Shrinkflation – The Consumer View

Thursday, 5 May 2022

According to the ONS, the average price paid for food and non-alcoholic beverages was up 5.9% over the last year, and the cost for restaurants and hotels saw an increase of +6.9% (CPI, March 2022). Inflationary pressure is likely to remain for at least the remainder of 2022 and we discuss the impact on consumer demand here. In this piece we explore how the food offered to consumers may be impacted through the manufacturing term ‘shrinkflation’ – the practice of reducing the size of a product in response to rising costs to keep the price the same.

According to IGD, 80% of UK shoppers have noticed shrinkflation happening in retail in the last 12 months. Awareness of shrinkflation varies by grocery category. Sweet snacks have the highest level of awareness with 59% of consumers noticing items getting smaller in the last year. For chilled products, such as ready meals and prepared meats, this drops to just over a quarter of shoppers. While fresh meat and fish sits lower at 19% and dairy 17% (IGD, Shrinkflation Survey, March 22).

Rising costs, labour shortages and supply chain issues are just a few of the factors putting inflationary pressure on food supply chains. For the hospitality industry they are also contending with recovery post-pandemic. Many food manufacturers therefore have little choice but to pass on rising costs to their customers, through either reducing the size, re-formulating or increasing the price of offerings. This is the case for both products in retail, as well as meals in foodservice. Operators need to weigh up the potential loss of shoppers from increasing prices with a loss of shoppers due to dissatisfaction with a change in offering (which is typically seen as lowering value), in order to decide which route to take.

Reducing the size (Shrinkflation)

For meat and dairy in retail and foodservice this would involve reducing volume. Reducing weight would be easiest for categories where cutting is involved, such as steaks and cheese, or where you can package slightly less, such as mince, diced, yoghurt and ice cream. The last time food size reductions were recorded by the ONS between September 2015 and June 2017 they identified between 1% and 2% of products had reduced in size. With the current economic circumstances, we predict this rate could be much higher now.

What needs to be considered when reducing the size of an offering is if the shopper is going to be informed. Some companies will not communicate, hoping their change will go unnoticed by consumers. In foodservice, techniques such as using more decorative sauces or slicing meat diagonally are used to distract away from a change in portion size as the meat can cover the same area of the plate. However, in both retail and foodservice, the risk of media pick-up or negative noise on social platforms can be very damaging.

Alternatively, some companies take a more open and transparent approach, using packaging or advertising to explain why this has happened. For example, in the US Dominos communicated they were downsizing their $7.99 chicken deal to have fewer chicken wings, in response to shortages and rising costs. Other brands (more prevalent in packaged goods such as chocolate and crisps) can link a reduction in size to alternative reasons such as to make the product healthier or more sustainable. According to IGD, these justifications help shoppers accept a change with honesty likely to be rewarded with brand trust (Shrinkflation Survey, March 22).

Re-formulating

For meat and dairy in retail and foodservice, reformulating products would involve changing the make-up of an offering in order to save costs, rather than reduce the size. This could involve reducing certain ingredients in a dish while increasing others, such as removing some meat but bulking up with vegetables. Some brands may switch to cheaper ingredients or cuts, such as swapping butter for cheaper margarine. At AHDB the Meat Purchasing Guide has over 700 meat products, varying in cost, which can be utilised in market. What needs to be considered when re-formulating is maintaining the quality of the offering in order to not lose customers.

Increasing the price

For some businesses the above two options may not be feasible, or even considered, and therefore the cost has to be passed on to the consumer through higher prices. If this is the case, it is vital to justify these price hikes by ensuring they mean better quality offerings, including highlighting provenance, quality and sustainability.

Consumer view

According to IGD it is vital to understand your customer base when considering which of the above three options would work best for you.

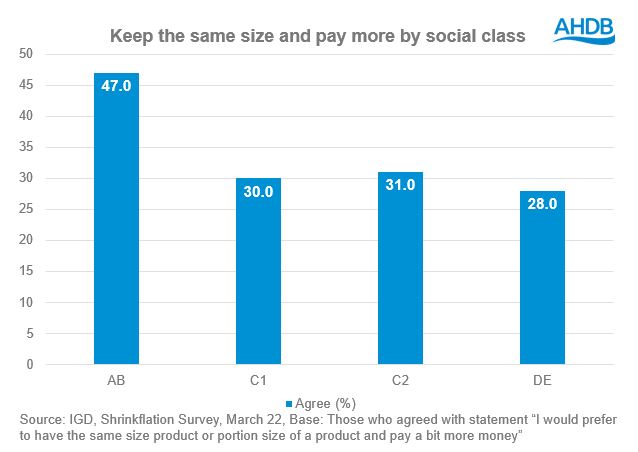

Overall, 45% of shoppers would prefer a reduced pack size over a price increase if a change had to be made, so it is a very polarising subject. This isn’t entirely surprising as the rising cost of living is currently at the front of minds for many shoppers. This is reflected in higher affluence groups being more accepting of increasing prices, whereas lower affluence groups would prefer to have a smaller pack size to keep the price the same. Similarly, the more affluent shopper is also more likely to agree that they would prefer ingredients to be the same quality and pay a bit more.

This indicates that a premium product may be more likely to be successful by increasing the price, whereas a value product may work better with a reduction in size, or re-formulation, if it helped to keep the cost down. However, it is not clear-cut and this highlights the importance of considering your customer base when deciding which approach to take.

Key highlights

- Inflationary pressures are felt by all and therefore an honest approach to product or pricing changes may be better received by consumers

- Quality is key - when changing an offering (either size or re-formulation) the quality of the product must be maintained or exceeded, and if increasing prices this must be justified

- When deciding which approach to take consider the spending ability, or social grade, of your customer base

- Consider other ways to cut costs to avoid a change in offering or price

Example 1 - shorter menus in restaurants allow venues to order fewer ingredients, cut food waste and capitalise on volume discounts and efficiencies

Example 2 – Just Eats “waste less” programme offers customers the option to order smaller portions, resulting in a less cynical way to shrink volumes because the consumer chooses to, not the seller

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: