Putting growth in dairy alternatives into perspective

Friday, 5 May 2017

Innovation has been important to the dairy category in recent years and there has been a wealth of new product development. There has also been continued growth in the number of products that market themselves as alternatives to dairy, as well as in the volume that is sold. Is this rapid growth likely to continue and what impact could it have on the global dairy market?

Reasons for reducing consumption

According to Mintel, half of Brits avoid or have a household member who avoids one or more type of food and one in five of these say the reason is due to an intolerance or allergy. One reason given for avoiding dairy is because of a perceived dietary requirement such as an allergy or intolerance, but it is important to remember that this is not the only reason. The decision can also be a lifestyle choice which may be influenced by a wide range of factors, such as media coverage of celebrity exclusion diets, or choosing to follow a vegan diet.

New product development in the dairy industry

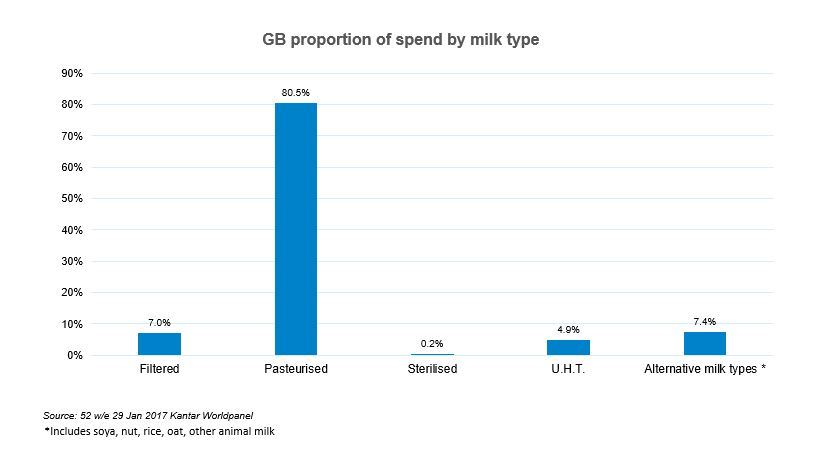

Part of the reason behind dairy alternatives achieving rapid growth is effective marketing and extensive new product development. Despite the high level of growth, it is important to acknowledge that its contribution to the total GB dairy market remains small at just 3.7% of the total milk category by volume and 7.4% by spend for the 52 w/e 29 Jan 17 (Kantar Worldpanel).

Innovation has not been restricted to dairy alternatives, with a wide range of filtered and vitamin enhanced cow milk products now available. This shows that the dairy industry has begun to target some of the health concerns of consumers, these added value products aim to emphasise the nutritional value of milk.

Topics:

Sectors:

Tags: