Pound sterling remains weak, how does this impact markets? Grain market daily

Friday, 30 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £287.35/t yesterday, down £3.15/t from Wednesday’s close. The Nov-23 contract was down £3.90/t over the same period, closing at £272.45/t.

- Traders continue to weigh up concerns about the escalating conflict in the Black Sea region. Russian wheat is said to have a considerable price advantage over EU wheat, competitive for global tenders.

- French maize harvest is past the halfway stage, with 51% of this year’s maize crop cut by 26 September, running 28 days ahead of last year’s pace. Paris maize futures (Nov-22) lost €1.50/t over yesterday’s session, closing at €337.50/t.

Pound sterling remains weak, how does this impact markets?

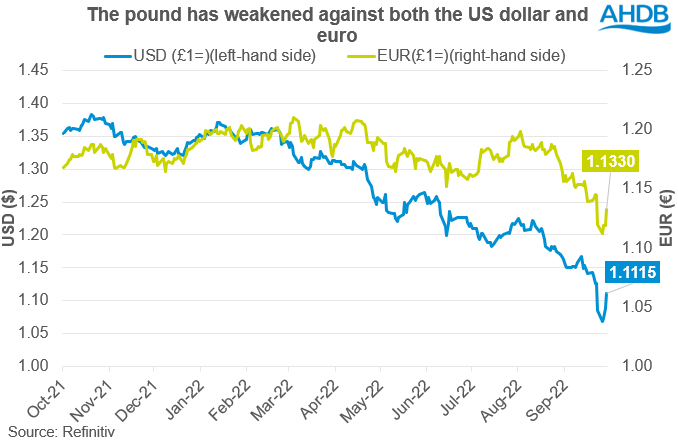

The pound sterling fell to a record low against the dollar on Monday (26 Sept), dropping to $1.0327 during the session. This was caused by market reactions following the UK government economic announcement last Friday. Despite recovering slightly from the start of the week, the pound remains weak against both the Euro and US Dollar.

Yesterday, the pound closed at £1= $1.1115 against the US dollar, and £1= €1.1330 against the Euro. These are down 10.0% and 5.3% respectively from 01 August, when we saw the pound start to weaken against other currencies.

According to Refinitiv, concerns around the UK’s economic strategies will likely see the pound stay weak against the dollar and other major currencies in at least the near term. So how will this impact UK growers going forward?

Competitive exports

A weaker pound means that exports will likely be more competitive on the global market. On the 20 September, exported East coast feed wheat for November loading was quoted at £272.50/t, down £9.00/t from the previous week. Looking globally, Russian wheat is currently competitively priced as mentioned above in market commentary compared to other origins.

In AHDB’s latest supply and demand estimates published yesterday, the 2022/23 wheat carry-in stocks were forecast at 1.846Mt, in line with the five-year average. Comfortable carry-in stocks, combined with a high production figure estimate of c.15Mt, should mean there will be a large exportable wheat surplus currently. With a competitive price on the global market, and increased domestic availability, could we see this season’s exports increase on the year? Possibly too early to tell, but something to think about.

Higher input costs (imports more expensive)

However, the weaker pound also means that imports are more expensive. As a result, inputs could likely increase in price.

As is well known, the halt in production of ammonia at CF Industries’ Billingham site has meant that the UK are having to depend more heavily on imported nitrogen products. The average spot price for imported AN in August was £830.00/t, up 5% from July and up 156% from the previous year. While the price increase is largely due to increased natural gas price, the weakened pound will further add to the cost.

Energy costs are also likely to increase as a result of a weakened pound. Even gas that is produced within the UK is said to be priced based on the US dollar, though energy price caps could limit this rise.

Conclusion

While exports look to become more competitive, helping growers market their 2022/23 crops, the weaker pound could still squeeze margins. This is due to increased input costs, continuing to raise concerns over the impact on next season's harvest.

The rising cost of borrowing is also something to consider, as businesses with loans and other borrowings could see a rise in repayments. The current Bank of England base rate sits at 2.25%, the highest cost of borrowing since 2008.

AHDB have many tools available to help businesses prepare for squeezing margins, including Farmbench and the nitrogen fertiliser adjustment calculator.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.