The likely impact of inflationary pressure on British meat and dairy sales

Friday, 25 March 2022

As the cost of living dramatically increases and consumers feel a degree of financial pressure not experienced since the 2008 financial crisis, we explore the causes of this, the effect on consumer behaviour and the likely outcomes for meat and dairy sales.

Inflation is also impacting farmers and processors directly with higher energy, feed and other costs. However, the focus of this piece will be on the impact that inflation will have on consumers, which indirectly impacts farmers and the wider supply chain. Of course, increased volatility and costs arising from the Russian invasion of Ukraine are expected to further exacerbate the pre-existing inflationary pressures.

Economic outlook

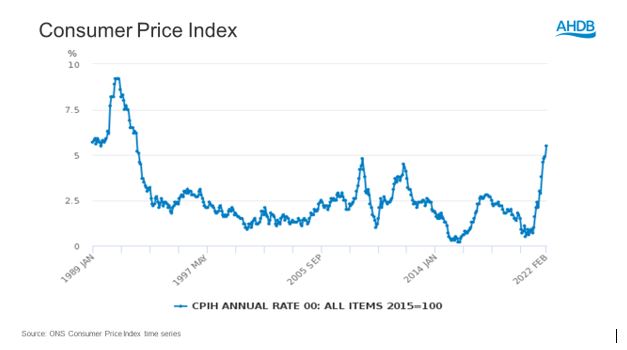

Since the beginning of 2021 the UK has bucked the long-term historic trend of low inflation and has crossed the 5% threshold for the first time since 2011, reaching 5.5% in February 2022. This is in excess of the 2% inflationary target set by the Bank of England. Inflation refers to a general progressive increase in prices of goods and services. Inflation above 5% has not been seen since the early 1990s. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

The key driver of current inflation is the rising global cost of energy. This causes higher energy and transport costs for businesses resulting in higher prices for consumers. Energy costs are a double whammy as they also directly impact on consumers who must pay more to heat their homes and fill their cars up.

We have also seen higher costs on a global basis due to increased shipping and transport costs and a number of supply problems. These include an increase in bureaucracy and trade friction due to Brexit and increasing labour costs due to ongoing staff shortages in certain occupations, contributing to these bottlenecks (for example, the well documented shortage of HGV drivers) resulting in wage increases for some.

In addition to inflation, there will be other cost of living increases in the coming months which will all impact on household finances in the UK. These include:

- Loss of the energy price cap resulting in average gas and electricity bills rising by £693 per annum from April 2022 (although somewhat mitigated by a planned £350 council tax rebate on homes in Bands A to D)

- 25% increase in National Insurance contributions for workers under the Health and Social Care Levy from April

- Rise in regulated rail fares of up to 3.8% from March and increases in broadband and TV costs

As well as the above, rises in interest rates which are intended to put a brake on inflation will also increase the cost of borrowing, including loans, credit cards and mortgage payments for many and will increase the cost of rented accommodation due to increased landlord costs.

Taking all these factors together the result will be that the vast majority of households will feel some degree of financial pressure in the coming year ahead which will be severe for some, particularly those households with lower earnings and no savings to fall back on.

Inflation affects individuals differently. When inflation is driven by rising costs in essential goods such as food and fuel, it will disproportionately affect those on lower incomes due to the inability to cut back on these purchases.

Consumers will adapt their consumption in a variety of ways in order to save money on these essential food items. These will be explored in more detail below but may include trading down, eating out less, cooking from scratch and buying more value range items, etc.

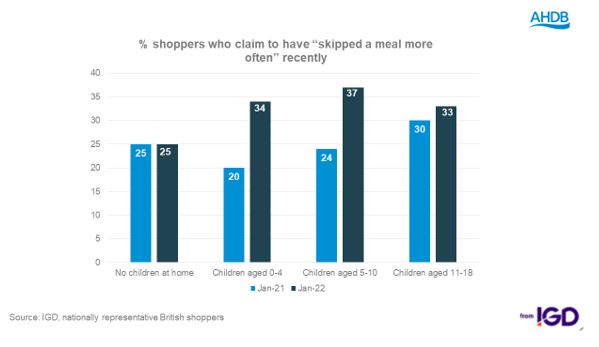

Some less affluent consumers are already reporting an increase in skipping meals to save money. As Marcus Rashford’s recent school meals campaign highlighted, when finances are tight, some children go hungry.

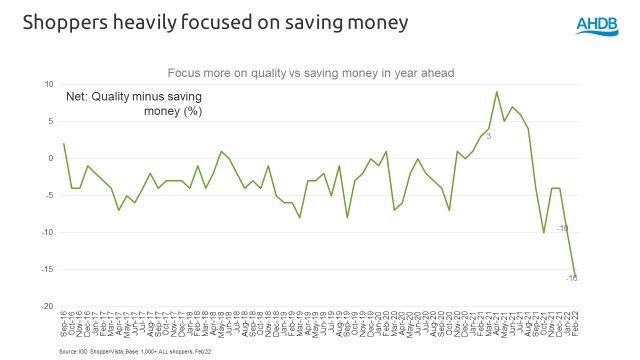

Low confidence

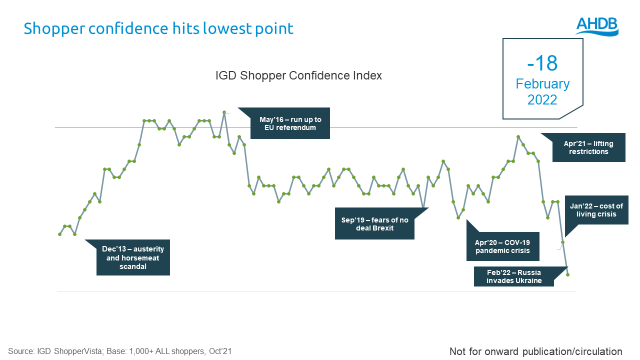

The media has been full of stories about rising costs ahead and this has put a brake on consumer confidence. Confidence was at a low ebb during the early part of the pandemic but grew as the vaccine programme rolled out and restrictions were eased. However, first the Omicron variant caused another surge in Covid numbers and then the cost of living crisis has led to diminishing confidence levels. According to IGD, these levels are now at the lowest point since 2013 when austerity and the horsemeat scandal were taking place.

Meat and dairy prices in the “new normal”

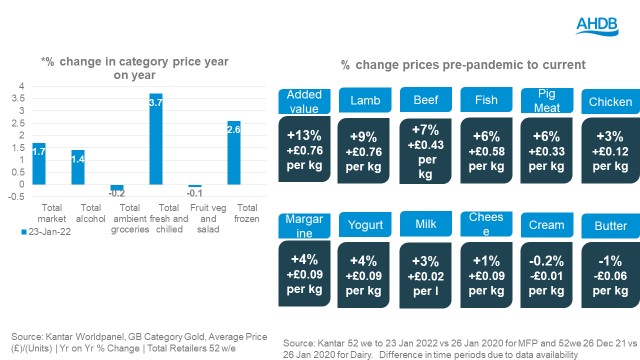

Over the past 12 months retail food prices have been rising but this has been variable by category. While the costs of ambient (non-chilled/frozen) foods have been static the costs of frozen and particularly fresh food have risen noticeably.

According to Kantar, fresh and chilled products have risen most of all being driven by meat and primarily red meat. While not all of this is due to inflation (changes in product mix also play a role), looking at the average price paid by shoppers gives an indication. Added value meats including marinades, sous vide, etc. increased in price the most from pre-pandemic to now growing by 13.0% or £0.76 per kilogram.

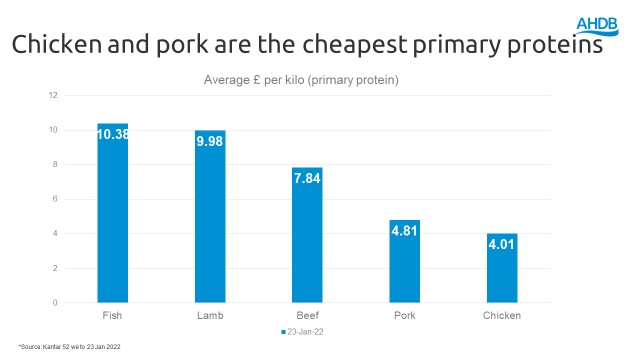

The cost of lamb rose by 9.1% from pre-pandemic to the latest period, adding £0.76 per kilogram to what consumers already perceive as a more premium option. Beef rose by 6.5%. Whilst the cost of pig meat has increased by 0.6% year on year, price growth in 2020 means that overall the cost of pig meat is up by £0.33 per kilogram since before the pandemic. Chicken increased less by only £0.12 per kilogram making it seem a more attractively priced protein.

Changes in dairy prices have been less marked, with milk rising by 2ppl and cream and butter actually fell in price overall compared with before the pandemic. The continuing low price of dairy milk versus alternatives could be an advantage in future. Milk alternatives, on average, cost £1.21 per litre in the 12 months to 26 December 2021 (Source: Kantar) double the cost of real cow’s milk at £0.61 per litre. The cost of milk alternatives rose by 4.0% which was faster than cow’s milk increase of 3.3%.

This is potentially due to the fact that particularly on core products like bread, milk, cheese and chicken, supermarkets are always trying to drive prices down because they know that’s what drives footfall and a competitive point of difference. It is likely that these prices will be ‘managed’ more closely than some others.

Consumer behaviours

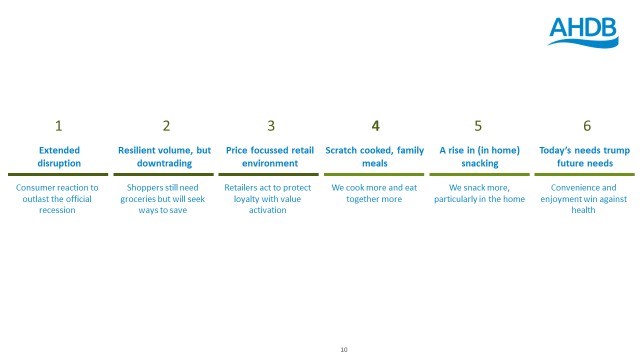

Although the period following the financial crisis of 2008 and the credit crunch was not notable for high inflation, we can see it as an analogous period considering the economic pressures that many consumers found themselves in. Kantar reported that during this period there were a number of behaviours that stood out and we can see how these may come back into play for 2022.

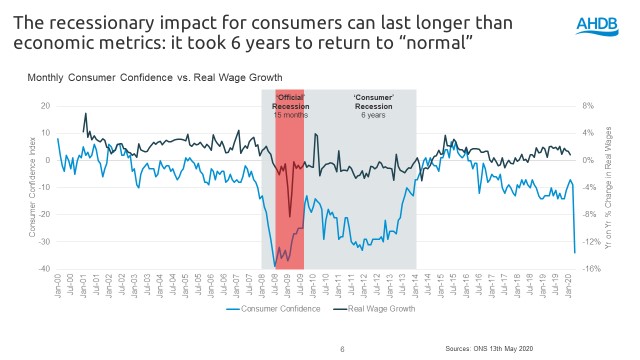

1. Extended disruption

In the wake of the 2008 financial crisis and following recession, the duration of weak consumer confidence far outlasted the official recession. This meant that consumer recessionary behaviours were a longer lasting proposition too. Even if inflation settles, unless wages keep pace with prices the impact may be long term.

2. Resilient volume but downtrading

Food generally is a category of comparatively lower elasticity in that demand will tend to remain fairly constant even with changes in price – everyone has to eat! Therefore, overall volumes should remain stable. However, where budgets are tight consumers will use various tactics to manage the cost of goods in their baskets.

- Change retailer – 2008 saw the rise of the discounters

- Buy on deal/promotion where possible

- Substitute proteins e.g. roast chicken or pork instead of beef or lamb

- Trade down a tier or product e.g. economy 15% fat mince rather than premium or standard steak mince

- Select cheaper cuts e.g. pork shoulder rather than loin steaks

- Use less meat/more veg e.g. use half the meat in a chilli or cut out all together. Plant-based meals on average cost £1.04 per portion which is cheap compared to one containing meat, fish or poultry at £2.52 per portion (Source: Kantar Usage Feb 21). However, meat substitutes can themselves be expensive as the category is dominated by brands. On average according to Kantar, in 4w/e to 31 Oct 2021 meat alternatives were £7.25 per kg

Consumers also value food that is filling in a recession. Red meat is particularly good at fulfilling this need (overindex of 162 compared to total food according to Kantar 52w/e 21 Feb 2021) which makes it feel better value.

