Lamb market monthly update - October 2022

Thursday, 10 November 2022

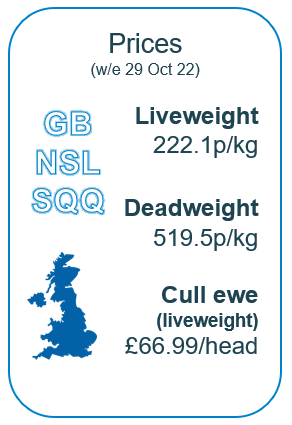

Prices

GB new season lamb prices continued to ease in October following seasonal trends. Liveweight SQQ prices have dipped below where they stood this time last year, however these prices remain well above the 5-year average.

Deadweight SQQ prices showed slightly more stability. Like liveweight prices, deadweight prices have dipped below those seen a year ago but remain substantially higher than the 5-year average.

The story for cull ewe prices is a similar one. Prices have been in steady decline from their records highs since July, recently dipping just below 2021 prices but remaining above the 5-year average.

While finished lamb prices have remained similar to year-ago levels over the last month, the store market has seen more price pressure. In the four weeks ending 1 October, new season store lambs averaged £70/head through GB markets, 5% behind prices for the same period last year.

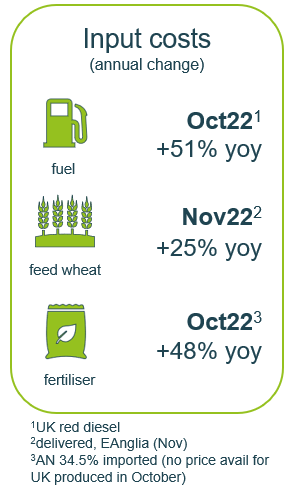

Costs

Input prices are still high, remaining significantly above year earlier figures and despite record high prices seen this year, farmer margins will be feeling the pressure. Although feed ingredient prices have eased from pre-harvest highs, tight supplies are keeping prices supported as we enter winter peak demand. The September figures for GB animal feed usage show GB animal feed compound production fell by 5.8% (Jul – Sep). Nearby ICE Natural gas prices are still at historically high levels, reducing domestic production and increasing imports which is sustaining high prices.

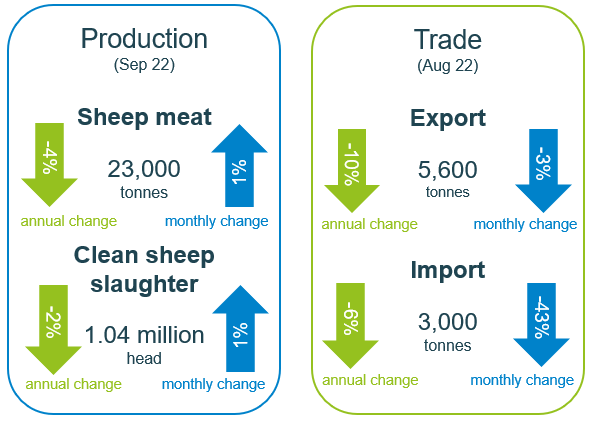

Production and trade

The UK has produced 200,700 tonnes of sheep meat so far in 2022 (Jan-Sep), 5% more than at the same point last year. UK lamb kill is up 4% year on year, totalling 8.7 million head.

Imports of so far this year (Jan-Aug) have been rising year on year, up 25%, however Brexit severely hindered trade in the first half of 2021. Volumes imported do seasonally drop in late summer/autumn as UK production peaks and imports in August were behind those of the previous month and from last year.

Exports for the year to date (Jan -Aug) are up 14% year on year. Although volumes dipped in August, competitive pricing bolstered by a weakening GB pound may support growth in the coming months, supported by the EU short term outlook forecasting continued production declines on the continent.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.