- Home

- Pork market outlook

Pork market outlook

February 2026

Key points

- UK pig meat production is forecast to reach 972,000 t in 2026, a 0.3% decline year-on-year, with heavier carcase weights partially offsetting lower slaughter numbers

- Future breeding pig numbers are expected to contract further, reflecting anticipated changes in legislation around pig housing

- Turbulent geopolitics and disease outbreaks continue into 2026, and are likely to continue to cause disruption to trade flows

- Downwards pressure on pig prices is likely to continue through H1, but there is scope for some price support in H2

- Pig meat consumption is expected to grow modestly in 2026, driven by retail purchases due to affordability and shoppers trading down from pricier proteins

Overview

2025 was another strong performing year for the UK pig industry.

Pig meat production grew 2.3% year on year (YOY) to 975,200 tonnes. This growth was driven by an increase in both clean pig kill (up 1.4% to 10.39 million head) and average carcase weights. Meanwhile, consumers increasingly chose to purchase pork over other proteins, particularly beef, as affordability and versatility became clear focus points.

Despite a turbulent year for geopolitics, UK pig meat exports also held strong in 2025. For the year to date (Jan-Nov) the volume of pig meat (including offal) shipped globally was up 3.8% YOY at 283,900 tonnes (product weight). Traders have been capitalising on the UK’s positive positioning with China, amid ongoing tariff battles.

Adding to the positive sentiment was the substantially lower imports of pig meat to the UK in 2025, despite the increasing gap between UK and EU pig prices. The UK received 693,800 tonnes (product weight) of pig meat through Jan-Nov, an annual decline of 4.4%. British retailers have been championing British pork throughout 2025.

This is welcome news for the industry, with retail volumes accounting for 84% of total pig meat purchases (AHDB estimates based on Worldpanel by Numerator UK retail and out-of-home data, 52 weeks ending 28 Dec 2025).

However, there is still plenty of caution within the industry. Key components of the cost of production (COP) continue to increase, while pig prices have come under pressure through the back end of the year. The impact of future government policy is still uncertain, with consultations on welfare reforms proposed for later in the year alongside heightened levels of disruptive animal rights activism.

Supply

Overall supply is expected to see minimal change YOY in 2026, as heavier carcase weights partially offset lower slaughter numbers to support pig meat production volumes.

Pig meat production

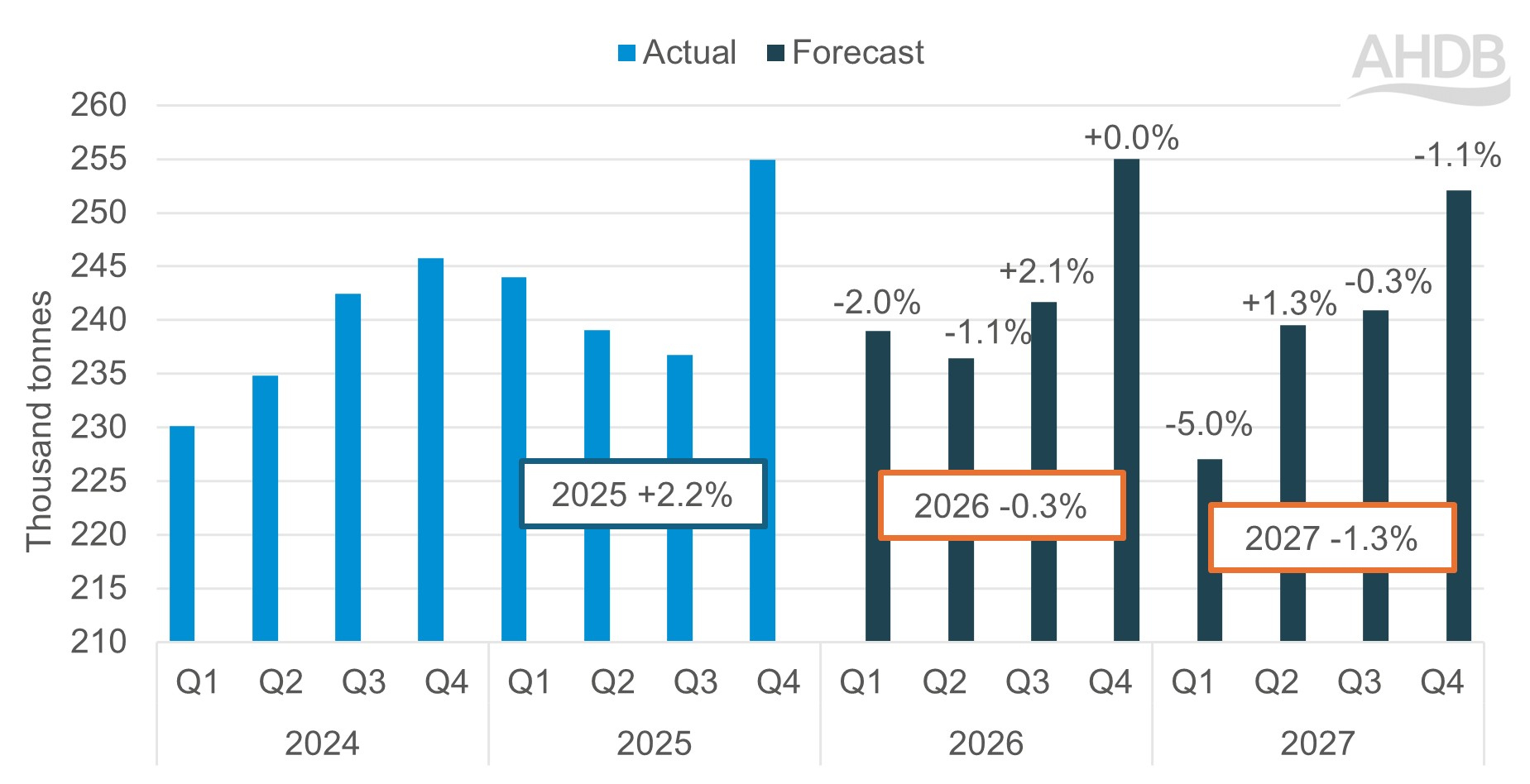

We are forecasting that full year UK pig meat production for 2026 will total approximately 972,000 tonnes, a marginal decline of 0.3% compared to a strong 2025. The decline in production will be driven by lower clean pig kill.

We expect carcase weights to remain higher in 2026, averaging 91.5 kg over the 12 months, up over half a kilogram compared to last year. These heavier weights will keep pig meat production supported, limiting the YOY decline.

In the first month of the new year, we have seen carcase weights at record highs of over 95 kg in our weekly SPP sample. We do not expect these weights to last long into Q1, as pre-Christmas farm backlogs are cleared, and more usual processing routines return.

Looking to 2027, we anticipate carcase weight growth will slow, with average weights stabilising on 2026 levels. This, combined with an expectation of lower slaughter, will result in a further 1.3% decline in pig meat production to circa 960,000 tonnes.

The sharper reduction in Q1 2027 and uplift in Q2 is due to the earlier timing of Easter and associated adjustments in working days across the quarters.

Figure 1. Actual and forecast UK pig meat production

Source: Defra actuals, AHDB forecasts

The bar chart in Figure 1 shows trends in quarterly UK pig meat production from 2024 to 2027, with year-on-year changes. The chart contains actual figures for 2024 and 2025 from Defra in light blue, with AHDB forecasts for 2026 and 2027 in dark blue. UK pig meat production is forecast to fall in 2026 and 2027.

Slaughter numbers

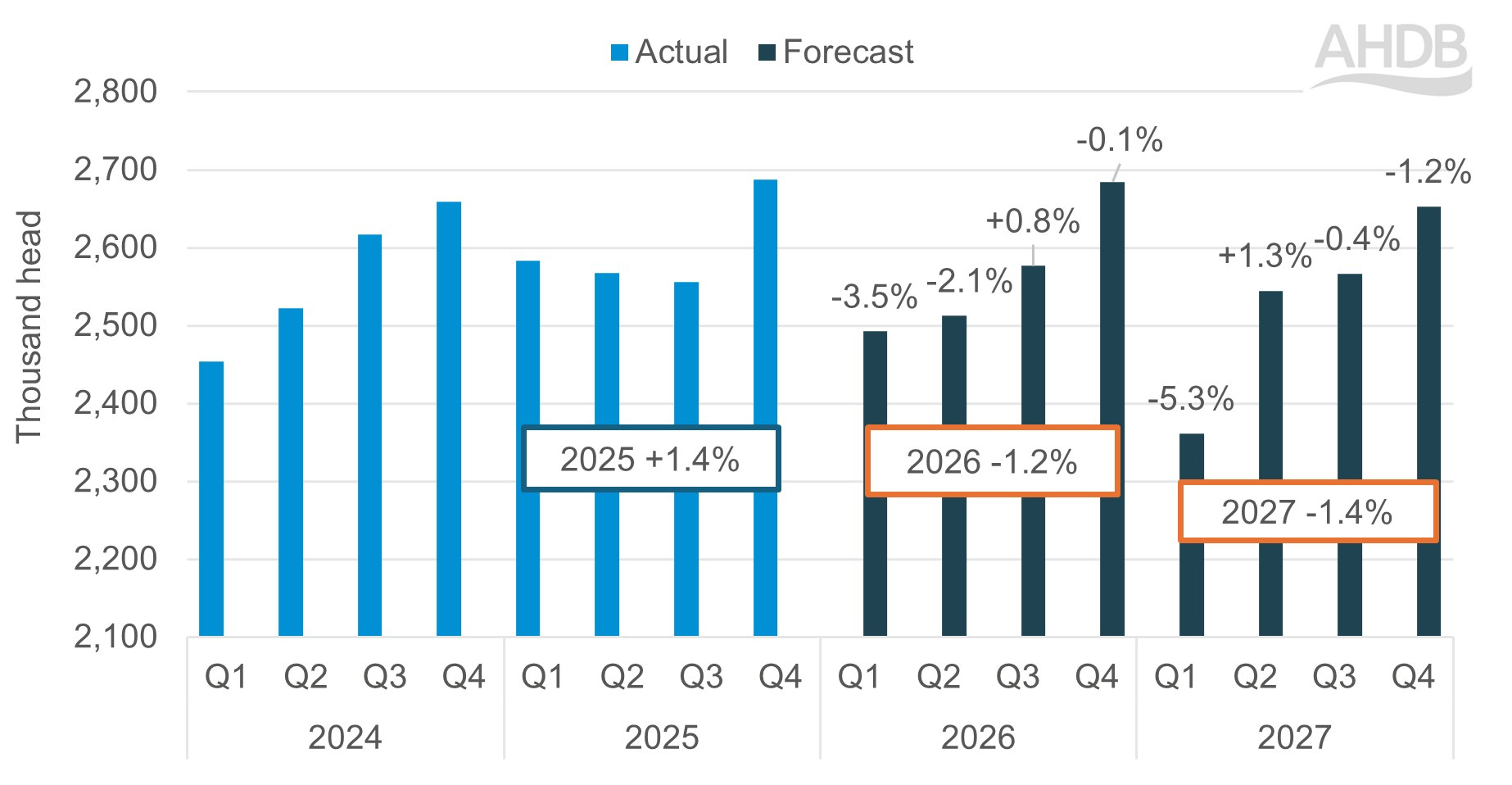

We forecast clean pig kill to total approximately 10.3 million head in 2026, down 1.2% YOY. The overall decline in slaughter numbers is driven by further contraction in the female breeding herd but is more weighted to the first half of the year.

This decline in UK slaughterings is exacerbated in Q2 2026 by the negative impact of prolonged hot weather from May to August 2025 on sow fertility. The minor growth in Q3 is due to annualising against a lower throughput period in 2025, which was also caused by the hot weather and compound feed quality issues.

We expect to see continued productivity gain, in terms of pigs weaned per sow per year, which will partially offset the reduced sow herd. However, this will not be enough to halt the overall expected decline in slaughter numbers.

Looking ahead to 2027, slaughter numbers are forecast to decline further, to circa 10.1 million head (-1.4%) as a consequence of continued rationalisation in the female breeding herd. Again, this is expected to be partially offset by increasing productivity (pigs weaned per sow).

As commented in the section above on pig meat production, an early Easter in 2027 adjusts kill patterns through Q1 and Q2.

Figure 2. Actual and forecast UK clean pig slaughter

Source: Defra actuals, AHDB forecasts

The bar chart in Figure 2 shows trends in quarterly UK clean pig slaughter from 2024 to 2027, with year-on-year changes. The chart contains actual figures for 2024 and 2025 from Defra in light blue, with AHDB forecasts for 2026 and 2027 in dark blue. UK clean pig slaughter is forecast to fall in 2026 and 2027.

Female breeding herd

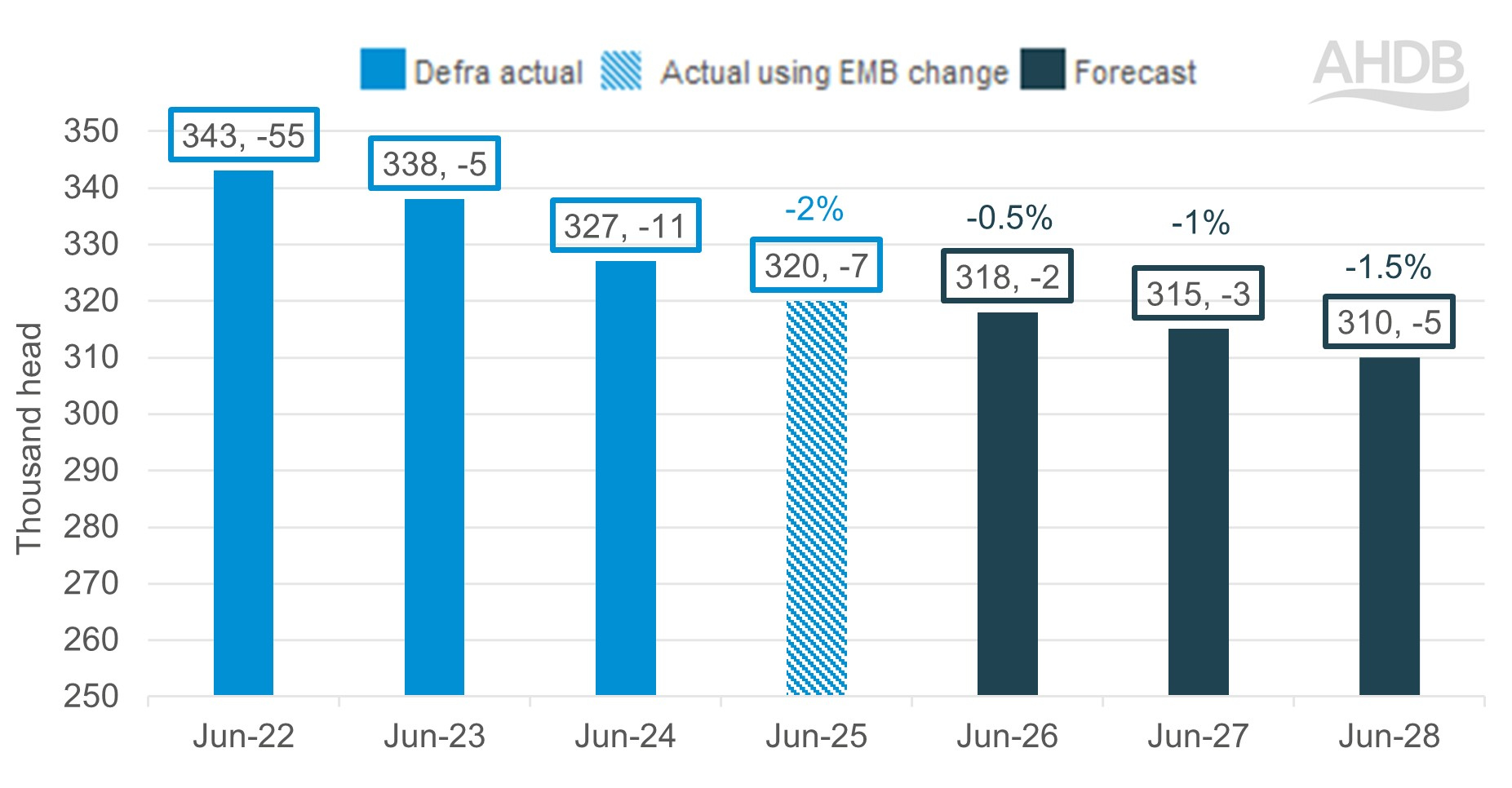

Following Defra’s publication of the 2025 June livestock survey – which showed a 3.3% decline in the UK female breeding herd to 316,000 head – AHDB has queried some of the figures. This follows substantial differences between the survey results and other data sources, as well as anecdotal insights from industry.

Due to this, our 2026 production forecast is calculated using the percentage decline reported in the electronic Medicines Book for Pigs (eMB) data for breeding pigs as of Q2 2025, which was -2.1%. Applying this rate gives an estimated UK female breeding herd of 320,000 head as of June 2025. The eMB dataset covers approximately 95% of the UK industry, as submissions are required for farm assurance schemes (e.g. Red Tractor and Quality Meat Scotland (QMS)).

In 2026, we are forecasting marginal change in the annual female breeding herd by June. Producer net margins have broadly remained favourable in the last 12 months, but pressure is mounting with labour shortages, tax burdens and changing regulations, which may lead some businesses to make hard decisions.

Looking further ahead, we expect the national breeding pig population to continue to contract as a growing number of producers invest in higher-welfare indoor farrowing systems in anticipation of future legislative changes.

New government legislation will require flexi-farrowing pens to have a significantly larger footprint than their traditional alternatives. As a result, producers adopting these higher-welfare systems will need to invest in additional farrowing buildings if they wish to maintain their existing herd size.

However, with planning authorities seemingly reluctant to approve new building applications, many farmers seeking to install flexi farrowing pens will instead be forced to refurbish existing facilities and reduce sow numbers accordingly. Without changes to planning regulations, this shift could lead to a significant long-term contraction in the UK pig population.

Figure 3. UK breeding sow numbers as of 1 June each year, with annual changes

Source: Defra actuals, AHDB estimates and forecasts

The bar chart in Figure 3 shows actual and forecast trends in the size of the UK sow herd between June 2022 and June 2028. Year-on-year changes are displayed. The chart contains actual figures between June 2022 and June 2024 in light blue, AHDB's estimate for June 2025 in hashed light blue, and forecasts for June 2026 to June 2028 in dark blue. The chart shows that the UK sow herd is forecast to contract by approximately 5% between June 2024 and June 2028.

Trade

Turbulent geopolitics and disease outbreaks continue into 2026 and are likely to continue to cause disruption to usual trade flows.

Exports

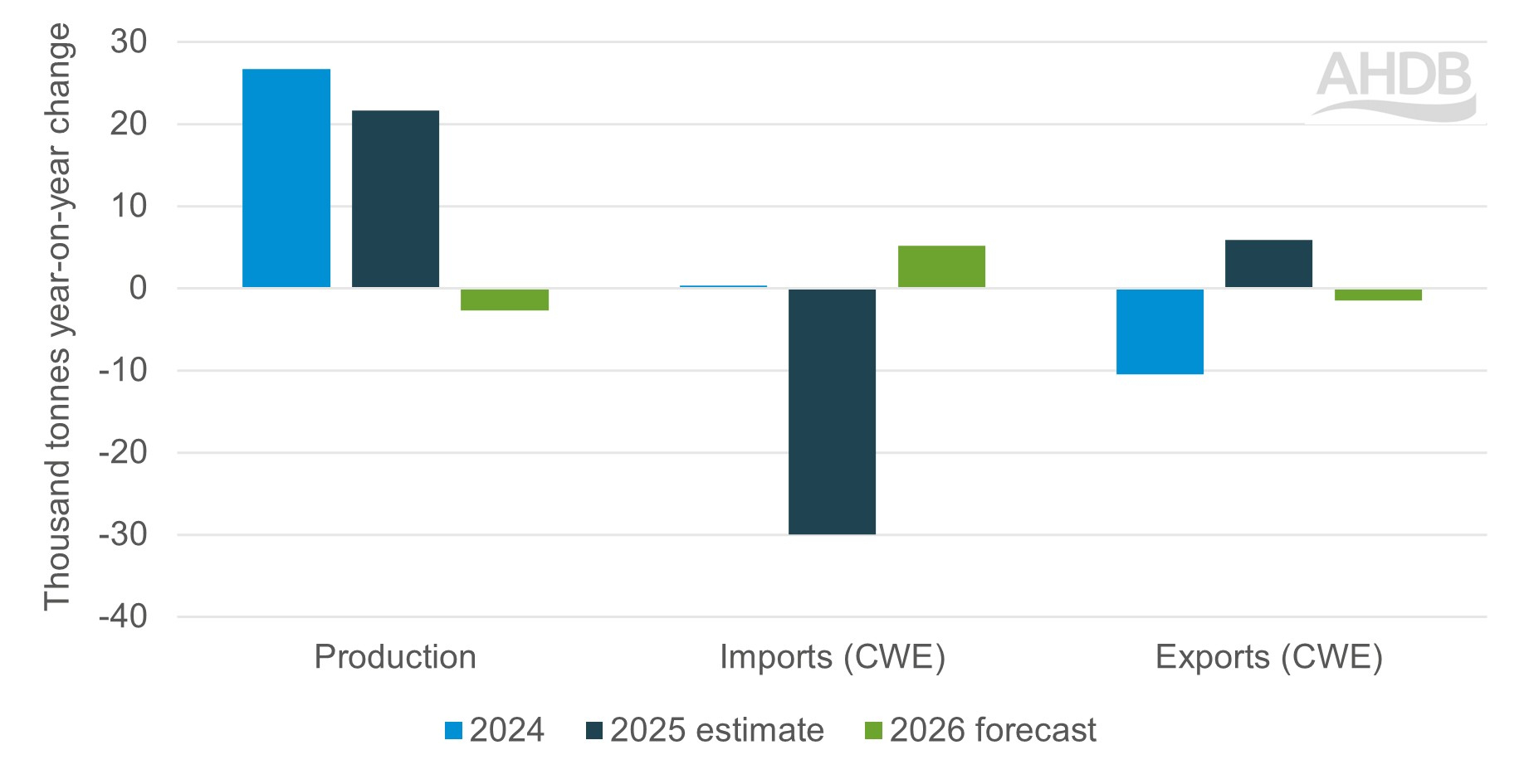

Despite only marginally tighter domestic production, our 2026 forecast is for UK pig meat exports to fall by between 1–2% YOY. The larger export decline is due to wider challenges on the global market.

Import demand from China (the UK’s largest export destination for pig meat) is slowing as the Chinese government work toward their self-sufficiency targets. However, as seen in 2025, the UK remains a more politically favourable nation for the Chinese to trade with.

In other key destinations such as the Philippines, UK product is being outcompeted on price by larger global producers, namely Brazil and the USA. However, the current downward pressure on UK pig prices may help to limit some volume losses.

Closer to home, export opportunities to the EU seem more limited. UK shipments to the continent have waned in the last couple of years as European production has strengthened, and changing dietary focus have softened consumption. These longer-term trends are now being compounded by the recent increase in pig meat availability across the bloc, following Spain’s loss of access to several key export markets due to the detection of African swine fever (ASF).

With a large volume of Spanish pig meat no longer able to access key global markets, increasing volumes will be sold within the EU. This has caused dramatic price falls in recent months, making UK product comparatively more expensive. Although the ASF outbreak is relatively contained at time of writing (limited to one region and confined to wild boar) it will take time for markets to readjust, and even longer to recover. Some European commentators suggest this process could take at least a year.

Imports

Despite the growing differential between UK and EU pig prices, in 2026 we are forecasting a flat to marginal increase in UK pig meat imports (up to 1% YOY).

The gap between UK and EU reference pig prices has been growing since summer 2025.

In November the EU averaged a discount of over 50p/kg to the UK and yet import volumes that month were 4,500 tonnes lower compared to the same month last year (product weight, incl. offal). Seasonally we see consumer demand for pig meat peak in November and December ahead of Christmas celebrations, but this did not appear to materially support imports.

Although consumers purchased more pig meat in retail settings in 2025, purchases made in out of home settings (dine in and takeaway) have seen weaker performance. Many retailers have commitments to using British sourced pig meat. However, foodservice settings are more likely to source product on a cost basis over provenance.

In 2026 we are forecasting this area of the market to remain relatively flat (see consumption section below for more detail); we anticipate this, alongside weakening pig prices, to limit growth in imported pig meat volumes.

Figure 4. Actual and forecast trends in UK pig meat supplies

Source: Defra, HMRC, AHDB estimates

CWE = carcase weight equivalent

The bar chart in Figure 4 shows the year-on-year tonnage change in key metrics for the UK pig meat market between 2024 and 2026. Calculations based on Defra's actual data are shown for 2024 in light blue, AHDB estimates for 2025 are shown in dark blue, and forecasts for 2026 are shown in green. The chart shows our forecast for lower production, import growth and export decline in 2026.

Prices

After two years of relatively stable pricing, GB deadweight pig prices started 2026 at the lowest level for three years (EU spec SPP w/e 10 Jan: 193.2p/kg), having been under pressure since the end of August.

Although our estimated cost of production has eased during 2025 – which will soften pig prices for those contracted on a COP basis – market pressure is also being driven by movements in Europe.

EU reference prices have been falling since the end of June, accelerating in September after China imposed import duties on EU product, and again at the end of November when ASF was detected in Spain.

Historically the gap between the UK and EU grade S average pig price has been around 30p. However, the significant drop in EU prices over recent months, compared to more subdued movement in the UK, has resulted in the gap growing to a record size at almost 70p (w/e 25 Jan 2026).

EU pig prices are likely to remain below recent years’ levels throughout 2026, with greater volatility as the domestic market adjusts to increased supply following Spain’s loss of key export markets. This will likely sustain a wider than average price differential between UK and EU pigs.

However, there may be some opportunities of support for UK prices.

High beef prices continue to be proving beneficial to pig meat consumption, both at home and across the globe. We expect this to continue through 2026, and it may help to limit some larger price declines. Alongside this we have seen that most of the major domestic retailers continue to champion British pig meat, with the percentage of British product facings having remained stable throughout 2025.

Overall, it is plausible to see 2026 pig pricing as a year of two halves. Downwards pressure is likely to continue through H1, driven by external market pressure. However, there is scope that if robust domestic demand continues, we may see some price support in the latter half of the year.

Consumption trends

In 2025, total pig meat volumes in GB were up 1% year-on-year, as 1% growth in retail volumes (Worldpanel by Numerator, 52 w/e 28 December 2025) balanced out a -2% decline in out-of-home volumes (AHDB estimates based on Worldpanel by Numerator OOH, 52 w/e 28 December 2025).

For more details on recent trends on pig meat and cut specifics, see our retail and foodservice dashboards.

For 2026, we expect consumer confidence to remain muted as high food inflation and frozen tax thresholds add pressure to household incomes, as detailed in our economic outlook. This squeeze on finances will likely impact shoppers’ standard of living with many continuing to use savvy shopping methods to ensure they are getting the best value for money.

With pig meat expected to gain volumes due to its affordable price point, we forecast total pig meat volumes in 2026 to be up by 2% versus 2025.

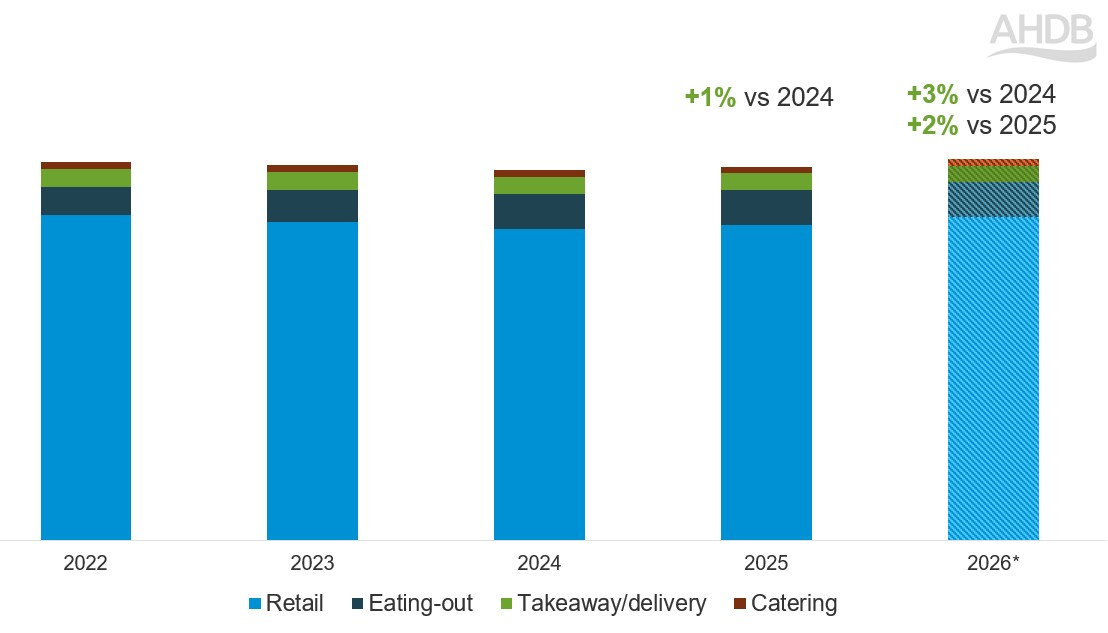

Figure 5. Actual and forecast volumes of pig meat sold in the UK

Sources: AHDB volume estimates for UK based on Worldpanel by Numerator UK retail and OOH data

*2026 figures are AHDB estimates

The stacked bar chart in Figure 5 shows volumes in 000 kg for pigmeat sales in UK split by retail (light blue bar), eating-out (dark blue bar), takeaway/delivery (green bar) and catering (brown bar). Actual volumes are shown for 2022 through to 2025. AHDB estimated volumes are shown for 2026. Over the 5-year period, retail is consistently the largest component. In 2025, total pig meat volumes were in growth +1% versus 2024. AHDB estimates volumes for 2026 will be +2% in growth versus 2025 and +3% in growth versus 2024.

Retail will continue to drive this growth, with pig meat expected to benefit from shoppers switching out of more expensive proteins. Consumers are turning to pork for cost-effective everyday meals.

While loyal pig meat shoppers are increasing their volumes, the category is still losing shoppers (Worldpanel by Numerator, 52 w/e 28 December 2025). The price differential to chicken will be an important factor to watch for pig meat. Anticipated price falls for pig meat in the second half of 2026 combined with shortages in chicken supplies could see some shoppers return to pig meat.

We also expect pig meat to continue to do well at seasonal events – particularly at Christmas. There are also opportunities for pig meat at Easter and during the summer for barbeque options.

The movement of some dining out or takeaway occasions to meals cooked at home is also an area where pork will likely benefit, particularly added-value options like ready to cook or sous vide products.

Research shows 71% consumers have a preference for protein from whole foods or natural sources (AHDB/Blue marble, trust research, August 2025) and we see consumer concern around ultra-processed foods is impacting their shopping behaviour. This could be both a benefit and a watch-out for pig meat. The supply chain may consider how we can retain those processed pig meat shoppers in the category by offering them more natural swaps.

Health will continue to be a priority for some consumers, and this makes it important to communicate the health benefits of pig meat.

In the out-of-home market, consumers are opting to save dining out for more celebratory or special occasions but are still price conscious. With pig meat being a cheaper protein, we expect some consumers may choose it more, and restaurants may give pig meat more menu space due to better margins. Therefore, we expect pig meat to see growth in the dining out market, particularly around key events. The football world cup this summer may also see pig meat volumes boosted as consumers choose to eat at venues showing the matches.

While takeaways may also benefit from the world cup, this will not be enough to balance out losses from shoppers cutting back due to costs.

How might the pig meat outlook be improved?

The pig meat outlook might be further boosted, if the industry:

- Address health concerns by communicating the health benefits of pig meat, such as rich in vitamins B12 and B6, good sources of iron and zinc, and a high source of protein

- Looks to retain shoppers who may be concerned about ultra-processed foods within pig meat by showcasing similar quick, easy and tasty meals with lean primary pork cuts

- Highlight the versatility of pig meat dishes which can offer nutritious and filling meals for families at a reasonable cost. Inspire batch cooking and new recipe ideas as an alternative to chicken and cheaper option than beef and lamb

- For more premium cuts of pig meat, capture meal occasions from more expensive proteins or out-of-home occasions by encouraging tasty, treat dinners such as fake aways or dine-in meal occasions

- Engage with consumers regularly to maintain and build trust and to share the work that farmers are doing in the UK around animal welfare, environmental stewardship and their high levels of expertise to provide quality food products

AHDB have a range of marketing activities planned for the year, including the Love Pork campaign. Please visit our marketing pages for more information.

For more insight around consumer demand visit our retail and consumer outlook page.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.