Beef and lamb May production update: Beef supply continues to tighten

Thursday, 19 June 2025

Key points

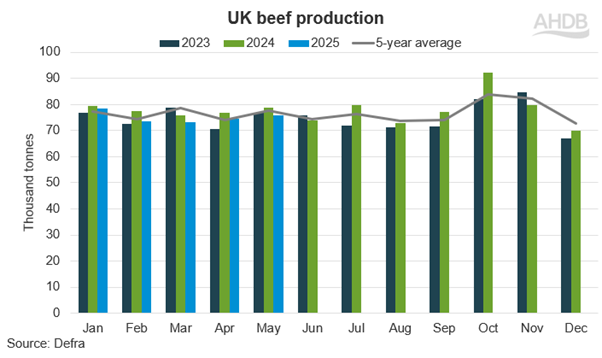

- UK beef production for May rose by 2% on April, but was down 4% vs May 2024

- Cull cow numbers fell amid strong milk prices likely incentivising cow retention

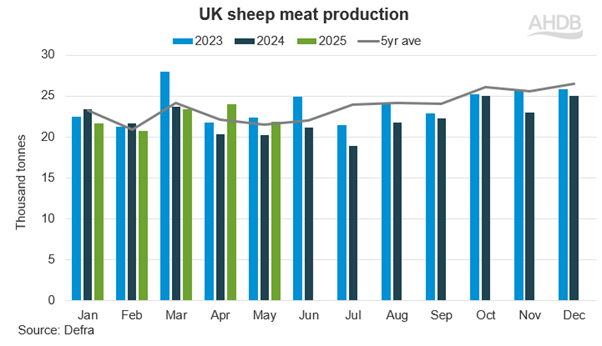

- Lamb production dipped by 9% on the month, but was up 8% year-on-year

- Clean sheep slaughter dropped on the month, following strong slaughter in the run up to Easter

Beef

The latest production data published by Defra for May 2025 has recorded UK beef production at 75,900 tonnes representing an increase of 2% (1,400 tonnes) on the previous month. However, when comparing this figure to the same month of last year, this represents a 4% reduction (2,900 tonnes) on May 2024’s figure. UK beef production has now been below 2024 levels for every month of 2025 so far, representing a year-to-date fall of 10,000 tonnes (3%) to total 300,000 tonnes (Jan to May 25).

Prime cattle slaughter for May 2025 followed suit with production, increasing by 5,000 head (3%) on the month to total 178,000 head. This could be reflective of producers trying to catch the recent strong prices, as elevated returns may be incentivising them to finish cattle. Adding to this, the slaughter figure fell by 7,600 head compared to May 2024 (4%), suggesting the forecasted tightness in supply may be starting to kick in.

With firm farmgate prices, it may have become more financially worthwhile to grow cattle on for longer, as each additional kilogram is returning greater value, especially when compared to the relative price of feed. This is supported by the rise in average prime cattle carcase weights, which hit their highest level since June 2022 at 347 kg, up 1.2 kg on the month and 2.9 kg compared to May 2024.

Cull cow slaughter fell by 3,000 head on the month to 41,000 head. This was also down 3,000 head compared to May 2025. This could be a consequence of favourable milk prices, especially when looking at milk price to feed ratios, encouraging cow retention and reducing supplies available from the dairy herd. This may also be a contributing factor to the increase in GB milk deliveries which set a new peak month record for May.

Lamb

According to the latest Defra data, UK sheep production for May 2025 fell by 2,000 tonnes (8%) on the month to 21,900 tonnes. Although, this represented a rise of 1,800 tonnes (9%) compared to May 2024. This drop from April is somewhat due to reduced demand after the spring festive season. However, the increase from May 2024 is reflective of the higher carryover we’ve been seeing throughout 2025.

Slaughter of clean sheep for May 2025 was down 71,300 head (7%) compared to April 2025 to reach 911,000 head. This follows reports of reduced hog purchasing as old season lamb supplies dwindle and are replaced with lighter new season lambs. Yet, compared to May 2024, this figure rose by 86,000 head (10%).

Clean sheep carcase weights fell by 0.8 kg on the month, averaging 20.7 kg/head for May 2025. This reflects the introduction of new season lambs to the mix, with livestock markets reporting some lighter, leaner NSLs coming through.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: