It's all go for food-to-go

Monday, 5 August 2024

The out-of-home market has seen continued growth in 2024, both for value and volumes purchased. In the 52 w/e 9 June 2024, more than £48.2 bn was spent on food in the out-of-home market, an increase of 14% year-on- year. Though perhaps more importantly, volumes purchased increased by more than 9% (Kantar Out-of-home).

In this time, purchasing habits have changed, and consumers are turning to smaller meals and trading down to cheaper options as a means to engage with the market while still managing their budgets.

Food-to-go purchases have been particularly important for this and have been the channel to have achieved the most notable growth from pre-covid compared with other out-of-home channels (Lumina, 2024). In the same period, £8.3bn was spent on food-to-go, an increase of 26% year-on-year (Kantar Out-of-home, 52 w/e 9 June 2024).

According to IGD, the UK food-to-go market is anticipated to see positive market growth over the next few years and by 2028 is expected to increase in value by almost 40% on 2019 levels. Value growth has been driven by inflation over the last few years, however volume growth has returned in 2024 and is expected to continue and become the key driver of performance from 2025.

So, what is driving food-to-go performance?

Return of commuting is boosting food-to-go sales

While almost half of all food-to-go meal occasions happen as part of a daily activity, such as going to work, the convenience of food-to-go is also becoming increasingly relevant to consumers. Recent research by IGD highlighted that more than half of food-to-go purchases are less routine and are more likely to be spontaneous and unplanned. This is particularly as consumers find it more convenient to engage with food-to-go than to cook at home.

Since August 2021 working from home has become the norm for almost two-fifths (39%) of consumers (AHDB/YouGov, May 2024). An increase in those saying they work from home at least occasionally (+2%) coupled with a decrease in those who say that they exclusively work from home (-8%), suggests hybrid working has become more common.

Less commuting than before the pandemic means that there are reduced interactions with the out-of-home market. However, consumers are more indulgent when they do eat out, and those who commute one or two days a week are likely to spend up to 18% more per trip than other commuter groups (Kantar Out-of-home, 52w/e 24 December 2023).

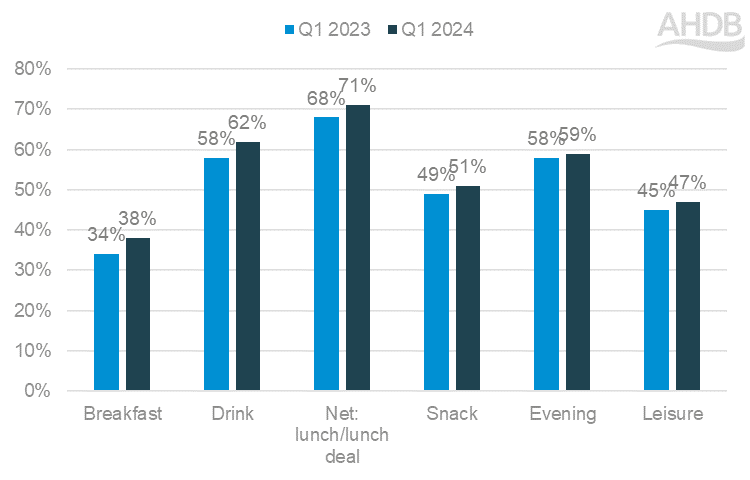

Lunch remains a key meal for food-to-go, and in the first quarter of 2024, IGD reports that 71% of food-to-go customers purchased for this meal occasion. Lunch as a meal is well suited for food-to-go, often associated with lower spend than other meal occasions, but still managing to deliver on a sense of enjoyment for consumers.

Percentage of food-to-go customers conducting each mission in the last four weeks

Source: IGD ShopperVista Food-to-go, 2024

Although lunch has the highest proportion of food-to-go consumers completing this mission, recovery of frequency of purchase has been fastest for breakfasts, drinks and snacks (IGD, 2024). This is likely as these meal occasions remain an affordable treat, and the increase in people commuting for work once again means commuters may be looking to purchase pick me up treats for their journey to and from the office.

Battle of the lunch – meal deal evolution

Whether featuring a classic sandwich, or something a little different, such as a slice of pizza or burger, meal deals are big deal when it comes to lunchtime in foodservice. Value plays an important role in this, particularly as almost three-quarters of consumers say they like to look for offers and deals when purchasing food-to-go (IGD, 2024).

Despite consumers looking for affordable treats, high end sandwiches have been seen as an emerging trend in food service (Lumina, 2023). Development of ranges, in particular the introduction of tiered meal deals by retailers, has meant that consumers have been able to ‘treat’ themselves to a more premium lunchtime meal, whilst still having the confidence the meal fits within their budget.

Outside of the classic retail meal deal, quick service restaurants have seen chains introducing value meals to tempt shoppers back, particularly at lunchtime. These feature a hot meal, snack and drink for as little as £4, or mix ‘n’ match meal deals for as low as £3.

Supermarkets are also looking at ways to capture consumers outside of standard meal deal promotions, and partnerships between supermarkets and restaurants are becoming more common. These strategies help to broaden market reach, as well as cater to consumer interest in hot meals and snacks.

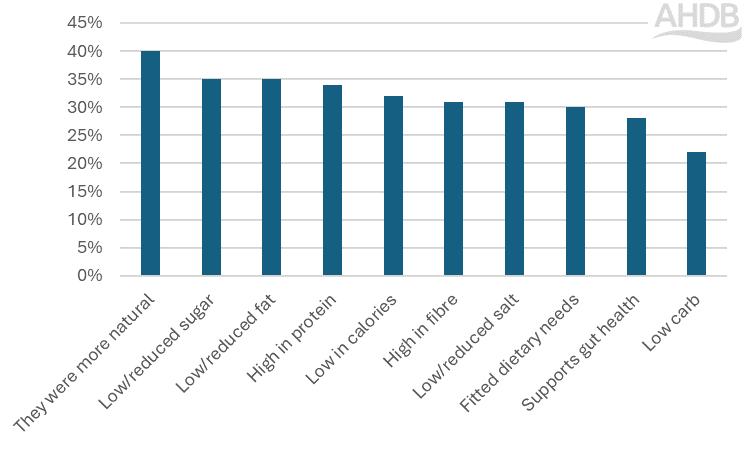

Health is becoming more important to consumers, with 58% of food-to-go consumers claiming that having healthier options was important to them, and almost a fifth saying they visited more than one outlet if the first didn’t have a good range of healthy items available (IGD, 2024).

How important were the following factors when purchasing food-to-go?

Source: IGD ShopperVista Food-to-go, 2024

With health being top of mind for some consumers, ensuring that there is inclusion within ranges for consumers to be able to make healthy, informed decisions and give confidence in their food-to-go purchases is important. This is particularly important to 18–24-year-old consumers as the naturalness of products were more important to them than any other age group (IGD, 2024).

When looking at who is purchasing food-to-go, consistently it is older consumers (aged 55+) who account for the greatest share of purchases than any other demographic, regardless of protein type (Kantar Out-of-home, 52w/e 9 June 2024). This is potentially due to increased disposable income meaning they are able to indulge in on-the-go meals more than the other age groups.

Impact on red meat sectors

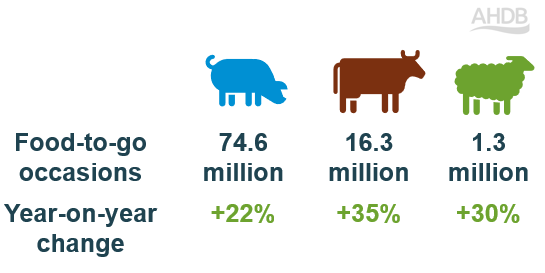

In the 12 w/e 9 June 2024, there were 92.2 million food-to-go meal occasions which contained beef, lamb and pork, an increase of almost 24% year-on-year.

Red meat performance for food-to-go

Source: Kantar Out-of-home Usage, consumption occasions, 12 w/e 9 June 2024

While all proteins saw an increase in occasions, pork accounted for almost three-quarters of this growth.

In some ways it is unsurprising that pork has been so significant in its contribution to food-to-go performance. In the 52 w/e 9 June 2024, pork’s top meal occasions were lunch (24%) and breakfast (23%) (Kantar Out-of-home), both of which are key meals for on-the-go dining.

In this period, sandwiches (standard, rolls/baps, and baguettes) account for 41% of all pork-based food-to-go purchases. And from the total out-of-home perspective (on-the-go, dine-in and takeaway), pork accounts for almost 40% of sandwiches sold, and more than half (52%) of savoury pastries sold, highlighting it as a staple protein for on-the-go food for consumers.

Pasties are seen as a popular food-to-go option for beef, accounting for almost 13% of volumes purchased (Kantar Out-of-home). For beef and lamb, where takeaway and dine in classics such as burgers and kebabs dominate total out-of-home sales, these are not seen to be as popular as food-to-go meal options (Kantar Out-of-home). Offering options for burgers and kebabs, or other typical takeaway dishes, in an on the go dining format could help boost sales and increase beef and lamb’s share of the food-to-go market.

Opportunities for food-to-go

- As consumers’ disposable income starts to return, some may look to trade up to more expensive options or to full-service restaurants. Premium menu items and new products featuring trending flavours will help keep customers engaged.

- As financial pressures ease, health and sustainability will re-emerge as consumer priorities. Communicate the values of food-to-go ranges at the point of purchase to cater to these needs.

- Food-to-go is more likely to be purchased by an older consumer. To tempt in younger demographics, target new product releases with food trends and flavours that may appeal to broader demographics

- To boost red meat performance in food-to-go, ensure there are meal options outside of sandwiches to help increase meal occasions, especially for beef and lamb

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: