China pork market update: Challenges of 2023 to roll into 2024

Wednesday, 6 March 2024

Key points:

- In 2023, Chinese pork production was up year-on-year following increased slaughter and culling rates

- The pig population is forecasted to contract in 2024, following a decline in the sow herd

- Liveweight pig prices continue to ease and are reported to be lower than the cost of production

- Imports of pig meat excluding offal fell 12% year-on-year in 2023, with Europe losing out on market share to North and South America

- Imports of offal grew 6% as consumer demand for more affordable cuts increases in reaction to a slowing economy

Supply

According to the National Bureau of Statistics China, pork production in 2023 totalled 57.94 million tonnes. This is a year-on-year increase of 5%, driven by increased slaughter with reported oversupply on the domestic market and reduced producer margins leading to increased culling rates.

To stabilise pig production and supply, the Ministry of Agriculture and Rural Affairs (MARA) recently revised the Implementation Plan for Pig Production Capacity Regulation by adjusting the national target number of reproductive sows from 41 million heads to 39 million heads. It has been reported that the sow herd has already been in decline through 2023 and into 2024, with sow numbers down between 5 and 7% year-on-year.

The USDA forecast that the total Chinese pig population will decline 6% in 2024. This is likely to tighten China’s domestic pig meat supplies in the short term. However, in the longer term, some gradual production gains are expected as on-farm efficiency and sow productivity improve, following new genetics and controlling disease spread.

The Chinese government are firmly standing by their pork self-sufficiency goal of 95%, as set out in 2020, actively encouraging the move away from small-scale to large-scale production. The Chinese government also continue to monitor market behaviour and will intervene when production, pig numbers or prices move above or below certain thresholds. These thresholds have recently been updated in the revised Implementation Plan for Pig Production Capacity Regulation.

Prices

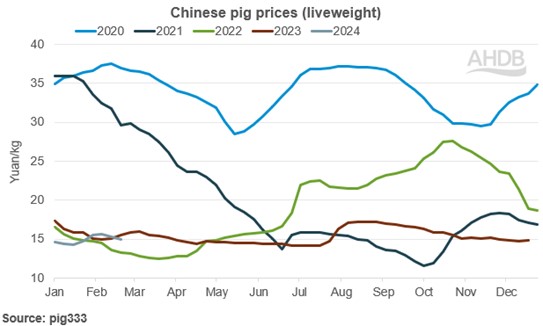

Chinese pig prices remained low throughout 2023, averaging 15.41 yuan/kg (source: pig333.com). This was a decline of nearly 4 yuan/kg compared to the 2022 average price. It is reported that the cost of production for producers is around the 16 yuan/kg mark, resulting in financial losses and increased culling. In turn, this has led to an increase of available product to the market, pressuring prices even lower.

So far in 2024, pig prices have averaged 14.95 yuan/kg. Although there was a small uplift in late January/early February to meet the demand of the Chinese New Year holiday, peaking at 15.61 yuan/kg at 07 Feb, prices have since eased back again to 15.02 yuan/kg at 21 Feb. It is likely that pig prices will remain pressured in 2024 while domestic supply rebalances; consumer demand may provide some seasonal support through the year.

Imports

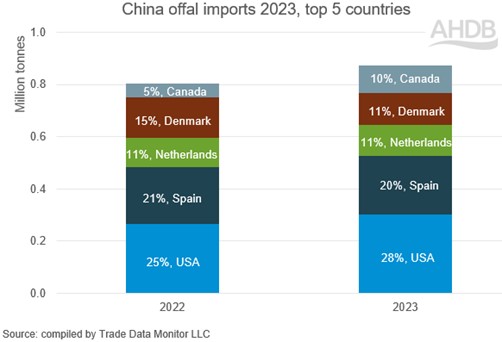

There were two sides to the story of Chinese pig meat imports for 2023. When looking at total pig meat excluding offal, import volumes fell 12% year-on-year to 1.54 million tonnes – the lowest annual import volume since the ASF outbreak in 2018. However, offal volumes grew 6% year-on-year to 1.10 million tonnes.

When looking at the key trading partners, the competitiveness of product on the market has been highlighted. Although the EU27 block remains the largest exporter of total pig meat (excluding offal) to China, Spain has been knocked off the top of the individual country list and overtaken by volumes from Brazil as well as losing market share to Canada and the USA. These changes have been driven by the lower product prices in Brazil and the USA compared to higher pricing in Europe.

For the offal category, it is a similar story, with EU27 retaining the largest volume share as a whole but Spain and Denmark losing market share to the USA and Canada.

Shipments from the UK to China have declined in volume terms year-on-year due to lower production. However, UK product has not lost out on market share, maintaining 4% of total pig meat excluding offal and 5% of offal imports to China. This at least holds some positive undertones for UK producers in terms of carcase balance alongside keeping tension in the domestic marketplace, with all pig meat produced able to find a home on the market.

Demand

Demand has picked up amongst Chinese consumers for more affordable cuts following a slow economic recovery post covid and global inflationary pressures increasing the cost of living. Consumers are eating out more, but they are spending less. Price has become the dominant decision maker for consumers, which is hurting the food service sector.

The economic situation is not expected to see significant changes in the coming year, and so we expect consumption trends from 2023 to carry through 2024. There is potential for a small opportunity for import volumes to increase as domestic Chinese pig production contracts in the short term; however, competitive pricing remains key.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.