UK consumer perception of New Zealand red meat imports

Monday, 11 July 2022

Since the UK exited the EU, new and potential trade deals have been highlighted in the news, including Free Trade Agreement (FTA) negotiations with New Zealand. But are UK consumers likely to buy New Zealand produce in our supermarkets and restaurants?

Consumer attitudes to New Zealand FTA

A study conducted by the Department for International Trade (DIT), found that 64% of UK consumers support securing an FTA with New Zealand (DIT, February 2022). Interestingly, UK consumers, place ‘protecting UK farmers’ in second place of the top three things UK government should be giving highest priority to when negotiating an FTA with New Zealand, alongside creating new jobs in the UK but both sit below protecting existing jobs in the UK. Maintaining environmental and UK food standards sit in fifth and seventh place respectively.

Willingness to buy

AHDB commissioned consumer research with YouGov to identify UK consumers’ willingness to buy imported foods from New Zealand. Our research found that if meat produced in New Zealand was sold in the supermarket or in a restaurant, and was labelled as produced overseas, but cost the same as British produced meat, 42% of Brits would likely purchase it, with a similar proportion (40%) saying it was not likely. This highlights the spilt nature of purchase decision making based on country of origin.

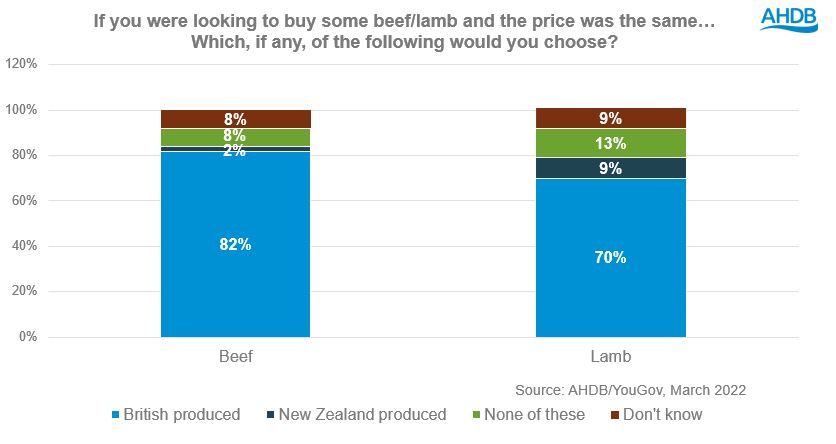

When asked specifically about a type of protein and prompting them on a particular product, the majority of consumers claim they would purchase British beef (82%) and British lamb (70%), even if beef or lamb produced in New Zealand was priced the same in-store.

It’s worth noting that price has a significant impact on consumer buying behaviour, and in the current climate with inflation at a record high, household budgets are likely to experience some pressure, which may see consumers turn to cheaper goods.

Consumer perception of New Zealand’s production standards

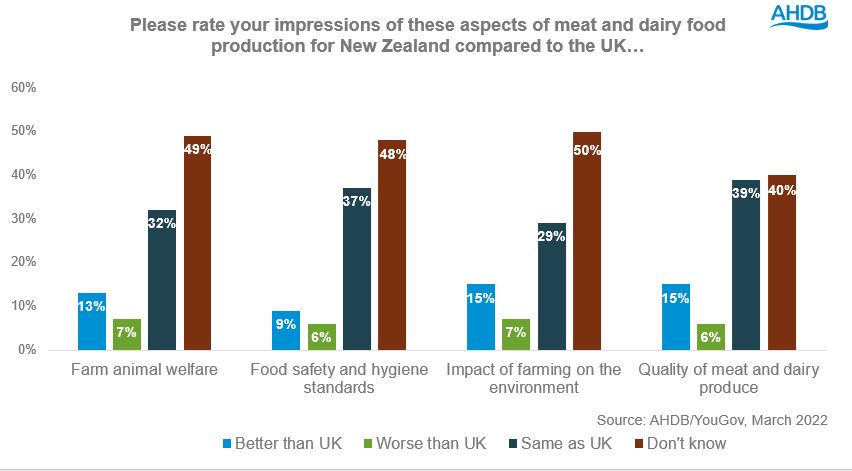

In the AHDB/YouGov study, UK consumers were asked to rate their impression of New Zealand meat and dairy production standards compared to the UKs, which found the majority of consumers aren’t able to differentiate domestic red meat and dairy production standards with overseas production standards, as around half of consumers answered each question with ‘don’t know’.

Although consumers aren’t necessarily aware of New Zealand’s red meat production standards, it is understandable that UK consumers place trust in New Zealand products with notable pockets of consumers feeling production standards are around the same as the UK. New Zealand has had preferential access to the UK’s market for much of the 20th century and therefore consumers are used to seeing New Zealand beef and lamb on the supermarket shelves.

The smaller shares fall to those who give decisive ‘better’ or ‘worse’ response. In those circumstances the scores for New Zealand being ‘better’ is slightly larger than those replying ‘worse’. For instance, 13% of UK consumers believe New Zealand’s animal welfare is better than the UKs, compared to 7% who stated it was worse.

This was also the case within the topic of environment where 15% of consumers believe New Zealand’s meat and dairy production has a better impact on the environment than domestic. Which makes sense, as New Zealand’s climate allows farmers to rear beef and dairy cattle and sheep outdoors all year round, whereas in the UK, livestock are often housed at some point during the year.

Around the topic of quality, most didn’t know (40%) or thought the quality was the same (39%). Of those who did differentiate, 15% of consumers believed meat and dairy produced in New Zealand is of better quality than domestic with only 6% feeling the quality would be worse than the UK.

What does this mean?

The reality is that as consumers face economic pressure, with inflation at record high levels, shoppers are going to look to save money on the food shop and this could be through moving from branded goods to retailer own lines, shopping at discount stores and scratch cooking more meals. However, consumers may also look to reduce costs through eating out less and recreating restaurant favourites at home, which could involve treating themselves to more premium cuts of red meat.

With purse strings tightening, consumers are likely to look for cheaper alternatives, and this could include moving from British red meat to cheaper imported products such as New Zealand beef and lamb. However, at the present time, New Zealand and other exporters of beef and lamb are exporting to Asian countries, where there is greater opportunity, therefore it is unlikely New Zealand red meat would flood UK supermarket shelves.

Another factor to bear in mind is that whilst labelling of country of origin is commonplace in retail, when it comes to the food service sector, we know that it rarely appears on menus. As such, consumers dining out are less likely to be aware of the origin of what they are eating.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.