3. Price focussed retail environment

A notable feature of the last recession was the growth of the discounters with Aldi and Lidl both taking market share from the Big 4. In response many retailers moved away from volume-led promotions, such as Buy One Get One Free, to an Everyday Low Pricing strategy.

We may expect to see less retailer focus on the premium ranges and more on the no-frills economy lines as the Big 4 look to head off further incursion from the discounters and maintain market share. However, there will be opportunities for displaced eating out occasions to be taken in home that lend themselves to the more premium ranges.

4. Scratch-cooked family meals

Scratch cooking is a good way to manage costs when preparing meals as convenience costs more. Meals cooked from scratch on average save the shopper 68p per portion compared to convenience meals (Kantar usage, 52 w/e 28 Nov 21). Growth in scratch cooking was already a feature of the pandemic and with more people adopting a hybrid working pattern there is more time available for scratch cooking. Recent months have seen a resurgence in convenience as cooking fatigue came in but with budgetary pressures may begin to wane again.

Growth in scratch cooking can benefit meat and dairy as a key ingredient, particularly cheaper, family-friendly cuts such as mince and sausages.

5. Basic, low effort meals to grow

Easy and cheap meals prioritising being quick and filling will see growth. Things on toast (beans, cheese), eggs, soups and sandwiches that can be prepared with minimal effort and that are a low cost per portion.

6. A rise in snacking (and enjoyment over health)

When consumers are financially challenged, they may be looking to save money. However, small pick-me-ups such as a biscuit or a cake that are comparatively low cost tend to gain in importance. We also have seen in the past that, as economic pressure increases, health becomes less important as a driver of food choice where enjoyment becomes more important. Thus, we see an opportunity for tapping into the snacking occasion. Dairy products such as cheese, ice cream, cream and yogurt can all benefit here.

7. Challenges in foodservice

Less eating out (or trading down when doing so) and more in-home consumption could be a way for consumers to manage their overall budgets. 37% of people say they expect to eat out less than before the pandemic as they can’t afford it (Source: IGD Feb 2022).

This may be tempered to some extent by the amount of pent-up demand that developed during the pandemic. However, it is likely that many people will not eat out as frequently and when they do may look for cheaper options. Food service’s loss is usually retail’s gain and there may be opportunities for more special, celebration meals prepared at home to displace some eating out occasions. This could provide a lifeline for recipe kit/meal box services as well as promotions such as Dine in for £10 in retail.

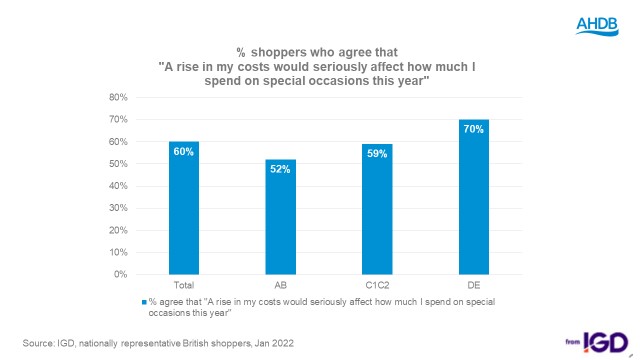

8. Constrained eventing

Previously, we had predicted that as Covid restrictions were left behind consumers would want to make the most of new freedoms with bigger social get togethers, particularly around events such as Easter and Christmas. However, the likelihood is now that some families will need to keep events smaller and more affordable. This could have implications for the bigger cuts of meat and more celebratory meals.

Predictions for meat and dairy going forwards

This is not intended to be a solid forecast or projection of future sales. That would require econometric modelling and/or a price elasticity study. The last such study was carried out by AHDB in 2009 in another period of financial challenge, so the findings are comparable. That study found slim evidence of a link between price and overall category volumes.

That makes sense in that people still need to eat, regardless of price and will seek to make economies in other areas if possible.

However, there will be a shift in category dynamics, in particular switching from more expensive proteins to cheaper ones. Given the above factors we can begin to draw some conclusions. It is important that we do give this consideration as the impact of financial challenges in terms of consumer behaviour can far outlast the initial stimulus that sparked a change in behaviour as seen in 2008 – the consumer recession lasted five years longer than the official recession.

It is unlikely that the pressures instilled by a period of inflation will “blow over” quickly.

Meat

Increase in retail price has the potential to lead to lower volumes. Those proteins that already command a significant price premium versus other proteins are likely to be hardest hit.

|

Lamb in particular could struggle and may find itself positioned firmly in the “special occasions” box by consumers.

|

Important to highlight how cheaper cuts such as neck or breast could be used economically in a slow cooker as part of curries or other meals. Also, inspiring consumers on how leftovers can be transformed into several meals: slow roast shoulder, shredded lamb wraps, shepherd’s pie. Include lamb in date night deals and dine in for X£ offers. |

|

Beef: Consumers may be less focused on health so could be switching from low-fat to higher fat, cheaper mince. Overall, it is likely that mince and burgers will perform well as can be used as part of economical meals that are already a central part of consumers’ repertoires. Roasting joints may struggle as consumers switch to cheaper options such as chicken or pork. In our 2009 study beef roasting joints were the cuts that consumers were the most price-sensitive towards. Steaks may find an opportunity in displaced food service volumes |

As with lamb highlighting cheaper/lesser-known cuts and leftover inspiration will be beneficial

Planning out promotional strategies on beef roasting joints to coincide with key events such as the Jubilee weekend to maintain volumes.

Ensure steaks are listed as part of Dine in meal deals and focussing on potential eventing such as Valentine’s or Date Nights at home. |

|

Pork: As a cheaper protein that has not increased price in the past 12 months pork is at a competitive advantage. However, higher tier, outdoor-bred pork could be at a disadvantage as some consumers look to trade down |

Make sure younger consumers know what to do with pork – offer recipe inspiration to use pork in familiar simple meals such as fajitas or stir-fries. Highlight versatility of pork roast leftovers to be used throughout the week. Reinforce welfare credentials of higher-tier pork to remind those consumers who value welfare to keep buying. Opportunity for ham and savoury products such as sausage rolls as lunchboxes set to increase. |

|

Poultry: Is likely to continue to do well due to a cheaper price point and favourable consumer impressions of versatility and health |

Movements towards increasing standards via the “better chicken” initiative may be less front of mind for consumers as many begin to trade down. |

Dairy

Although the cost of dairy has increased to some extent it has gone up by less than meat and many would argue that prices have been held artificially low for many years. As retailers use dairy, and milk in particular, as a benchmark product to compete with other retailers it is unlikely that we will see the kinds of sharp increases we are seeing in other proteins. Even when prices do go up dairy tends to be seen by consumers as a vital part of their everyday diets (77% according to AHDB/YouGov Nov 2021 and 99% of consumers have bought a dairy product in the past 4 weeks according to Kantar). As a less discretionary product we would expect to see a lower impact on dairy volumes.

|

Milk widely considered a loss-leader product so prices will be managed and is already a very cheap option. Supply-chain pressures could cause some price inflation going forwards although likely to be limited. May be some impact on more added-value branded milks that could lose out from trading-down |

Opportunity to reinforce the credentials of milk as a valuable source of cheap protein and nutrition where many households are struggling.

|

|

We may see some trading down in products such as cheese and potentially some reduction of repertoires |

This will be beneficial for those producing basic cheddar but could be a challenge for producers of specialist cheese such as stilton or other regionals or more artisan cheddars. Cheeses that work well in recipes such as mozzarella, halloumi and paneer could see growth continue. |

|

Yogurt could benefit from more people taking lunchboxes to save money and particularly multi-buy, value oriented yogurt could do well. |

There may be some trading down from branded to own label yogurts as people seek to manage basket costs. With less focus on health overall, yogurt needs to maintain its place in the snacking repertoire as biscuits and other more indulgent snacks take centre stage. |

|

Butter has become proportionately cheaper as its price has decreased over the past two years whilst the price of margarine has gone up. |

Will need to ensure consumers are not tempted away by price promotions on margarine. |

We assess and incorporate the impact of economic, consumer and production factors when producing our forecast of demand volumes for the coming year in the AHDB Agri-market Outlook.

You can read more here: ahdb.org.uk/agri-market-outlook

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: