Rising food prices a key shopper concern

Monday, 26 March 2018

In uncertain economic times, shoppers are telling us they are concerned about the price of food. What is the reason for this and how could it affect consumer behaviour?

The cost of living was the number one macroeconomic concern among shoppers surveyed by IGD ShopperVista with 79% saying they were fairly or very concerned (October 2017). When asked about their top personal economic concern, food prices came out on top, cited by 64% of shoppers (January 2018), rising to 74% for those over 55 years old. Three quarters of shoppers were expecting food and grocery prices to rise in the next year (February 2018).

Grocery inflation hits household incomes

Inflation, which reached a five year high in November 2017, may play a role in this fear. As goods become more expensive to import, prices in the UK have been rising at a rate that exceeds growth in wages. That means real earnings (average earnings minus inflation) have actually been falling for ten consecutive months and are still lower than pre-2008 crisis levels.

The UK imports around half of its food, so food price rises are an unsurprising side effect of a weakening pound. The UK food system is also highly dependent on migrant labour for production, manufacturing, logistics and food service roles. EU workers have seen their wages fall with the devalued pound and are increasingly seeking opportunities elsewhere in the European Union.

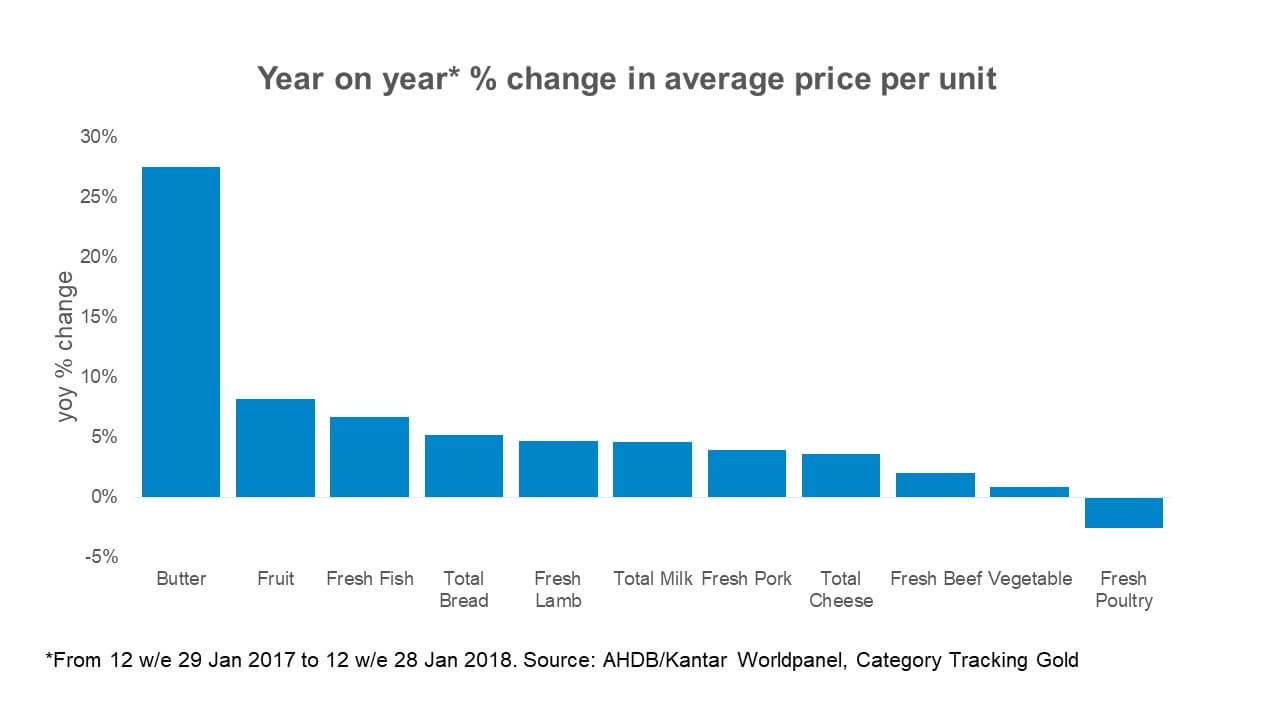

Certain foods have experienced more price inflation than others. Notably, a shortage of butterfat on the market last year meant butter prices were nearly 28% higher in the 12 weeks to 28 Jan 18 compared to the same period the year before (Kantar Worldpanel). Looking at the same time periods, primary fish, lamb, pork and beef were between 2 and 7% more expensive, while poultry was 2.6% cheaper (Kantar Worldpanel, Category Tracking Gold).

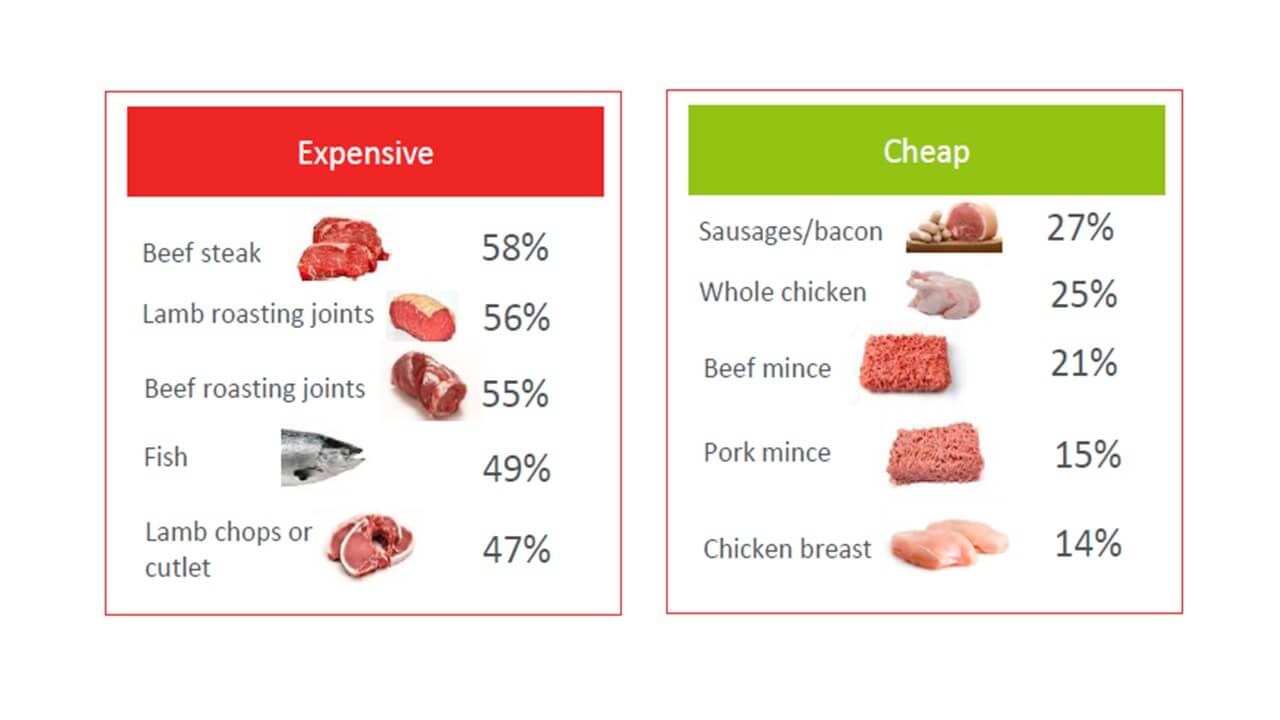

Tighter budgets could mean more savvy shopping. According to Mintel only 16% of shoppers buying unprocessed meat/poultry/game would not make changes to their meat purchasing if they had less money to spend on groceries. Meanwhile 46% would spend more time looking for the best deals, 35% would buy less, 26% would switch to cheaper cuts and 24% would switch to cheaper types of meat eg from beef to pork. Cuts perceived as expensive are therefore likely to lose ground if wallets are further squeezed.

Those surveyed by AHDB/YouGov’s tracker perceived products such as sausages/bacon, whole chicken, beef mince and pork mince as cheap while beef steak, lamb roasting joints, beef roasting joints, fish and lamb chops were perceived as expensive. Encouraging savvy shoppers with deals and a different mix of cuts could help to retain shoppers in the meat category.

2017 was also the year that British consumers became familiar with phenomenon of ‘shrinkflation’. 83% of shoppers surveyed by IGD ShopperVista (June 2017) agreed that some food and grocery products had become smaller in size but had remained the same price or more expensive, compared to a year ago. This technique is favoured by manufacturers who wish to maintain competitive price points while coping with rising input costs.

However, when asked to consider trade-offs in the shopping basket, the majority of shoppers surveyed by IGD Shopper Vista said they would prefer to pay more for their products, rather than compromise on quality or product size. Snacks and confectionary was the category most strongly associated with shrinkflation.

This is supported by ONS analysis showing that the ‘Sugar, jam, syrups, chocolate and confectionary’ category was the only one in their representative basket of goods that had experienced notable shrinkflation. However, the ONS dismissed claims that shrinkflation was linked to Brexit and said it has actually been occurring consistently over the last five years.

Light at the end of the tunnel?

Chancellor Philip Hammond announced in his speech on 13 March that the UK economy had reached a turning point and there is light at the end of the tunnel, with growth to be slightly higher than expected in 2018. Inflation has also slowed this quarter with the latest figures showing a drop to 2.7%. The Bank of England expects real wages to begin growing again in 2018, driven by an increase in the national living wage and low availability of migrant labour. This should mean more money in the pockets of shoppers but will hit profits in the food sector and may lead to more food price inflation.

Topics:

Sectors:

Tags: