First quarter GB animal feed usage round-up: Grain market daily

Friday, 4 November 2022

Market commentary

- UK feed wheat futures (May-23) contract climbed £2.25/t over the session yesterday, to close at £282.30/t. New-crop futures (Nov-23) gained £2.95/t over the same period, to close at £264.45/t.

- UK prices did not follow suit in global markets, following yesterday’s announcement from the Bank of England to increase its benchmark interest rate from 2.25% to 3%. This is the highest level in 14 years. Following the news, the sterling lost value, closing yesterday against the US dollar at £1=$1.1165, down 2% over the session. Though today is trading up again as the US dollar weakens.

- Chicago wheat (May-23) closed at $319.55/t yesterday, down $1.37/t from Wednesday’s close.

- Paris rapeseed (May-23) lost €2.25/t yesterday, to close at €655.25/t. Global grain and oilseed markets continue to feel pressure as Russia urges the United Nations to ease their food and fertiliser exports, adding some optimism to the renewal of the grain deal.

- Yesterday, the latest usage data for GB animal feed production and UK human and industrial cereal usage was released. Read more about the animal feed production data below.

First quarter GB animal feed usage round-up

Yesterday, the September figures for GB animal feed usage were released by the AHDB, giving us a clear picture of cereal usage for the first quarter of the 2022/23 season (July – September).

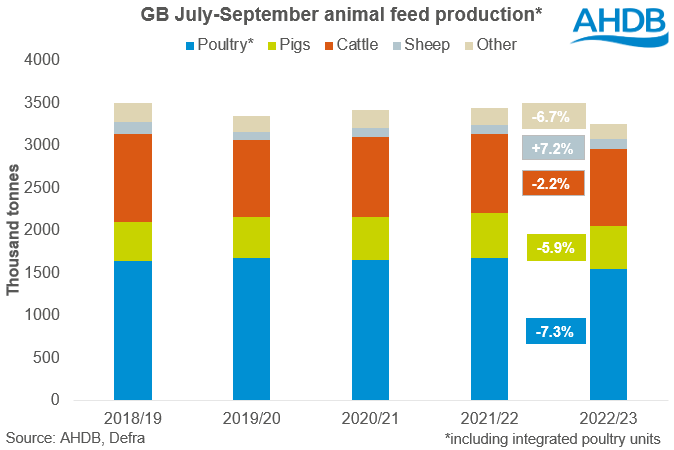

As could be expected, GB animal feed compound production fell by 5.8% in the first quarter of the season, compared to the same period a year earlier. A series of challenges are ongoing for livestock sectors, including squeezed margins from rising costs and recessionary concerns weighing on protein demand, as well as avian flu in the poultry sector.

As a result, cereal usage (wheat, barley, oats, maize) over this period was down 9.4% compared to the previous year. So, what were the main changes in production and usage in this first quarter?

Squeezed production figures – cattle, pig and poultry feed demand down

In terms of feed production, sheep feed was the only sector to see an increase year on year (+7.2%). This was mostly down to an increase of sheep breeding compounds, up 42.3%. Though compounds for growing and finishing also saw an increase (+5.2%). However, with total sheep feed making up just c.6% of total production last season, changes are unlikely to have a great impact on feed demand overall.

On the other hand, other sectors saw falling production in the first quarter of the 2022/23 season. While compounds for dairy cows were up 0.8% on the year, blends for dairy cows were down 3.5%. Total cattle and calf feed production saw a 2.2% decline on the year in the first quarter.

Combined pig and poultry feed made up c.60% of animal feed production last year including integrated poultry units (IPU). As is well known, pig and poultry industries have been facing challenges. Last year saw pig feed production inflated due to pigs held on-farm due to labour shortages meaning they were unable to be slaughtered. Going forward, AHDB forecasts point to a contracting UK pig breeding herd. Yesterday’s figures saw pig feed production fall by 5.9% this quarter compared to a year earlier, with the greatest loss in pig breeding compounds (down 12.5% over the same period) but also falls in growing and finishing compounds.

Poultry feed also saw a decline, down 9.8% on the year, with both layers and broiler compounds down 9.7% and 8.0% respectively. Integrated poultry units saw a 1.8% drop in total production, in the first quarter compared to last season.

Maize usage up

While usage was down for most raw materials, most significantly barley and oats, maize saw an 18.7% rise this quarter on the year.

It is likely that the increase in usage was due to a combination of high ending stocks (AHDB’s final 2021/22 balance sheet showed maize ending stocks at 248Kt, up 18% on the year), and a lag in the usage of purchased maize.

As mentioned in our early balance sheet, it’s expected that as maize isn’t currently pricing competitively, and due to a domestic surplus of wheat, inclusion of maize in rations going forward will likely be lower.

Using recent data, we can draw a comparison of how price competitive imported maize is to domestic wheat. On 27 October, UK feed wheat for November delivery (nearby/spot) into East Anglia was quoted at £266.50/t. On 25 October, spot Ukrainian maize delivered to compounder was calculated at £291.50/t. For information on this calculation, follow this link.

What can we expect going forward?

Going forward, challenges remain across livestock sectors as costs remain high and recessionary concerns for meat growing. Forage availability (as discussed in a recent analyst insight), combined with weather conditions (considering recent mild weather) will be important especially for ruminant feed demand due to turnout.

Additionally, with the severity of avian influenza breakouts this season, and the forecasted declining pig numbers, feed demand for pig and poultry sectors especially will be something to watch over the next few months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.