2022 pig cost of production in selected countries: Overview

Wednesday, 13 December 2023

2022 was a year of change in the global pork market, feed, fuel, and energy prices rocketed, but a generally tight supply provided strength to prices. In an upcoming series, we will be examining the aspects that make up the cost of pork production in selected countries.

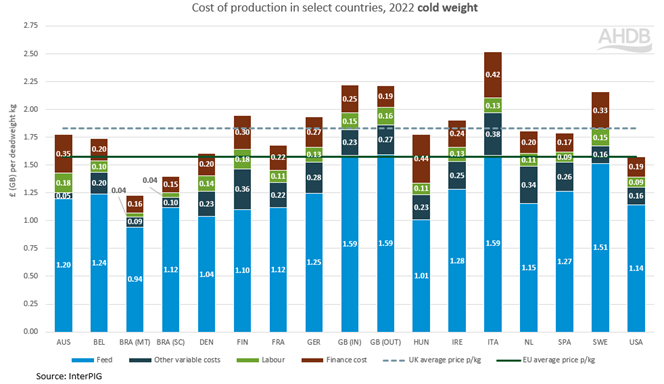

The production costs of pig meat in 2022 for all the countries covered in this series are shown below. This data includes all variable and overhead costs, other than transport of pigs to abattoirs and abattoir-related deductions, such as carcase classification and statutory levies paid at slaughter.

Overhead costs include depreciation and interest costs for capital items such as buildings and equipment. Costs for regular and casual labour are included but directors’ salaries or partners’ drawings are not included.

View previous years’ reports and the methodology

Key points

The average cost of pig production for indoor pigs in Great Britain increased to £2.60/kg for 2022, up from £1.79 in 2021. The average cost of production for EU countries was £1.89/kg, up from £1.50 in 2021. Italy saw the highest cost of production in the EU at £2.52/kg. The UK annual average price (including non-standard pigs) increased from £1.53, up 19%, to reach an average of £1.83 in 2022. The annual EU average price rose from £1.23 in 2021, up 28%, to £1.57 for 2022.

View more information on the quarterly GB net margins and cost of production

Despite the increases in pig prices, pressures still remained on pork producers. Feed costs in GB totalled £1.59/kg, costs were lower in the EU at £1.22 for 2022. Feed costs grew by 27% for GB and 32% for the EU. Average inflation rates in GB and EU rose to highs throughout 2022, with the average for GB at 9.1% and 9.2% for the EU. Inflation peaked at 11.1% for GB, and 11.5% for the EU in October 2022.

Germany saw the largest increase in feed, up by 56% from 2021. This suggests the largest source of competitiveness in pork production is feed costs per kg, which has impacted GB producers highly in this analysis. This could be a case of poor conversion rates or lack of competitive feed pricings. More generally, global feed prices were elevated across the year as feed wheat prices rose as a result of the Russian-Ukraine war.

Finance costs in GB indoor and outdoor herds were elevated from 2021, at 25p/kg for indoor and 19p/kg for outdoor. This is growth of 37% and 33% respectively. For the EU, costs averaged 28p per kg, up by 31% in 2021. This increase in finance costs for the year was driven by an increase in interest rates and borrowing costs, as countries tried to tackle inflationary pressures.

Cost of production in select countries, 2022 cold weight

Source: InterPIG

Pigs weaned per sow per year was stable for GB indoor pigs at 27.7 but increased by 4% to 25.1 for outdoor pigs. The EU average for 2022 was 30.2 pigs weaned per sow, up 1.5%, with an increase of 14% to 29.7 for Italy. Countries such as Spain, Belgium, Finland and Ireland saw drops of 1–2% from 2021.

Pigs finished per sow per year grew for both indoor and outdoor pigs in GB, up 4% and 8% respectively. The EU saw growth of 4% from 2021, up to 29.1 pigs finished for 2022. This was helped thanks to an increase of 17% from Italy to 28.2. Spain was the only country to see a fall in finished pigs, a fall of 1% to 25.1.

These key points provide a brief overview of what we will be producing in coming months, as we create further in-depth analysis in these areas of the international cost of pork production.