Lump sum and delinked payments explained

Tuesday, 1 June 2021

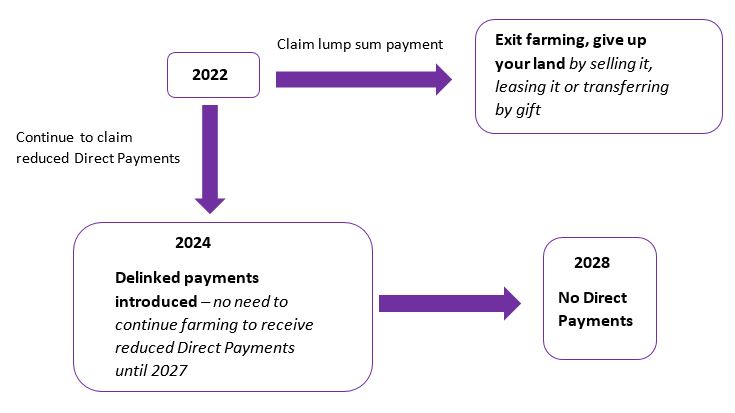

Under the new agricultural policy in England, Direct Payments in England will be phased out between 2021 and 2027, with no further payments from 2028 onwards. Schemes such as the Sustainable Farming Incentive intend to reward farmers for meeting environmental objectives, but by no means are these a direct substitute for income that will be lost through direct payments.

On 19 May, Defra launched their consultation in the ‘Lump sum exit scheme and delinked payments’. In 2022, farmers and growers can opt to receive a one-off payment to retire or leave farming rather than continue to receive Direct Payments for the remainder of the Agricultural Transition Period (ATP) (i.e. until 2027).

The reasoning behind this payment offer is to help farmers who wish to exit the sector but can’t, due to lack of finance, and to free up land for new entrants and existing farmers who wish to expand.

The criteria to qualify for the lump sum outlined in the consultation document is that you need to be a claimant of the Basic Payment Scheme (BPS) and wish to exit the farming sector. Other key points are:

- You must have claimed your first Direct Payment in 2015 or earlier (if you inherited a farm or succeeded to an Agricultural Holdings Act tenancy after 2015, it is proposed you will be exempt from this condition of the offer).

- If you take up the lump sum offer, your English BPS entitlements will be cancelled.

- If you take the lump sum, you will not receive further Direct Payments.

- The intention is that the lump sum will only be offered in 2022.

- If you receive the lump sum and then enter new land management agreements/ or existing schemes e.g. countryside stewardship schemes such as the SFI, you will have to pay back the lump sum.

- Farmers who claim BPS for their use of common land or shared grazing, would have to sell /rent out or transfer by gift their rights to that land in order to receive the lump sum payment. A farmer who has leased-in rights of common, would have to give up this lease.

- If you take up the lump sum offer, you must give up your land in England either by selling it or renting it out, or transferring it by gift. If you are a tenant, then you must give up your land tenancy in England.

One of the suggestions in the consultation document is that if an owner/occupier decides to rent out the land in return for the lump sum payment, this must be done on a Farm Business Tenancy of a minimum of five years so that new entrants or other farmers have ample time to plan their future activities.

The lump sum payment will be calculated as follows:

Lump sum (£) = 2.35 x lump sum reference amount (£)

The figure of 2.35 is used so that the lump sum is roughly the same amount of money farmers would receive if they had continued to receive direct payments for 2022 to 2027. However, a discount of 3.5% has also been factored in as well and an adjustment for inflation. The discount is essentially the price the farmer will pay for receiving future payments as a lump sum rather than annual payments for the remainder of the ATP.

The reference amount is proposed as the three year average BPS payments based on the 2018-2020 BPS years. It will be based on the value of payments received by the farmer in relation to their English entitlements before any penalties or progressive reductions were applied. If a farmer transferred land via selling/leasing etc. after the reference period, a percentage reduction in the lump sum payment will be made which is proportional to the decline in the farmer’s land entitlements.

A cap of £100,000 for the lump sum payment is suggested. This proposal will affect farmers whose reference sum payment is higher than £42,500

What does this mean for me?

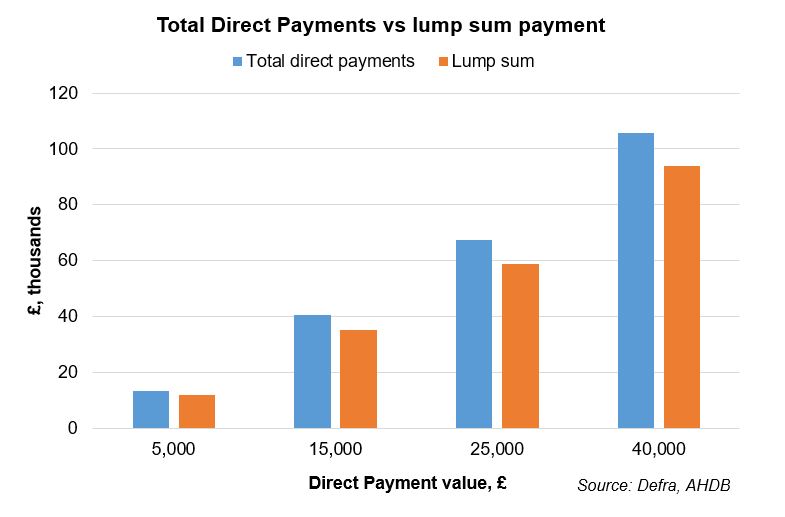

You can use the AHDB Business Impact Calculator to map out how your income from Direct Payments may change out to 2028. In the graph below, we’ve used some example Direct Payment values to illustrate the difference in the total amount received from 2022 to 2027 and the lump sum payment (determined by the proposed calculation described above).

(Please note that the calculation behind the figures generated by the Business Impact Calculator has used the rates of reduction published by Defra from 2021 to 2024 and a straight line reduction to zero from 2025 to 2028.)

The application period for lump sum payments is expected in the first half of 2022. Further information about the lump payment is due in October 2021.

Delinked payments

From 2024, Defra proposed to introduce delinked payments which means that farmers/growers would no longer have to continue farming to receive direct payments for the remainder of the transition period. This change will not be optional and payment and land entitlements will no longer be needed.

Delinked payments will be calculated as follows:

Delinked payment (£) = Delinked reference amount (£) x progressive reductions for that year

As for the calculation of the lump sum payment, the reference period for delinked payments is proposed as the average of the 2018 to 2020 BPS years, however, other combinations are mentioned in the consultation document.

|

Payment Band |

Scheme year |

|||

|

2021 |

2022 |

2023 |

2024 |

|

|

£30,000 or less |

5% |

20% |

35% |

50% |

|

Above £30,000 and no more than £50,000 |

10% |

25% |

40% |

55% |

|

Above £50,000 and no more than £150,000 |

20% |

35% |

50% |

65% |

|

Above £150,000 |

25% |

40% |

55% |

70% |

Source: Defra

For example, if a farmer’s reference amount is £25,000, the delinked payment he/she would receive in 2024 would be 50% lower than £25,000 (i.e. 12,500). The AHDB Business Impact Calculator can be used to help you calculate your delinked payment.

To be eligible to receive delinked payments:

- It is required that you are still farming at the end of the reference period or should still be farming in 2023 if the reference period is earlier than this.

- You are a tenants who receive BPS payments and will still be farming at the end of the reference period can claim delinked payments.

New entrants who start farming after the reference period will not qualify to receive delinked payments.

If the size of your farm changes after the reference period, delinked payments will not be affected as long as you haven’t stopped farming before 2024.

If you receive a delinked payment you can still take part in new schemes such as environmental land management

It is important to remember that these proposals are out for consultation and are not finalised.

The consultation closes at midnight on 11 August 2021 and you can respond to the consultation here.

While the details are not yet set in stone, these changes will be taking place so it’s important that you examine your options. As well as the Business Impact Calculator, there are a variety of tools and resources such as the Resilience Checklist, EU exit toolkit, and Business planning pages to help you make the best decision for you and your business.

Topics:

Sectors:

Tags: