US pork market update: production gains and lower pricing drive exports

Wednesday, 13 March 2024

Key points

- US pork production in 2023 totalled 12.4 million tonnes and is forecast to increase by 2.4% in 2024

- Lowering Hog pricing is maintaining the competitive advantage of US product on the global market

- US exports have grown 7.5% year-on-year while imports have fallen 16.0%

- New state laws come into force in 2024, which may provide an opportunity for UK exporters

Production

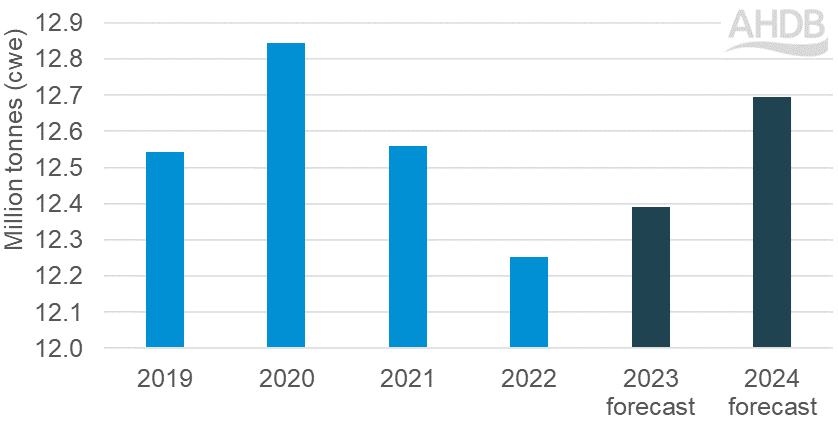

In 2023, pork production increased by 1.1% to 12.4 million tonnes according to the latest USDA forecast. US pork production is forecast to reach 12.7 million tonnes in 2024, a 2.4% increase year on year. The growth in production has been driven by an increase in slaughterings. In January 2024, slaughterings stood at 11.3 million head of pigs, a 2.1% increase compared to last year. Heavier weights are also reported to have supported production through a milder winter.

The latest inventory of hogs and pigs stood at 75.0 million head on 1 December 2023, an increase of just 15,000 head year-on-year. This is mainly following the growth in the number of market (slaughter) pigs, up 221,000 year-on-year at 69.0 million head. This outweighs the decline of 205,000 head recorded in the breeding herd which stands at 6.0 million head. Increased productivity gains has also been reported as a driver to ongoing supply growth.

US annual pork production

Source: USDA

Prices

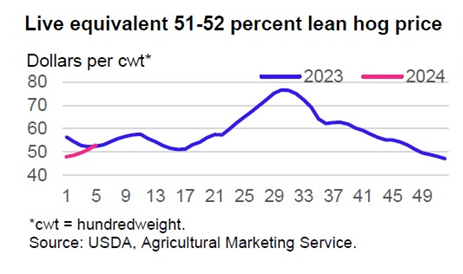

Despite bottoming out the seasonal winter decline, US hog prices at the beginning of 2024 have lagged behind 2023 levels. It has been widely reported that prices paid were trending downwards throughout 2023 and have been below the cost of production. This has led to increased slaughter and culling and a contraction in the breeding herd, boosting supplies and pressuring prices further. It is expected that this will remain the case for at least the first half of 2024, although lower feed prices should help farm margins. Improved demand both domestically and for exports is expected to result in prices firming later in the year.

While the US has seen prices easing over the last 12 months, prices at home in the UK and in Europe have generally been increasing, supporting the competitiveness of US product on the global market. Further to this, the cost of production in the US is considerably lower than that of the UK and Europe. This is predominantly driven by feed, as the US is less reliant on imports of key raw ingredients. The latest figures from InterPig show that in 2022 feed costs in the UK and EU averaged £1.59/kg and £1.22/kg respectively, while in the US feed costs averaged £1.14/kg.

Copyright: USDA, Economic Research Service

Trade

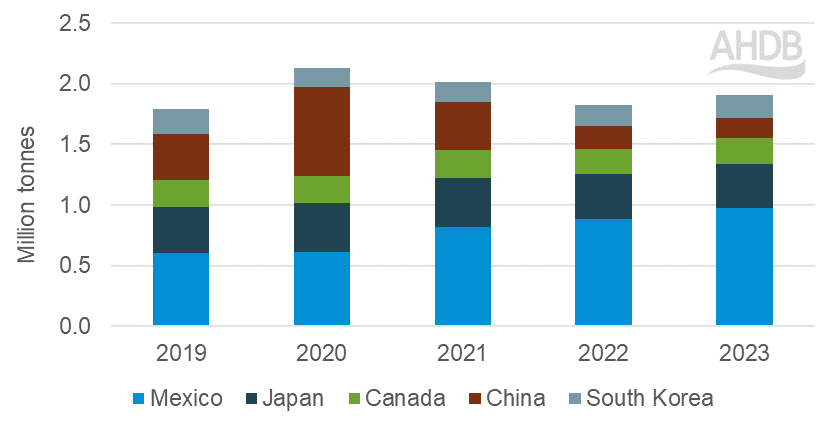

US pig meat exports (excluding offal) increased by 7.5% year on year to 2.43 million tonnes in 2023. Increased availability of product and competitive pricing have contributed to volume growth for the majority of key destinations, with the exception of China and Japan. Weaker consumer demand, sufficient domestic supply and wider economic factors have contributed to lower pig meat imports in China in particular.

Mexico continues to be the dominant export market for US pig meat with a 40% market share, unsurprising given its geographical location. Exports to Mexico have increased by 93,400t in 2023 compared to 2022. Other key destinations of South Korea and Canada increased by 17,500t and 13,100t respectively. Although Australia and the Dominican Republic receive smaller volumes of pig meat from the US, both have witnessed significant growth year on year, up 33,700t and 14,400t respectively.

The USDA forecasts that pig meat export volumes will increase 3.8% above 2023 volumes. This is a result of US product continuing to be more price competitive on the global market compared to product sourced from Europe.

Top 5 destinations of US pork export volumes

Source: US Census Bureau, compiled by Trade Data Monitor LLC

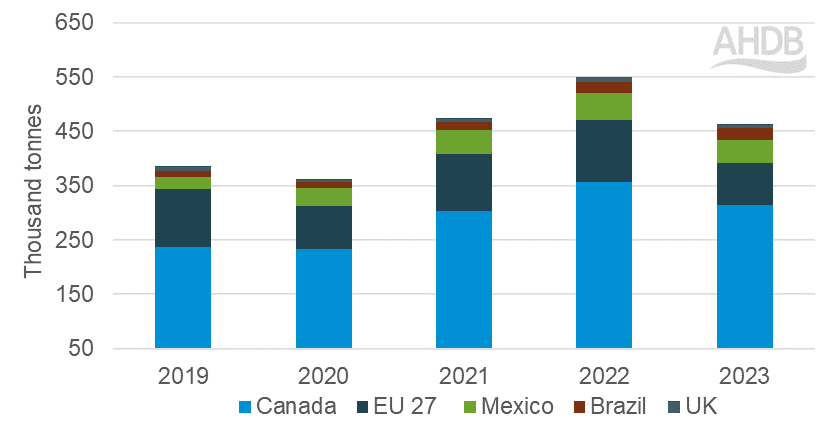

Despite the size of the US export basket, the US is also a major importer of pig meat. After recording import volume growth over the last two years, volumes fell by 88,100t in 2023. Increased production in the domestic market contributed to the fall in imports.

Canada continues to hold the lion’s share of the US import market, covering 70% of total volume, despite Canadian product volumes falling by 42,000t. Imports from the EU27 have declined by 38,700t in 2023, following lower production and higher pricing. Brazil is the only major source of US imports that has seen increased volumes in 2023, up 1,800t.

Top 5 sources of US pork imports

Source: US Census Bureau, compiled by Trade Data Monitor LLC

An opportunity for the UK

Proposition 12 in California came into force on 1 January 2024, disrupting the US domestic supply chain. This could provide an opportunity for UK exporters to maximise, by presenting premium UK product from high-welfare and outdoor-bred standards to the US market.

California is not the only state to have passed, or be in the process of, new welfare regulations. This is likely to result in ongoing changes to the structure of the US pork industry and it is expected that US import volumes will grow.

Some risks to the UK’s export potential are lower domestic production, reducing available supplies, combined with wider factors such as increased transport costs resulting in more expensive product. Consumer acceptance of price changes will be key to market success.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.