Russia's 2022 wheat crop continues to increase: Grain market daily

Tuesday, 27 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £287.50/t, gaining £3.30/t on Friday’s close. The Nov-23 contract closed at £271.75/t, gaining £2.75/t over the same period.

- The UK grain market moved up on Monday as Chancellor Kwasi Kwarteng pledged more tax cuts, on top of Friday’s mini-budget, when he announced the biggest tax cuts for 50 years. This led to sterling weakening against the US dollar (-1.6%) and euro (-0.7%) across the day to close yesterday at: £1 = $1.0856, £1 = €1.1118. Sterling has strengthened slightly against both respective currencies this morning.

- Despite the gains domestically, global grain markets were down yesterday as fears of a global economic recession, expectations of a large Russian crop and dry weather in the U.S. (for soybean and maize harvest) weighed on markets.

- Currently focus is on Russian plantings for harvest-24 as rains persist in central and southern regions of Russia, which could potentially lead to lower plantings.

Russia's 2022 wheat crop continues to increase

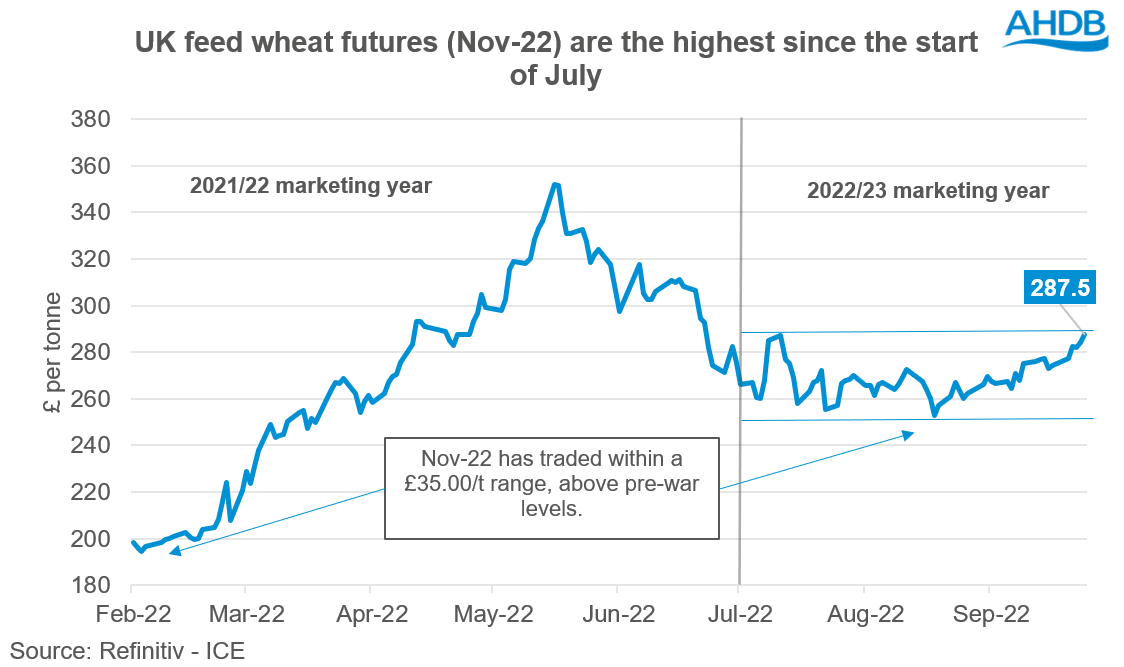

Volatility in domestic wheat markets continues as we progress through the 2022/23 marketing year. UK feed wheat futures (Nov-22) have traded within a £35.00/t range in just 60 days. Yesterday, Nov-22 futures closed at £287.50/t, although not a contract high, it is highest closing price recorded for the contract since the start of July.

Although UK feed wheat futures (Nov-22) have come down from the highs seen in May, they have found a foundation at a level that hasn’t dropped below £250.00/t since July, with the on-going war acting as a price floor for markets.

However, there is still a lot to play out for this marketing year with the potential of a looming recession, combined with the unknown future of the Black Sea grain corridor. Both are providing a big bear and a big bull to the market.

Further to that, Russia’s 2022 wheat crop just keeps getting bigger, this is something that could potentially weigh on markets.

Larger than expected Russian crop

When initial USDA new crop estimates for 2022/23 were released, they estimated the Russian crop at 80Mt. This figure has slowly started increasing as IKAR and Sovecon have been increasing their Russian wheat crop production numbers for 2022. Currently, the USDA peg the Russian crop at 91Mt, which was nearer to Sovecon’s August estimate of 94.7Mt.

However, in its latest estimates released last week, Sovecon upped its 2022 wheat production figure to 100Mt, adding further to what was already a record Russian crop. This increase is off the back of higher spring wheat yields.

An even larger Russian wheat crop has the potential to reduce global tightness of wheat further. However, there are potential issues with the global market accessing this ‘extra’ grain, if realised. Russia’s export campaign lags behind the usual average pace. Sovecon expects Russian wheat exports from July to September to be at 10.2Mt, down 14% from the five-year average pace for this period (Refinitiv). Citing that a stronger rouble combined with the state export tax as reasons for the lag.

Adding to this, shippers are wary of committing exports via the Black Sea and there has been developments since the war broke out on changing shipping terms, more information can be found in this article.

Conclusion

As mentioned at the beginning, grain markets have been volatile, and this is expected to continue as events evolve.

There is still a lot to play out for this marketing year from both a supply point of view; with South Hemisphere crops still developing, and from a demand point of view; if there is a recession, how much demand destruction will there be?

This ‘record-breaking’ Russian crop could have the potential to weigh on the global market going forward, especially if demand subdues substantially due to recession. However, there is still a lot of uncertainty around how much wheat will actually be shipped this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.