Long term protein trends explored

Thursday, 28 March 2024

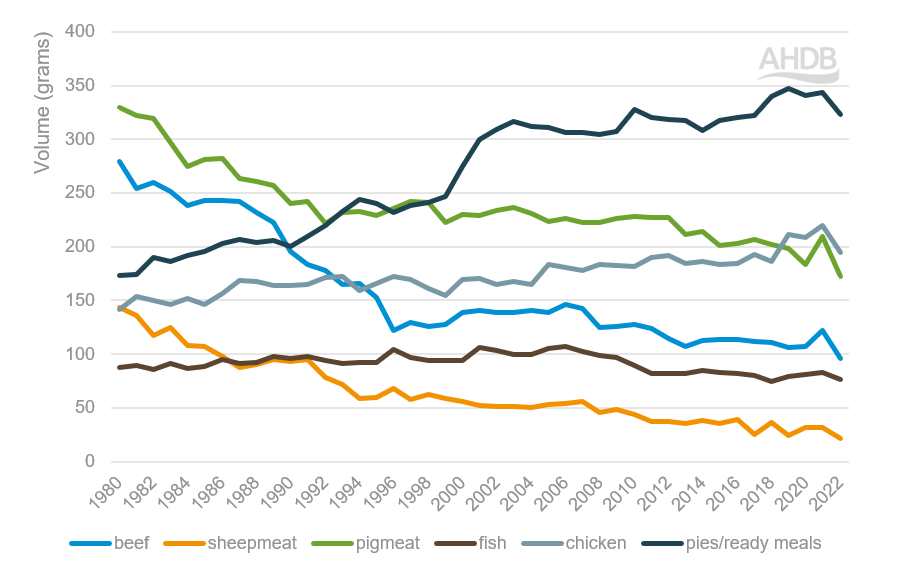

Long term, red meat has lost share to white meat and convenience products. According to the Defra Family Food Survey, UK consumers have reduced their combined household consumption of beef, pigmeat and sheep meat by almost 62% from 1980 to 2022, whilst chicken meat gained share.

Quantity of food and drink purchased for UK households (Average grams per person per week)

Source: Gov Family Food Survey (proteins include primary and processed cuts but exclude ready meals, pies, spreads and canned products)

In 1980, total pigmeat was the most consumed protein, followed by beef, lamb, chicken and fish. As consumer lifestyles and preferences have evolved over time, the share of proteins has shifted significantly.

Beef experienced the most cut back, particularly throughout the 1990’s, coinciding with BSE and Foot and Mouth disease. Consumption shifted from 14.5kg per capita annually in 1980, to 5.0kg in 2022. However, an increasing amount of meat fell under ready meals, pies, spreads and canned products. This makes up for some of the beef shortfall, offering convenience and value credentials.

As well as using different cuts of meat, both reducing consumption and trading down by protein type have been key strategies for consumers to save on their grocery costs.

Since our consumer tracker research began in association with YouGov in 2015, price has been a key factor considered when choosing meat, with most recent research indicating price is the most important factor for 78% of consumers (AHDB/YouGov, Nov 2023).

Lamb consumption has been declining since 1980, when volumes matched chicken. Chicken has since become the cheapest protein (Kantar), cuts such as chicken breast are reported by consumers to be easy to cook with, above that of red meat products (AHDB/YouGov, November 2023) *. The decline for pigmeat appears to be less prevalent, but from 1980 to 2022, 8.2kg less was consumed annually per capita (Defra family food survey, 2023).

Health factors contribute somewhat to these changes in eating habits, with consumers more likely to perceive chicken and fish as important to a healthy diet, less fatty, and more likely to be eaten in their household than red meat (AHDB/YouGov, July 2015 to November 2023).

In terms of protein share out-of-home, a similar story can be told for retail. Red meats have seen gradual decline since 2001, with poultry gaining volume (Defra out-of-home estimates, 2023).

More recently, in-home consumption declines

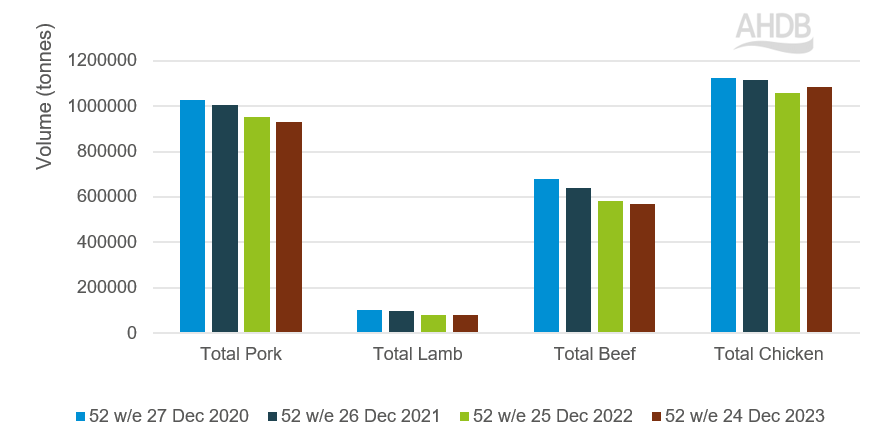

When looking at more recent trends, retail data shows that total volumes for beef, pork and lamb purchased have all experienced declines over the last 4 years. Chicken saw growth of 2.4% over the 52 w/e 24 December 2023, though 2022 levels were lower than the previous two years (Kantar).

Retail volume bought over 52 w/e period

Source: Kantar, volumes purchased 52 w/e 24 December 2023

Research conducted by AHDB with YouGov indicates that meat reducers have cut back due to animal welfare, the environment, and health reasons, but a dominating reason for cutting back on meat consumption is cost (AHDB/YouGov, November 2023).

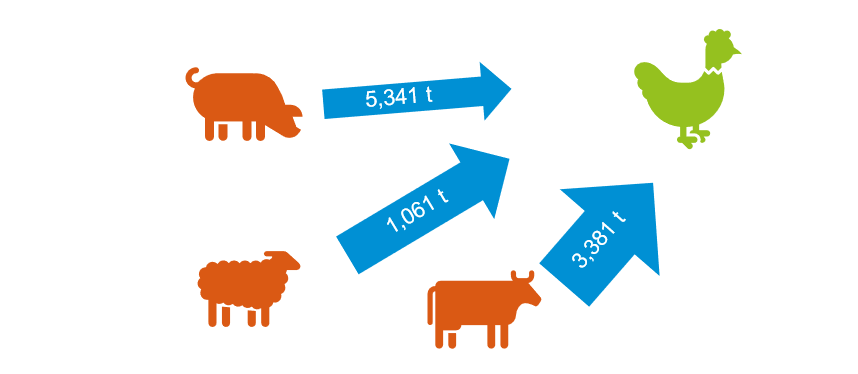

Over 2023, switching data explains that there have been substantial movements towards chicken, negatively impacting all other proteins (52 w/e 24 December 2023)**. Chicken can be considered by consumers as the most versatile meat (AHDB/YouGov, November 2023), along with appealing to those who are price sensitive, with average prices paid over the last two years being consistently around £1/kg less than pork (Kantar).

Total volume switching between proteins

Source: Kantar, Switching actual volume (000kg) 52w/e 24 December 2023

Size of visuals gives an indication of the weighting and direction of volume movements between proteins

Red meat gains out of home popularity

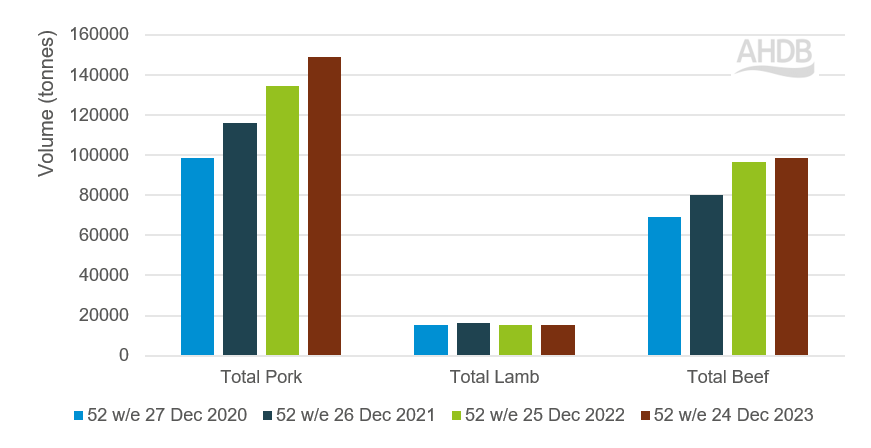

Contrasting the drop of demand in retail, red meat performance in the out-of-home market has seen increased demand, but it has not yet recovered to pre-covid levels of consumption.

Foodservice volume bought, compared over 52 w/e periods

Source: Kantar, Foodservice – AHDB estimates of Kantar OOH

Recent trends indicate that shoppers are looking for those out-of-home meal occasions, but to achieve this within in their budget are trading down channel to achieve this. However, more expensive meal occasions are still being indulged in, just at a lower frequency. As a result, volumes of beef, lamb and pork have all seen year-on-year increases (52 w/e 24 December 2023, Kantar Out of Home).

Opportunities for red meat

Following various challenges, shoppers are still reported to be struggling with their household finance. With grocery price inflation now at its lowest since March 2022, will we start to see greater uplift in red meat sales?

The AHDB 2024 Agri market outlooks predicted a 1% domestic increase in volume for beef but declines of -2% for both lamb and pork volumes.

The first quarter of 2024 has experienced firm demand for lamb, and high prices at farmgate level. With upcoming religious festivals, lamb is expected to be the protein of choice.

While price is clearly an important influencing factor at present, we anticipate that reputational topics around welfare, environment and health will grow in importance to consumers as consumer confidence returns. As a result, it is important to address these reputational areas so as to influence purchase intent for red meat products, providing reassurance and confidence for shoppers purchasing red meat.

*64% respondents say that chicken breast is easy to cook with vs 32% for pork steak, 23% for pork shoulder, 39% for pork mince, 38% for lamb mince, 44% diced beef, 24% lamb roasting joint and 38% for beef steak.

**60% meat reducers cut back because of cost reasons, 46% for health, 43% for environmental, 30% for animal welfare

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: