is still only a small part of the grocery market at 0.9 per cent.

Dairy products hold the largest share of the organic market at 32.1 per cent, followed by fruit, vegetables and salads at 26.2 per cent. Fresh poultry and game and meat come in lower at 2.9 per cent and 2.7 per cent share respectively. Year-on-year percentage spend growth for organic in the last 52 weeks ending May 2018 is being driven by chilled convenience (+31.2 per cent), alcohol (+23.1 per cent) and hot beverages (+21.8 per cent), whereas fresh meat sees the opposite trend and has declined (-21.9 per cent).

What is impacting performance?

The two per cent spend growth is mainly being driven by a price increase (up three per cent) as volume tonnage is actually declining by one per cent year-on-year. The growing price premium may be the hindrance to the overall organic performance as consumers claim price is the biggest barrier when shopping the category, even among those who already buy organic. While around a 30 per cent price premium is expected of the organic market, the actual premium paid is higher for certain organic produce: 55 per cent for fresh pork chops, and 51 per cent for Cheddar cheese and milk. This indicates the market may be stretching its shoppers in terms of what they are being asked to pay.

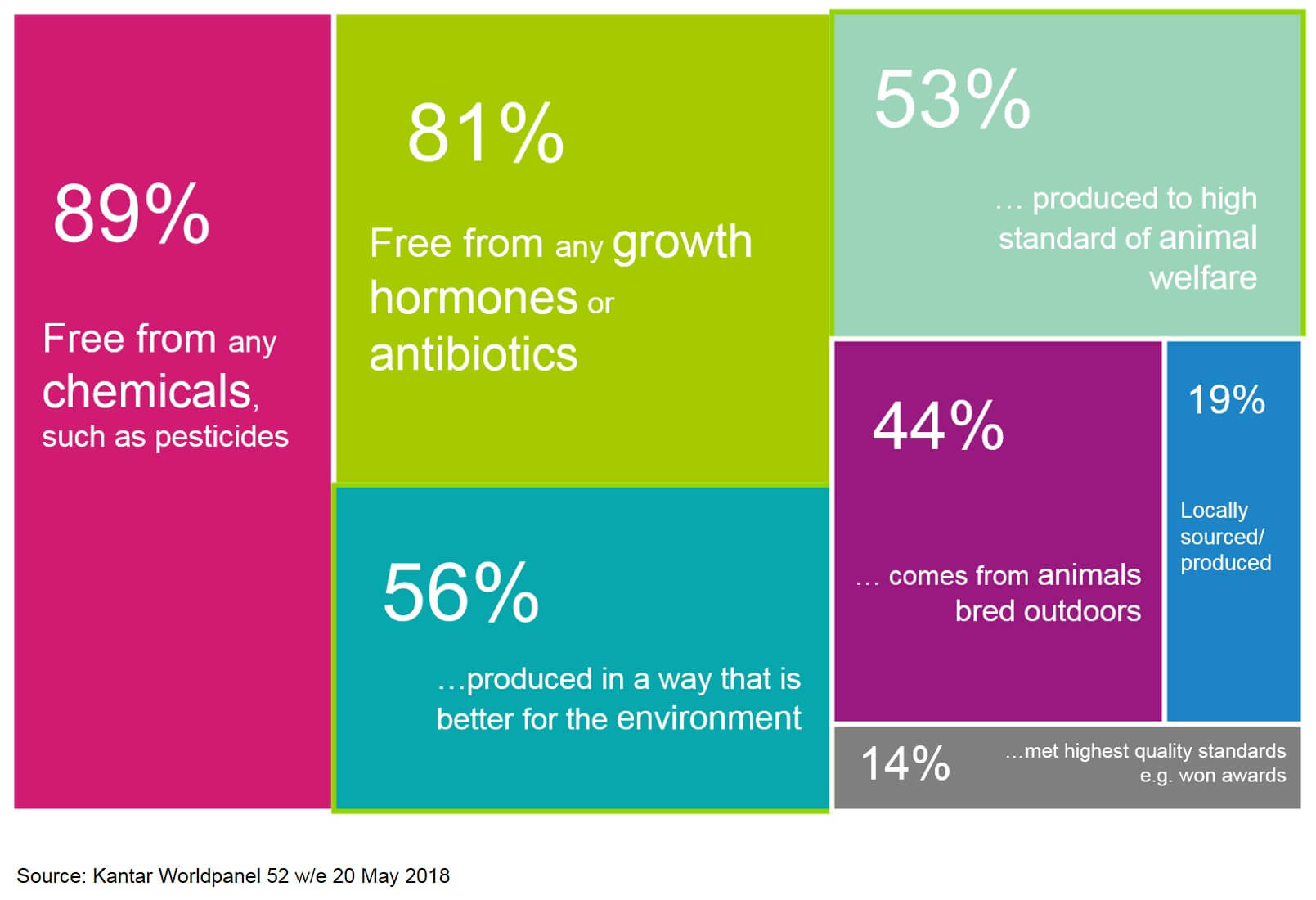

Coupled with this, justifying a price premium needs a shopper to understand what they get for the additional cost. For the organic market there is a general understanding of what organic means, with 89 per cent of those surveyed linking it to goods free from any chemicals such as pesticides and 81 per cent linking it to goods free from any growth hormones or antibiotics. However, beyond these overarching themes, perceptions linking to the environment, animal welfare and personal benefits (health benefits and taste) are much lower.

Among consumers who agree organic is worth paying more for, there is a perception that organic produce tastes better (73 per cent), is healthier (81 per cent) and is more nutritious (58 per cent), resulting in strong motivators for its price premium. The research highlights that these perceptions are higher among organic red-meat buyers than organic dairy buyers, indicating that organic red-meat buyers are more engaged with the category (probably because of the higher end price), showcasing an opportunity to engage dairy shoppers more.

Animal welfare opportunity

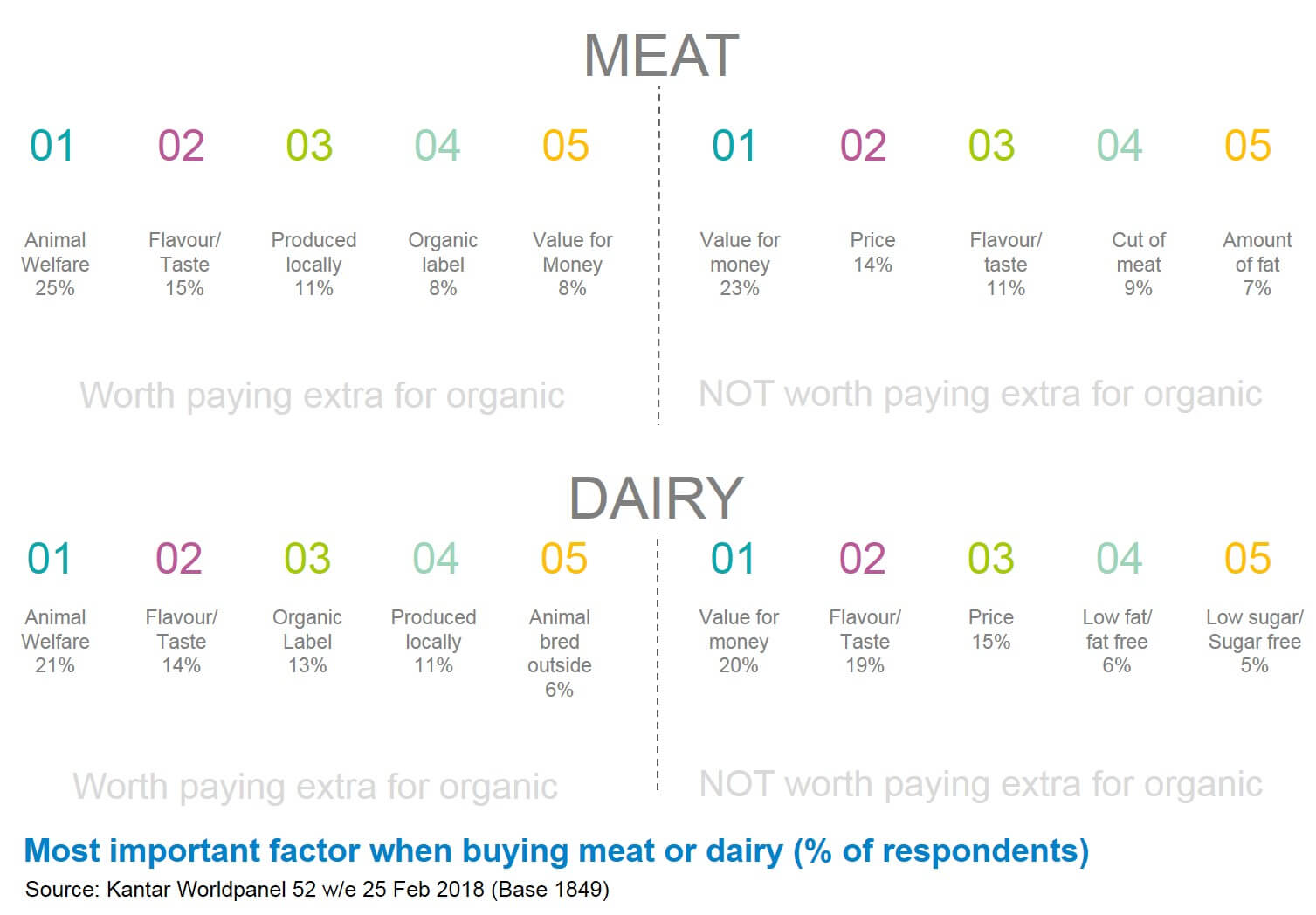

A clear opportunity lies with linking organic to animal welfare claims, where applicable. For both red-meat and dairy shoppers, animal welfare is the top purchase driver among those who claim organic is worth paying more for. Whereas among those who do not agree organic is worth paying more for, animal welfare does not feature and their top purchase driver is value for money. This highlights an area organic can differentiate itself by communicating this benefit to shoppers.

As with any market, it is key to understand its size, momentum and consumer perceptions. This research allows for this, as well as highlighting potential opportunities for the organic market. The full article includes additional information on the organic shopper profile as well as retailer share and performance in organic.