- Home

- News

- Analyst insight: The impact of declining herd numbers and forage availability on feed demand

Analyst insight: The impact of declining herd numbers and forage availability on feed demand

Thursday, 6 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £284.25/t yesterday, up £3.25/t from Tuesday’s close. The Nov-23 contract closed at £274.15/t, up £5.00/t over the same period.

- The conflict in the Black Sea region continues to add uncertainty to the market. The escalation in the conflict is thought to be affecting exports from Ukraine (Refinitiv).

- Paris rapeseed futures (Nov-22) closed at €632.75/t yesterday, down €13.50/t from the previous day’s close. The Nov-23 contract was down €7.00/t over the session, closing at €638.75/t.

- Yesterday, OPEC announced they would be cutting output by 2M barrels per day. Brent crude oil (Dec-22), closed yesterday at $93.37/barrel, up $1.57/barrel from Tuesday’s close.

The impact of declining herd numbers and forage availability on feed demand

Total animal feed production is expected to decline again this season (2022/23), driven largely by a reduction in demand by the pig and poultry sectors. There is currently a question mark over cattle feed demand, due to uncertainty around forage availability, high input costs as well as a possible reduction in consumer demand due to the ‘cost of living crisis’.

Cattle feed makes up around 30% of total animal feed production in GB, the second largest sector after poultry (which makes up around 40%). Therefore, it’s important to look at what could influence cattle feed, and therefore cereal demand, this season.

Declining herd numbers

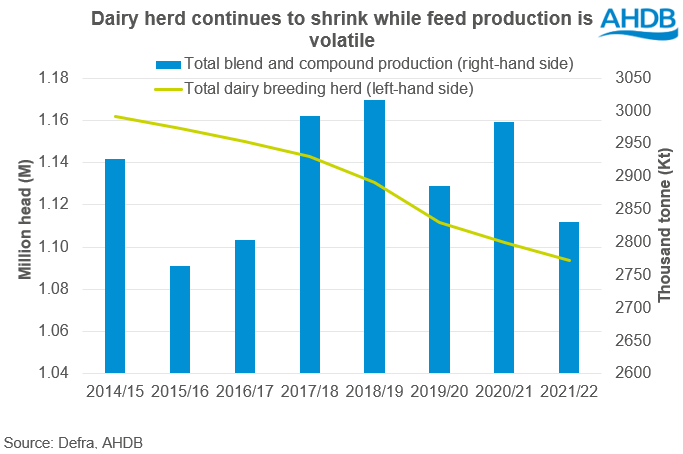

Dairy cattle feed production makes up over 75% of total cattle feed production in GB. As of 1 June, the English dairy breeding herd stood at 1.09 million head, down around 1% on the year. The milking herd has been in decline since 2015. Youngstock numbers have been rising since 2020, with this cohort beginning to move up into the milking herd this year, which may have helped contribute to the smaller losses seen.

Going forward it could be that high input costs, combined with labour shortages, will discourage most farms from looking at herd expansion. Recessionary concerns could also weaken demand and limit milk price increases, leaving little room for growth.

As dairy breeding herd numbers have steadily declined, production of compounds and blends for dairy cows has not followed a similar trend (as seen above). This suggests that while a shrinking herd could impact overall feed demand, other aspects such as forage quality/availability, weather, and cost of feed, could have a greater impact on demand than population changes.

Animal feed costs have risen considerably over the past 12-18 months, in line with grain and oilseed prices. While milk prices are relatively strong at the moment, it is not incentivising producers to feed more to improve yields as margins are being squeezed. The higher feed costs could encourage dairy farmers to utilise turnout or forage as a cheaper alternative to blends or compounds. However, this will be very much dependent on forage availability following the hot/dry summer, as well as conditions during the spring which may affect turnout.

Forage availability

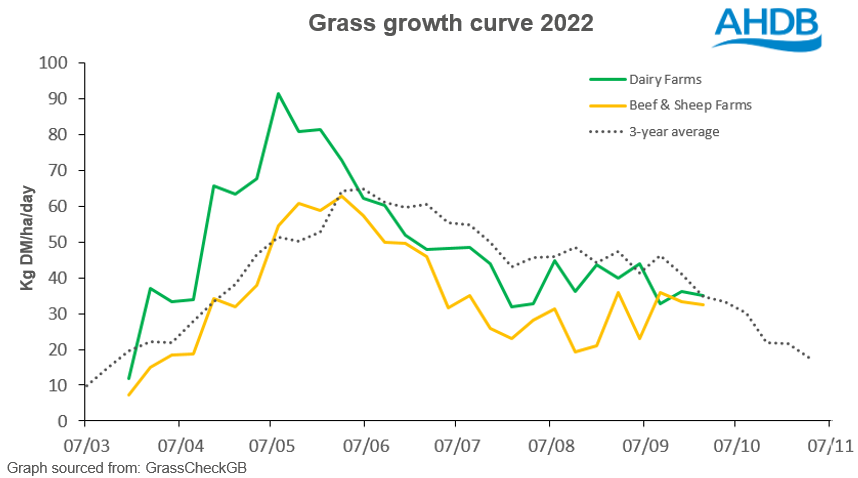

Grass growth across GB at the end of September was averaging 33.5 kg DM/ha/day, near to the three-year average of 34.6 kg DM/ha/day for this time of year. Dairy farms on average are seeing better grass growth than beef and sheep farms.

As shown above, grass growth on dairy farms earlier on in the season, when silage may have been cut, was above the three-year average. However, the UK experienced the 10th driest summer on record, and as a result, between June and the beginning of September, grass growth was limited, impacting those cutting silage later into the summer.

This season has seen huge variability in quality of grass silage. It’s thought that those farmers that maintained their normal fertiliser applications, despite the higher prices and cut on their optimal cutting date earlier in the season, have enough good quality silage. However, some who chose to reduce fertiliser input and aim for fewer and later cuts may see lower quality and availability, resulting in a need for more substitute feeding. There are also variations in regions, with those in the South generally impacted more by dry hot weather than those in the North.

While we don’t have forage prices, we can use hay prices as an indication of price movements. As could be expected, the price of hay is up on the year. Big bale hay as at 02 October was quoted at £73.00/t, up £9.00/t year-on-year, though historically these prices are in line with the three-year average. Average forage prices, when compared with high feed costs, could again encourage farmers to utilise forage or turnout.

Conclusion

As the biggest demand centre for cattle feed, falling dairy herd numbers, could see demand for cattle feed decline across the rest of the 2022/23 season. However, forage availability, feed costs and weather are also important aspects to consider when looking at feed demand. This year, those that were able to cut good quality hay or silage early in the season or can buy in silage or hay, will likely cut down on their blend or compound usage where possible. However, those that live further south and cut later in the season, resulting in poor quality and limited access to forage will likely be forced to buy in more compounds/blends.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.