Consumers can’t resist out-of-home spending, despite financial concerns

Wednesday, 29 May 2024

Foodservice remains an important channel for consumers, even for households with financial concerns. Over the last year, volume and spend have increased year-on-year, with increased trips per week driving the growth.

According to Kantar, a quarter of consumers are still struggling financially, and 66% are concerned about the rising costs of food. Despite this, foodservice continues to see value growth of 15% (52 w/e 17 March 2024). Since occasion growth increased by 12%, this foodservice growth is not just inflationary.

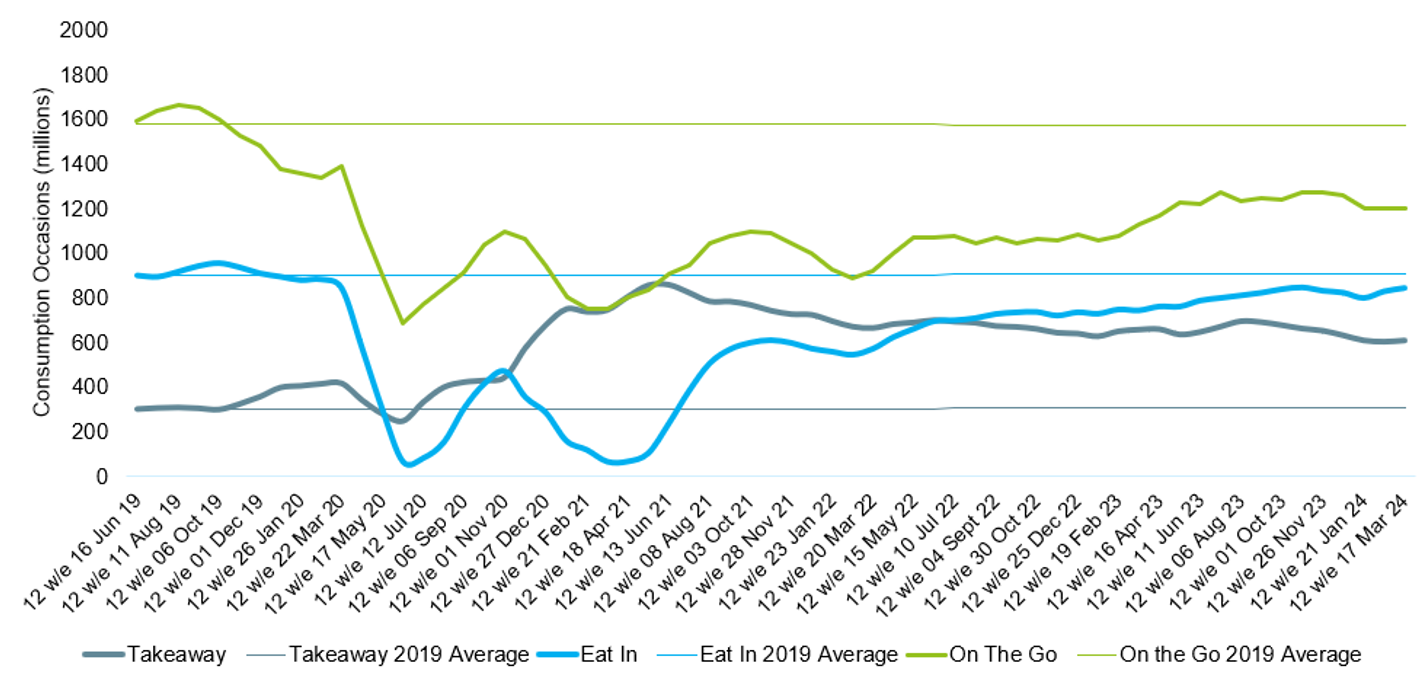

Total OOH method number of consumption occasions (millions) v. 2019 average

Source: Kantar Out of Home Usage | Consumption Method | Occasions (millions) | rolling 12 w/e 17 March 2024

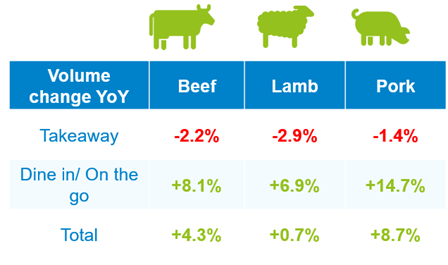

Although prices rose, beef, lamb and pork all saw an increase in the volumes sold out-of-home (OOH). AHDB calculations based on Kantar data show that red meat volume growth was largely driven by dine in and on the go options, overcompensating for a slight fall in takeaway volumes.

Source: AHDB estimates on Kantar Out of Home data. 52 w/e 17 March 2024

Treat yourself attitudes to out-of-home dining

Breakfast and afternoon snacking gained share in the 52 week ending October 29, 2023, likely due to more people increasing their levels of activity out of the home.

Kantar reported that working week trips grew throughout 2023, however the normalisation of flexible working has meant that the way in which consumers are engaging with OOH has not fully reverted to pre-Covid trends. The most spend on food per shopper comes from shoppers who commute 1 or 2 days a week, highlighting that consumers who commute less frequently are willing to spend more when they do eat out.

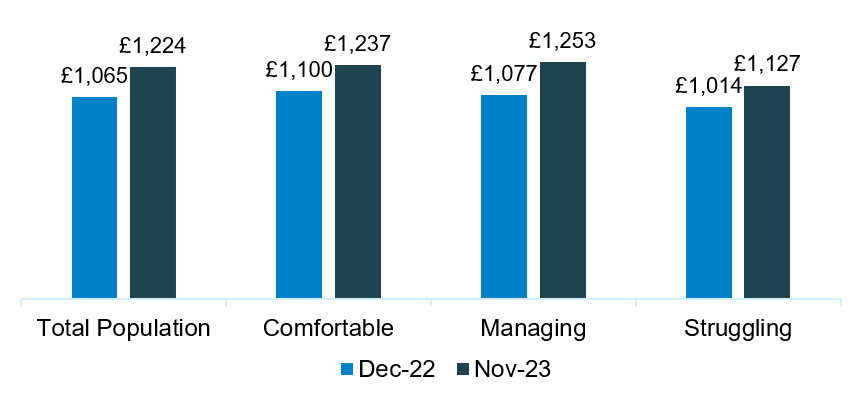

In terms of consumer sentiment, the greatest spend increase has come from consumers who are managing financially, above those who are comfortable. Surprisingly, those who reported to be struggling with their finances have increased their level of spend out of home.

Out of home spend per buyer

Source: Kantar Out of Home, Link Q Survey, Nov 2023

Savvy spending

This is not to say that value has taken a backstep in importance for consumers. People are continuing to find techniques to make these out-of-home channels affordable

Attention to promotions and loyalty cards

• Consumers have and use a range of loyalty cards, particularly for quick service restaurants (QSR). Many of which are now made more accessible via an app format. ‘Rewarding loyalty and repeat visit’ was voted the most encouraging method for increasing uptake of loyalty cards/apps.

• Promotions remain a key coping strategy and can have powerful impact when coupled with loyalty cards/apps.

Not missing out, but trading down

• Recovery of total out-of-home growth was driven by more affordable channels. Consumers have been trading down by channel from full service, to quick service and from there to supermarket on-the-go options. During the 52 we 24 December 2023, supermarkets received the joint most value growth YoY, as consumers reach for convenient, affordable options, such as meal deals. High Street saw the same strong growth during this period,

• This is particularly evident during the lunch occasion, as it has become a new battleground for brands to win shoppers’ wallets. Notably, QSR brands like KFC and Domino’s are pushing back against the grocery multiples by creating their own lunch meal deal offerings. Even more recently, McDonalds have continued this trend introducing their ‘3 for £3 mix-n-match’ offer.

• Consumers also trade down in the form of meal choice when eating out by reducing the number of items within a meal. For example, by foregoing side dishes and desserts or through choosing cheaper options, such as a burger rather than a steak. In terms of beef occasions per dish in foodservice, burgers dominate.

Opportunities

• Spending money OOH is ingrained in consumer habits, but reframing these channels as budget friendly remains key if growth is to continue. There is scope for further purchase intent for red meat and dairy through more affordable outlets and menu offerings, along with promotional offerings.

• Restaurants and dine-in settings could see benefit by offering trading up options for basic meals. For example, burgers with the option to add toppings, such as bacon or blue cheese. For more information see our menu trends article.

• Cheaper channels, such as supermarket lunches, can continue to offer more premium and value options to give consumers a wide range of choice no matter their budgets.

• As inflation slows, we expect to see some return on consumer willingness to spend. There may be greater opportunities for more premium products in a more stable economic landscape, where sustainability and health claims could boost sales. Uplift in Premium lines and channels is expected to be gradual, as much of the consumer money saving habits have become embedded in their decisions.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.